THEME ALERT: AN ACTIVE MRP THEME

I. Today’s Thematic Investment Idea A deep dive into a market driver with alpha generating potential.

Uranium Back on the Rise as Spot Market Stays Hot, Europe Plans a Nuclear-Powered Future

Summary: Uranium miners surged throughout the last week as spot prices of U3O8 rebounded back to $40/lb. Uranium has seen an uptick in interest from hedge funds over the last few months, while Sprott’s Uranium Trust continues to acquire ever-more physical supplies.

Sentiment toward uranium and nuclear energy is also shifting among European governments – partly due to a burgeoning energy crisis across the continent. 10 EU member states, led by France, recently submitted a letter to the European Commission, urging them to designate zero-emission nuclear power as a “green energy”. In the UK, plans for the construction of a major nuclear plant in Wales, capable of supplying 6 million homes with electricity, are already being discussed with reactor manufacturers.

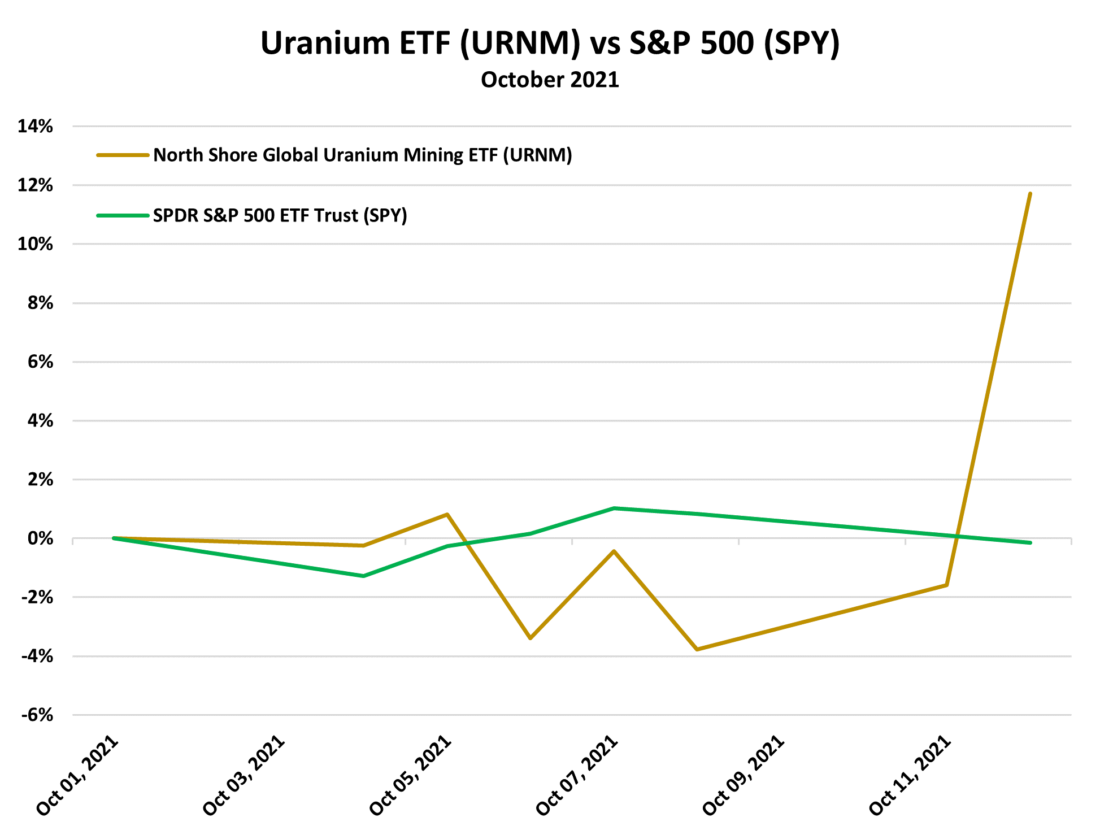

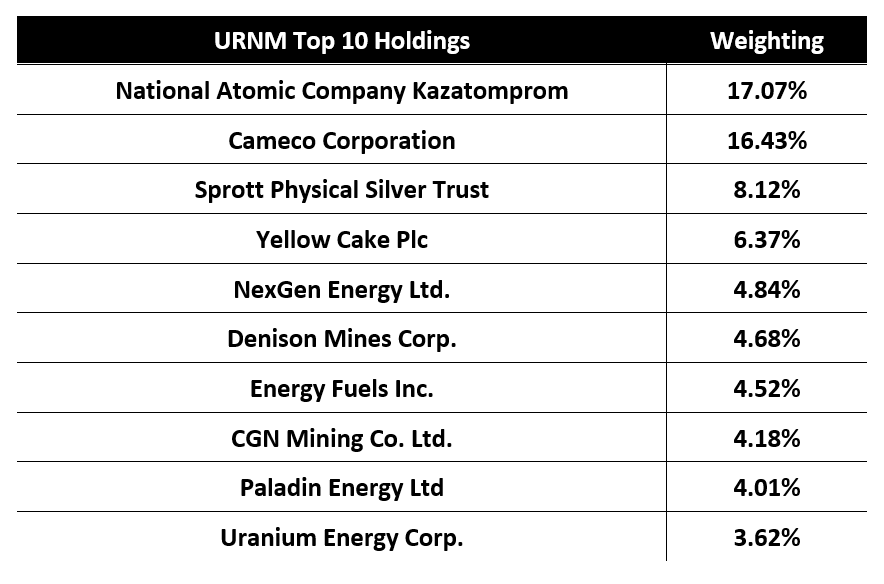

Related ETF: North Shore Global Uranium Mining ETF (URNM)

Hedge Funds, Sprott Continue to Stock Up

Uranium prices have resumed their climb over the last week, as spot prices have regained the $40 per pound mark; that’s up more than 50% versus the start of the year. Long-term contract prices, the primary driver of uranium miners’ valuations, remain even higher than spot prices.

Hedge funds have been taking notice, initiating their own purchases of uranium supplies. The Financial Times reports that funds including Tribeca Investment Partners and Ben Melkman’s New York-based Light Sky Macro have started piling into the trade. Melkman has gone so far as to say the focus on green energy now makes uranium “one of the most asymmetric trades for the coming years”.

Hedge fund buying of uranium was largely kicked off by hedge fund Anchorage Capital Group. MRP noted last June that Anchorage had amassed a huge bet on uranium, a rare occurrence for a firm that typically invests in corporate debt. Per the Wall Street Journal, the fund purchased ‘a few million’ pounds of uranium, illustrating the fact the hedge fund is betting on a price trend reversal in the upcoming years.

As MRP highlighted last month, the most consistent spot purchases have been coming from the Sprott Physical Uranium Trust (SRUUF). In September, the Toronto-listed trust, which begun purchasing uranium in July, expanded its purchases – amassing over 28 million pounds of U3O8 – equivalent to an NAV of more than $1.3 billion. Sprott’s holdings represent more than a quarter of the annual spot volume from 2020, which Yellowcake pegs around 92 million pounds. On Tuesday, updated fund data indicated SRUFF raised another $90 million – part of which was used to acquire another 400,000 lbs of uranium.

European Sentiment Shifts on Nuclear Power

The growing energy crisis that threatens to grip Europe this winter, combined with aggressive decarbonization goals across the continent, has caused several key economies to reverse course on nuclear energy.

Earlier this week, a group of ten European Union (EU) countries, led by France, asked the European Commission to recognize nuclear power as a low-carbon energy source that should be part of the bloc’s decades-long transition towards climate neutrality. Per Reuters, the EU is expected to finish the climate portion of its sustainable finance taxonomy – a first-of-its-kind regulation that aims to steer private capital out of polluting economic activities – within the next few months. The European Commission categorizing nuclear energy as a “green” investment would be an extremely bullish prospect for the uranium market.

French President Emmanuel Macron said on Tuesday that, along with generating utility-scale electricity, France’s nuclear plants would also be a major asset for producing green hydrogen via electrolysis. MRP has highlighted the huge potential of hydrogen to revolutionize the renewable energy mix as well, with total investment into projects amounting to an estimated $500 billion through 2030.

Euronews notes that nuclear plants already generate over 26% of the electricity produced in the EU, but the energy source had largely fallen out of favor over the last decade. Per the Financial Times, Macron had previously announced the intention to shut 14 reactors and cut nuclear’s contribution to France’s energy mix from 75% to 50% by 2035. The President’s rapid U-turn comes not only in response to this new energy crisis, but to rising popularity of nuclear energy among the French populace and his political opponents in the country’s 2022 presidential election.

Poland, one of France’s co-signees in their letter to the EU, has largely lagged behind its fellow EU member states in green energy deployment. As we wrote in August, the Eastern European nation is now making its own turn toward nuclear energy with 6 plants expected to be constructed by 2043.

More investments in Polish nuclear energy capacity have been rolled out over the last month. On September 23, state-owned copper producer KGHM signed a key agreement with US nuclear technology developer NuScale for four 77-megawatt (MW) reactors, of which the first could come online in 2029. Reporting Democracy notes that a joint venture focused on building six 300MW reactors by the end of the decade is also in development by chemicals tycoon Michał Sołowow, Poland’s richest man, and businessman Zygmunt Solorz.

Bulgaria, Croatia, the Czech Republic, Finland, Hungary, Slovakia, Slovenia and Romania were the other signatories of the letter to the EU.

Britain Plans a Nuclear Energy Buildout

Though it is no longer an EU member state, the United Kingdom is feeling the same pull toward nuclear power as its European counterparts. The British energy grid has been hit especially hard by thinning energy supplies – especially since its wind power capacity in the North Sea has seen a significant drop off in recent months. UK energy giant SSE said its renewable assets produced 32% less power than expected between April 1 and Sept. 22 thanks to historically dry and low-wind conditions.

To counteract potential reliability issues in other forms of green energy, Foreign Policy magazine reports Britain has just announced a crash program to build over a dozen new nuclear reactors by 2035. Just last month, Reuters noted that Britain had initiated talks with US nuclear reactor company Westinghouse on building a new nuclear power plant on Anglesey in Wales – able to generate enough electricity to power more than six million homes.

THEME ALERT

Nuclear energy is undoubtedly having a breakout moment that likely marks an inflection point in the uranium market. MRP added LONG Uranium to our list of themes on April 8, 2021 on the expectation that nuclear energy infrastructure was poised to rebound and permanent mine closures would push the price of the commodity higher. After years of miners cutting mining operations, the annual global supply deficit of uranium is expected to average a total of 23 million pounds through 2022, or roughly 13% of global uranium demand, according to Scotia Capital.

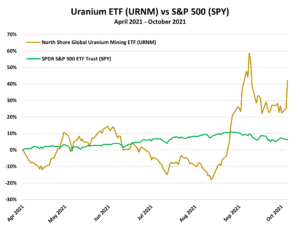

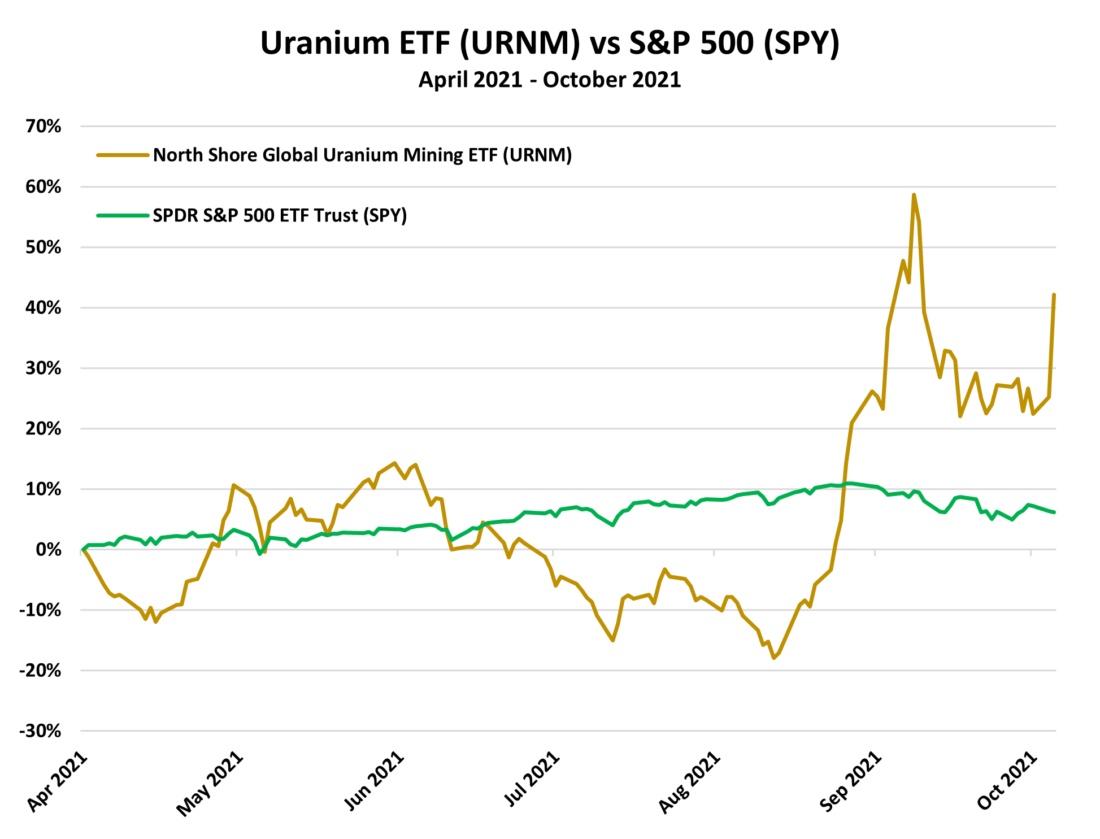

Since we added LONG Uranium to our list of themes, the North Shore Global Uranium Mining ETF (URNM) has risen +42%, vastly outperforming the S&P 500’s return of +6% over the same period.

CHARTS

Source material for today’s market insight…

Czech support for nuclear becomes law – Read the full article from World Nuclear News +

UK plans fossil fuel-free power grid by 2035 using nuclear energy – Read the full article from Al Jazeera

—

Originally Posted on October 13, 2021 – Uranium Back on the Rise as Spot Market Stays Hot, Europe Plans a Nuclear-Powered Future

Questions, comments or learn more about subscribing to MRP, contact –Rob@mcalindenresearch.com 646-964-6152.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from McAlinden Research Partners and is being posted with its permission. The views expressed in this material are solely those of the author and/or McAlinden Research Partners and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Hedge Funds

Hedge Funds are highly speculative, and investors may lose their entire investment.

Disclosure: OTC Securities

An investment in an OTC security is speculative and involves a high degree of risk. Many OTC securities are relatively illiquid, or "thinly traded," which tends to increase price volatility. Illiquid securities are often difficult for investors to buy or sell without dramatically affecting the quoted price. In some cases, the liquidation of a position in an OTC security may not be possible within a reasonable period of time.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.