While Treasury Bonds are short-term oversold and have reached levels that have previously provided support (126-00 in the March contract), the market might pause and wait for some important fundamental information in the coming weeks. This market has had some counter-intuitive reactions to classic fundamental developments in the past, including a rush to buy Bonds in the face of hot inflation data and persistent stepwise increases in the US Federal Funds rate. The trade’s reasoning was that the medicine needed to shut off inflation would be overwhelming for the US economy and would result in a recession.

Not surprisingly, the Covid crisis and the accompanying fear of a depression resulted in nearby Bonds posting a 45-point gain from early 2021 to mid-March 2021. This was followed by a three-year, 83-point decline from the pandemic-inspired high that seemed to realign the market to a more rational level. Looking back at that decline, it was not surprising to see periodic recoveries against the downtrend.

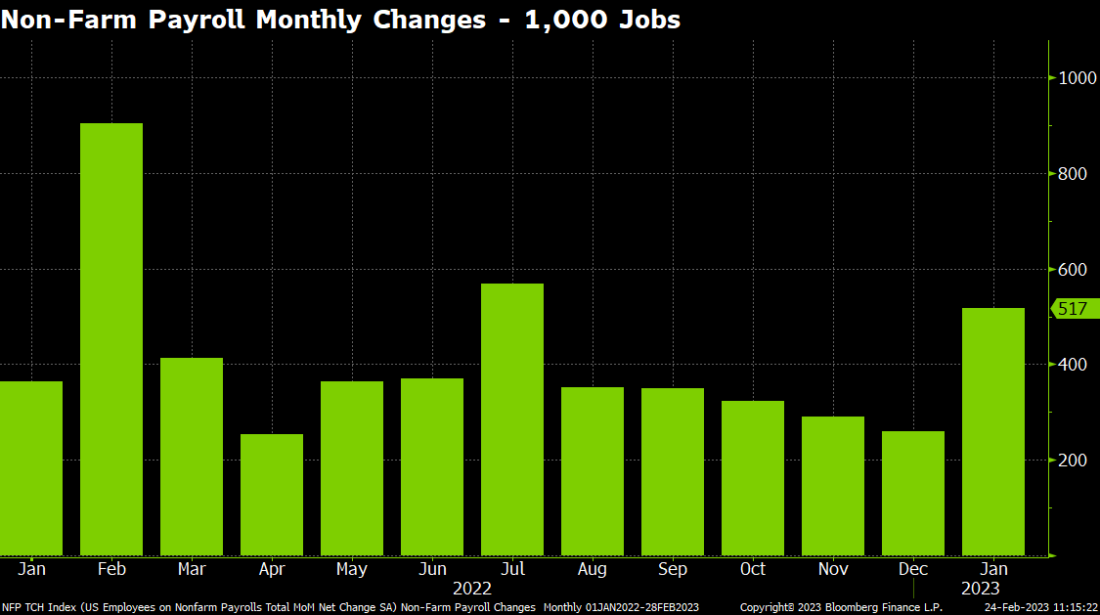

In retrospect, we view the 15-point rally from last October’s low to the late January high as normal corrective action that put the market in a better position to resume its long-term downtrend. More importantly, seeing Treasury prices fall 8 points in the wake of a much hotter than expected January jobs report and hotter than expected inflation readings in mid-February confirms the market’s shift back to classic fundamentals.

The hard break from the January high took place after the trade posted its largest spec and fund net short since March 2021. The Commitments of Traders reports have been postponed for several weeks due to a data problem, but we estimate that the net short reached historically significant levels at this week’s low, leaving the market deeply oversold.

We see Treasuries settling into a long-term downtrend but also recognize that the oversold condition could prompt short covering ahead of the US jobs report on March 10. For those looking to sell Bonds, we suggest combining a short futures position with option protection.

—

Originally Published February 24, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)