- Declines across asset classes in 2022 may be a net positive for ETFs as investors repair and retool their portfolios

- Areas away from the S&P 500 are capturing flows while high yields in the Treasury market attract record-high idle cash

- At the same time, advisors may rethink how they allocate capital in 2023 given favorable relative costs and the tax benefits of ETFs versus SMAs

- With so many moving pieces, monitoring ETF trends will be key this year along with managing risk in the space

Last year’s market pain was ETFs’ gain. Big-time tax-loss harvesting allowed investors to sell losing mutual fund positions and purchase similar, often lower-cost, ETFs to improve their portfolios. It’s yet another tailwind for the ETF industry. Also consider that significant stock and bond market declines have not seemed to ding folks’ plans to continue putting money to work in various asset classes. According to one survey, 65% of retail investors intend to stick with their investment plans in 2023 while 29% expect to increase allocations.¹

An International Equity ETF Renaissance

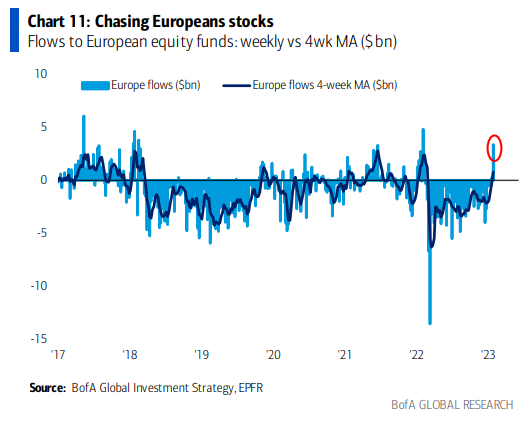

And we have already seen significant inflows to areas that were not so hot in 2022. China’s economic re-opening and the sudden outperformance among European equities since Q4 last year has led to a rebound in net flows toward those once beleaguered regions. According to data from EPFR, Euro Area equities took in more than $3 billion in net flows during the final week of January – the best single week in a year following a streak of 49 weeks of outflows that was halted the week prior. Todd Rosenbluth, VettFi’s head of research, notes that Chinese equity ETFs have gained popularity this year amid the ongoing rebound in emerging market stocks.²

European Equity Funds Capture investors’ Dollars Following Strong Performance in Q4

Source: BofA Global Research, EPFR

Big Yields, Big Flows

What’s more, higher bond market interest rates has led to significant money moving into short-dated Treasury ETFs. Expect that trend to continue as the Fed notches up its policy rate to the highest levels in more than 15 years to combat inflation. Fixed-income investors will finally be rewarded with positive real yields without stepping out far on the risk spectrum. A popular trade throughout the second half of last year and so far in 2023 is to play it safe in short-term Treasury ETFs.

Rates on the Rise, Money Pours into Treasury ETFs

Source: ETF Trends (2022 data through mid-September)

More Room to Run? Investors’ Record High Dry Powder.

Amid investor allocations shifting toward somewhat aggressive international shares and to risk-off Treasury ETFs, the landscape is shifting. No longer are people fixated on simply owning the S&P 500 or a broad U.S. stock market ETF. This new regime stands to benefit other asset classes and sub-asset classes, along with many ETF issuers. And there’s still opportunity for more money to shift into tax-efficient ETFs. Consider that there is more cash parked on the sidelines in money market mutual funds today than ever before, according to data from the Investment Company Institute as of January 26, 2023.³ At just shy of $5 trillion, that dry powder may eventually get put to work in equity and fixed-income ETFs.

Trend to Watch: RIA SMAs Converting to ETFs

Pivoting away from stocks and bonds, there is a broader bullish wave for ETFs. The tide may be moving out for traditional separately managed accounts (SMAs) and coming in for ETFs. Financial advisors no doubt recognize the benefits of the ETF wrapper, but for years it was assumed that it was only a boost for ETF issuers, not independent RIAs. Now, though, through technology and industry evolution, it’s easier and cheaper to launch an ETF to replace an SMA. Better tax treatment, fee insulation, making complex strategies easier to hold, and even, as VettaFi notes, the ability to hold alternative investments within retirement accounts, are all upsides to ETFs relative to SMAs. This is one theme we will be keeping our eyes on this year.

Wall Street Horizon’s ETF Data Coverage

Having the best data ETF data is paramount to managing risk. Wall Street Horizon is known for our award-winning corporate event data coverage for institutional investors, quant traders, academics, and portfolio managers. We’ve been beefing up our ETF database as the industry continues to expand.

The Bottom Line

2022 was like hitting the reset button for investors. Steep losses in stocks and across the bond market allowed people to reassess their allocations. Heavy tax-loss selling late in the year prompted money to be allocated away from mutual funds and into lower-cost, more tax-efficient ETFs. Moreover, with a rebound in foreign equities, investors are finally putting new money to work in regions that were unloved for years. Meanwhile, higher yields today and economic jitters attract cash to both the short and long ends of the Treasury curve. These trends may persist with record cash on the sidelines, too. At a higher level, wealth managers will likely be increasing their use of ETFs as costs retreat.

—

Originally Posted February 9, 2023 – ETF Trends in 2023: What Investors Must Look Out For

¹ https://www.cnbc.com/2022/12/08/retail-investors-say-stock-market-will-bottom-in-2023-finimize-survey.html

² https://www.etftrends.com/the-etfs-outside-the-big-three-pulling-in-cash/

³ https://www.ici.org/research/stats/mmf

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Tax-Related Items (Circular 230 Notice)

The information in this material is provided for informational purposes only and does not constitute tax advice and cannot be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local or other tax statutes or regulations, or to resolve any tax issue.