By: Wood Mackenzie

The past 12 months has seen a profound shift in the outlook for the global economy. Security of energy supply concerns sparked by the war in Ukraine, higher rates of inflation than those seen for a generation and the persistence of the COVID-19 pandemic in key markets weighs upon expectations of economic growth. In part in response to these crises, 2022 saw notably aggressive new policy packages adopted in the US and EU (European Union) in support of energy and climate security goals.

The US Inflation Reduction Act (IRA) and REPowerEU (REU) plans respectively provide new grounds to anticipate a more rapid transformation in the ways energy is produced and consumed. Certainly both plans offer wider and deeper regulatory support for the energy transition. They also offer a bullish signal for the value of those equities and commodities positioned for growth in the renewable energy space counter those economic headwinds which defined the second half of 2022 and early 2023.

US shifts focus on greater domestic supply chain capacity

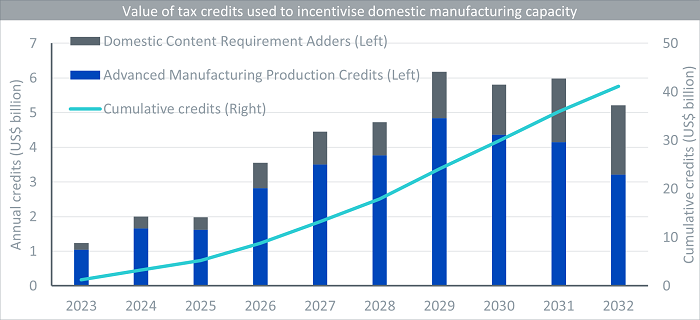

On 16 August 2022, US President, Joe Biden, signed the IRA into law. One objective of the IRA is to raise US demand for renewable energy. To do so, a range of fiscal incentives, including existing tax credits, have been extended and new forms of support have been introduced. As shown in Figure 1.1, these credits hold considerable cumulative value; Wood Mackenzie estimates in excess of US$40 billion over the next decade.

The IRA also introduces specific tax credits and bonus adders to encourage uptake of US-made equipment for renewable developments. The aim of this is to help offset the investment cost of expanding manufacturing capacity. Wood Mackenzie’s assessment is that the IRA will help spur further investment in US renewables manufacturing.

However, this will take time. Demand is already so great and the premium for US production so high – many capital-intensive pieces of equipment, such as wind turbine blades and PV (photovoltaic) panels, have up to a 34% price premium over imported counterparts – that imports are part of the landscape for some time to come. As a result, original equipment manufacturers (OEMs) and entities across the sustainable power value chain will strategically position themselves to take advantage of the US market.

One issue to watch is the final guidance from the US Treasury Department, the IRS, and the Department of Commerce on key provisions of the IRA with respect to what counts as “US manufacturing” and how domestic thresholds are calculated. Interpretation on these parts will be critical in determining the economic feasibility of setting up a domestic manufacturing supply chain, and, therefore, developer appetite for US equipment. That said, the outlook for US listed players in the renewable energy and sustainable power (electricity production) space, and the domestic supply chains that support them, have received an unexpected dose of regulatory support irrespective of how those provisions are settled.

Source: WoodMackenzie.

Historical performance is not an indication of future performance and any investments may go down in value.

Europe adds to already aggressive capacity targets

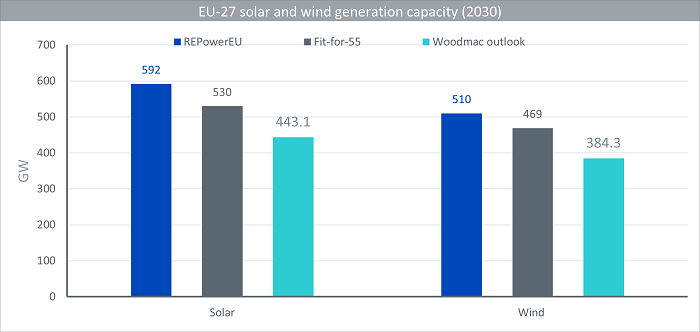

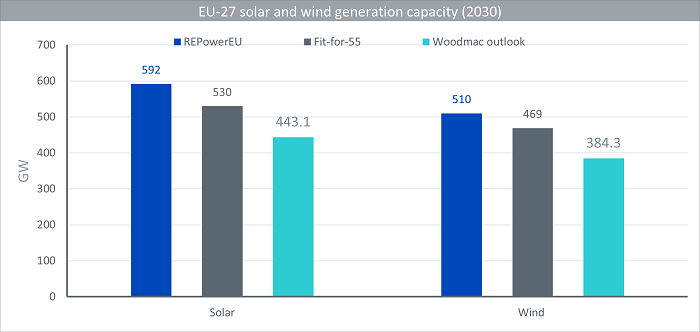

The European Commission (EC) published its detailed REU plan on 18 May 2022. Its goal is to rapidly reduce reliance on energy imports from Russia, without abandoning Europe’s decarbonisation objectives. Underpinning the plan is the target to increase the EU’s renewables target to 45% by 2030.

Wood Mackenzie estimates that a goal of 45% of the supply mix by 2030 requires total renewable generation capacity to reach 1,236 GW by 2030 – 15% higher than Fit-for-55 and more than double today’s capacity. Energy storage is an essential component of any power market with a high share of variable renewable generation. REU highlights that energy storage will play a crucial role in providing flexibility and future supply security.

The European Commission may assume (or hope) the storage market will take off on its own with the rising shares of variable renewables in the power system. But recent trends have demonstrated that this cannot be taken for granted. Even in 2022 – a time of rapidly rising power prices – price cannibalisation still happened. That’s a red flag for some investment theses and European renewable electricity players have become increasingly vocal that more needs to be done to ensure that the characteristics already being displayed in markets do not become major barriers to the continued expansion of renewable power supply.

Source: WoodMackenzie.

Historical performance is not an indication of future performance and any investments may go down in value.

A new renewable energy race

Wood Mackenzie research indicates the IRA will incentivise development of further US renewable equipment manufacturing capacity to support the expansion of renewable power capacity. Likewise, REU is a notable statement of EU alignment and heightened climate and energy security ambition for a larger share of renewable power capacity in the future. Both policies promise to accelerate the energy transition despite the macroeconomic context within which the policies were formulated.

The policies also indicate a contest is afoot to establish domestic supply chains capable of supporting an aggressive pursuit of net zero carbon emissions. Renewable supply chains, challenged by COVID-19 and the war in Ukraine, are being brought onshore and the race is on to see who can gain advantage in terms of lower cost and greater access to key technologies and commodities. The early indications are that the IRA, with the promise of stable long-term tax incentivisation, has given the US an early lead. Attention is now focusing on the EU, its member states, and just how it may respond to deliver a similar domestic capacity boost like the IRA has for the US to support its net zero targets.

—

Originally Posted March 27, 2023 – Energy transition gets unexpected boost

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)