Portfolio Managers John Kerschner, Nick Childs, and Jessica Shill discuss how investors can take advantage of higher short-term yields while still managing duration exposure.

Key takeaways:

- Short-term interest rates have risen far more than intermediate and long-term rates in the current tightening cycle. The resulting inverted yield curve has presented investors with the rare opportunity to earn higher yields with less interest-rate risk.

- In our view, AAA rated collateralized loan obligations (CLOs) currently offer a compelling option to access higher yields within the short-duration universe.

- Investors may consider pairing Treasuries or mortgage-backed securities (MBS) with their AAA CLO allocation to fine-tune their overall portfolio duration.

Whether one is a fisherman or not, it can be universally appreciated that it’s best to go fishing where the fish are. It goes without saying that casting a line into a body of water containing no fish is guaranteed to yield very little. That’s why avid fishermen spend countless hours studying the behavior of fish and use sonar-powered fish finders to put themselves in the right place at the right time.

We think bond investors would do well to apply the principle of “fishing where the fish are” as they consider how to position their fixed income portfolios. In the case of bonds, we are not talking about fish, of course, but yields. While it is true that bonds can provide returns from either yield or price movements, yield has historically been the primary source of return and, therefore, the element to which investors should pay the most attention.

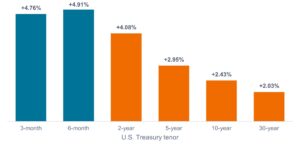

Yield changes on the 10-year U.S. Treasury have garnered much attention recently, but the bigger story is the change at the short end of the yield curve. As shown in Figure 1, since the beginning of 2022, when rates began to move in response to high inflation and a hawkish Federal Reserve (Fed), short-term rates have risen far more than intermediate and long-term rates.

Figure 1: Change in U.S. Treasury rates by tenor (Jan 2022 – Feb 2023)

Short-term rates have moved up far more than intermediate and long-term rates in this tightening cycle.

Source: Bloomberg, as of February 24, 2023.

Note: Bars represent the change in the yield to maturity on U.S. Treasury bonds by tenor from January 1, 2022 to February 24, 2023.

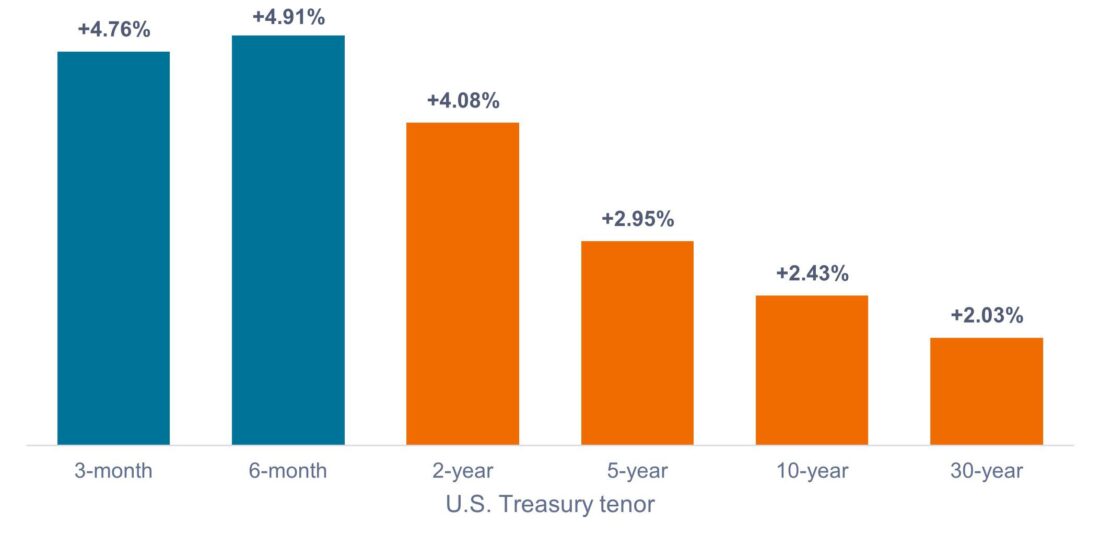

Due to disproportionate changes along the yield curve, the yield to maturity on short-term Treasuries is now higher than on longer-dated Treasuries, resulting in an inverted yield curve. Bond investors now have a unique opportunity to earn higher yields while taking less duration (or interest-rate) risk, as shown in Figure 2.

It is important for investors to grasp how rare inverted yield curves are: In the 31 years since February 1992, the yield on the 2-year U.S. Treasury has been above the yield on the 10-year Treasury for less than 9% of all trading days.

Figure 2: Yield to maturity on U.S. Treasuries by tenor

Inverted yield curve means higher yields are available with less interest-rate risk.

Source: Bloomberg, as of February 24, 2023.

Note: Chart shows current yield to maturity for U.S. Treasuries by tenor.

Gaining short-duration exposure

Now that bond investors know where the fish are, so to speak, the question becomes how best to gain exposure to short-duration yield. Typically, investors have turned to corporate credit, but we think there is a better alternative.

In our view, AAA rated collateralized loan obligations (CLOs) offer a compelling option for investors seeking short-duration exposure. As shown in Figure 3, the reasons for this are fivefold: Compared to corporate credit, AAA CLOs currently offer better yields, with higher credit quality, at more compelling valuations, with the diversification benefits of floating-rate coupons, and low correlation to the Barclays U.S. Aggregate Bond Index (Agg).

Figure 3: AAA CLOs vs. short-duration corporate credit

| AAA CLOs | 1-3 year corporates | |

| Yield to worst | 6.03% | 5.52% |

| Credit quality | AAA | A-/BBB+ |

| Current spread as a percentage of 10-year average spread | 113% | 93% |

| Coupon | Floating | Fixed |

| Correlation to Agg | 0.216 | 0.723 |

Source: Bloomberg, J.P. Morgan, Janus Henderson Investors, as of February 24, 2023. Indices used to represent asset classes: AAA CLOs (J.P. Morgan AAA CLO Index), 1-3 Year Corporates (Bloomberg U.S. Corporate 1-3 Year Index).

What if rates fall from here?

While investors can appreciate the yields on the short end of the curve, some are concerned about missing out on a rally in long-term rates if they’re overexposed to short duration. Their logic? Inflation is trending down from its 2022 peak; the Fed is close to pausing and may even start cutting rates later in 2023. We don’t want to be short duration once rates begin to fall – it would be better to be long duration to pick up the price appreciation.1

We do not agree with this logic. First, we believe investors should avoid trying to predict where the “fish” will be in the future. Instead, they should focus on where the yield is right now, bearing in mind that yield has historically been the most significant contributor to total returns in fixed income.

Second, while it is true that inflation is coming down and we are nearing the end of the rate-hiking cycle, the Fed is still raising rates. And after January’s hotter-than-expected inflation readings, it seems likely that the central bank will hike at least once or twice more before pausing – another tailwind for floating-rate bonds. The Fed has also stated it does not intend to cut rates in 2023.

What if the Fed starts cutting aggressively?

While we think it’s unlikely that rates will fall materially anytime soon, the chances are not zero. The scenario in which this may occur is if the economy enters a deep and prolonged recession, and if that happens, longer-duration bonds are likely to outperform.

Investors who do not want to be caught with too little duration in that scenario may consider pairing their AAA CLO allocation with longer-duration assets, such as Treasuries, mortgage-backed securities (MBS), or corporate bonds.

We think pairing AAA CLOs with corporate bonds for a recession scenario would be suboptimal for many of the same reasons we listed for short-duration corporates, as shown in Figure 4. Furthermore, if the economy does enter a recession, corporate spreads are likely to widen from current levels, because, in our view, they are not adequately pricing in the chances of a recession.

That leaves the option of pairing AAA CLOs with Treasuries or MBS. While Treasuries would be a viable option, MBS has the added benefit of a pickup in yield and the possibility of outperformance from spread tightening.

Figure 4: MBS vs. Treasuries and Corporates

| MBS | Corporates | U.S. Treasuries | |

| Yield to worst | 4.75% | 5.47% | 4.34% |

| Credit quality | AAA | A-/BBB+ | AAA |

| Current spread as a percentage of 10yr average spread | 125% | 95% | – |

| Duration | 6.1 years | 6.9 years | 6.0 years |

Source: Bloomberg, Janus Henderson Investors, as of February 24, 2023. Indices used to represent asset classes: MBS (Bloomberg U.S. Mortgage-Backed Securities Index), Corporates (Bloomberg U.S. Corporate Bond Index), U.S. Treasuries (Bloomberg U.S. Treasuries Index).

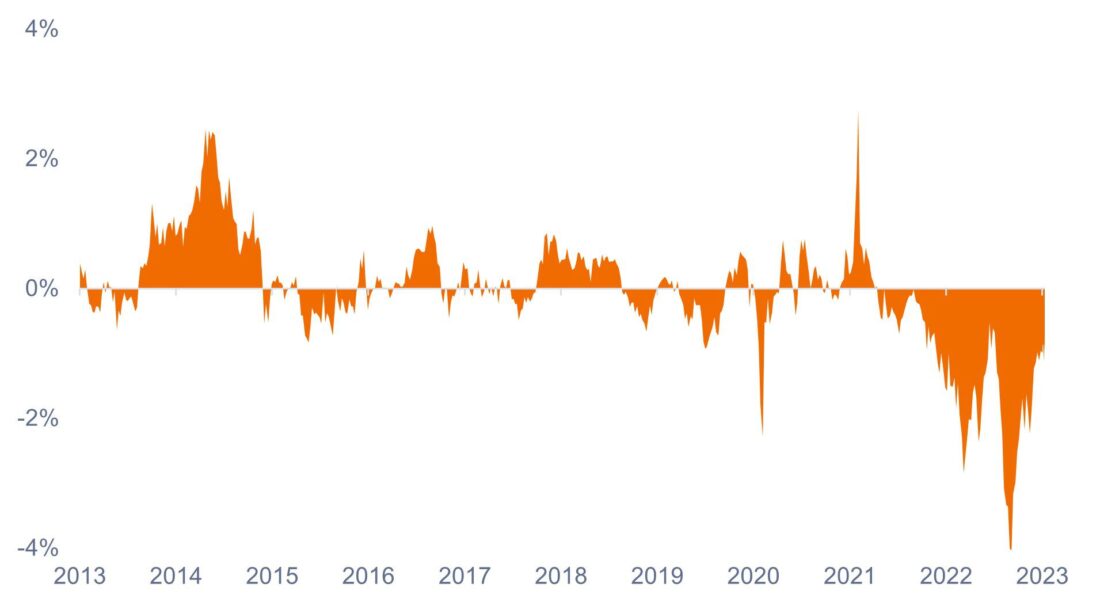

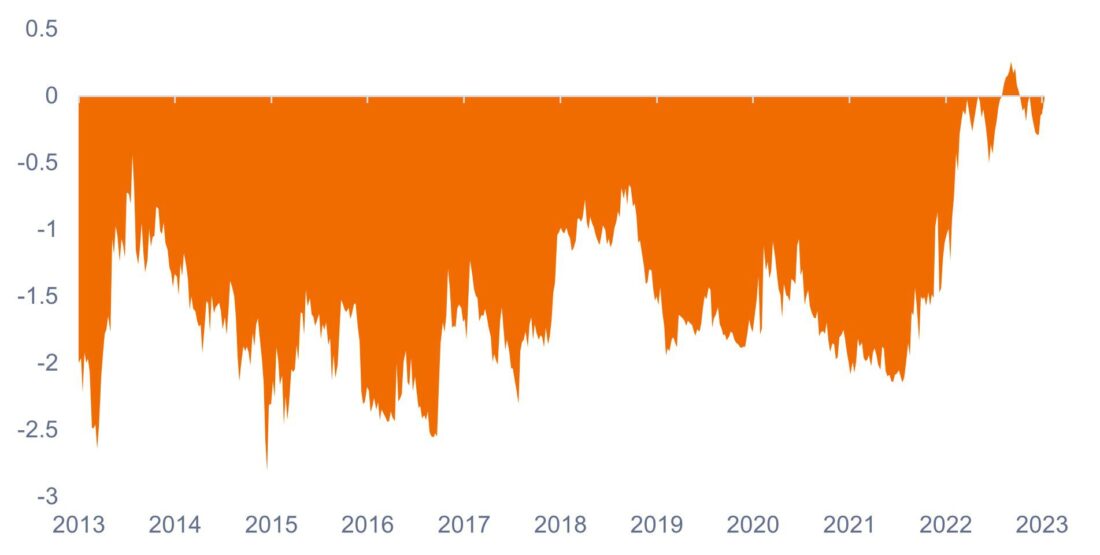

Our premise for using MBS to add duration is based on two post-COVID developments in the MBS market. First, MBS have significantly underperformed Treasuries since late 2021, as shown in Figure 5. However, many of the reasons for their relative underperformance, such as high interest-rate volatility and supply concerns as the Fed reduces the size of its balance sheet, have begun to unwind. While not as cheap as they were in the fall of 2022, we think MBS do still have the potential to outperform Treasuries as priced-in risks continue to dissipate.

Figure 5: MBS excess return over U.S. Treasuries (rolling 12 month)

Since late 2021, MBS have underperformed Treasuries, but we believe they’re poised to outperform from here.

Source: Bloomberg, as of February 24, 2023.

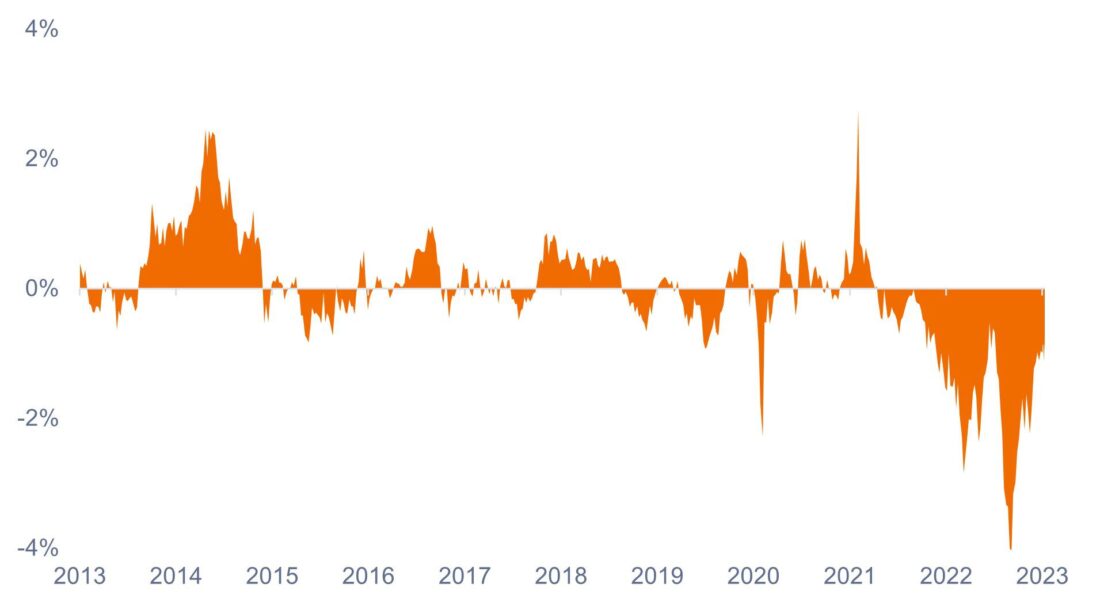

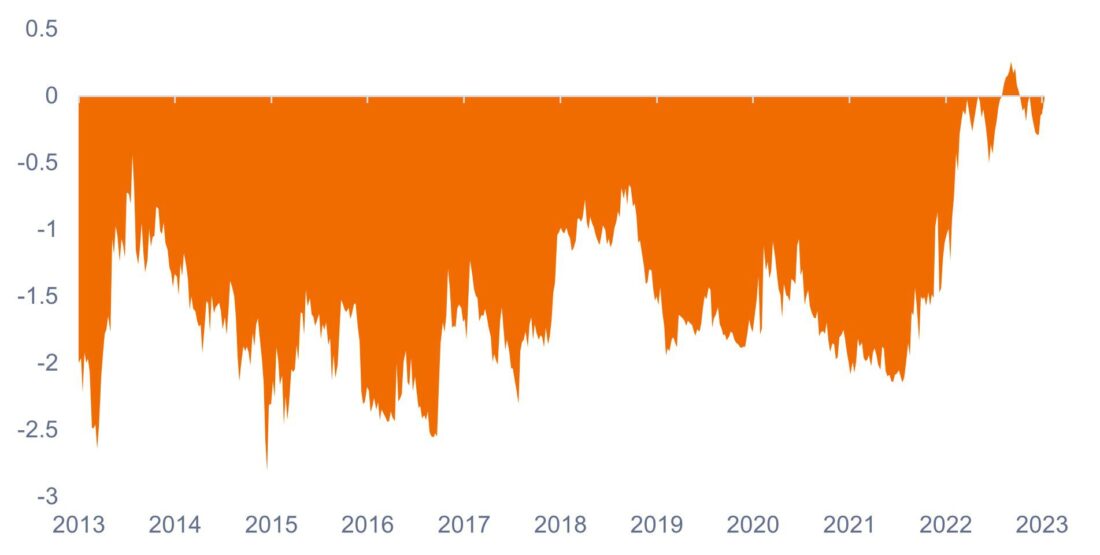

The second development is that negative convexity risk in MBS – which has historically dissuaded investors from using MBS as an instrument to add duration to portfolios2 – has dropped to all-time lows, as shown in Figure 6. Negative convexity is simply a measure of the cash flow variability of mortgages. Due to the record number of home purchases and refinances at extremely low rates in 2020 and 2021, more than 90% of existing mortgages were originated at rates of 4% or lower. With the current mortgage rate above 6%, most mortgage holders have no incentive to refinance. The result is that mortgage cash flows are more certain than they’ve historically been and, therefore, we believe now is a good time to consider using MBS as a duration lever.

Figure 6: MBS negative convexity at historical lows

Refinancing risk is lower than ever, resulting in a more stable duration profile for MBS.

Source: Bloomberg, as of February 24, 2023.

In summary

Since 2008, fixed income investors have been lamenting low yields under the Fed’s zero interest-rate policy. Now, rates have finally risen to the extent that bonds are generating better income, particularly on the short end of the yield curve. We think AAA rated CLOs present a compelling option for investors seeking to access the yields on offer. And when paired with Treasuries or MBS, investors can continue to “fish” for yield in short duration, while still fine-tuning their desired duration exposure.

Footnotes and Definitions

1 When interest rates fall, prices of long-term bonds typically rise more than prices of short-term bonds.

2 When rates fall, duration on MBS typically falls too, because homeowners are incentivized to refinance their mortgages at lower rates. Bond investors thereby receive earlier payback, which reduces the duration of their investment, and they end up not fully benefitting from falling rates.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

IMPORTANT INFORMATION

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

—

Originally Posted March 2, 2023 – Fishing for yield in AAA CLOs and MBS

Disclosure: Janus Henderson

The opinions and views expressed are as of the date published and are subject to change without notice. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes and are not an indication of trading intent. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Janus Henderson and is being posted with its permission. The views expressed in this material are solely those of the author and/or Janus Henderson and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)