We’re just past the two-week point in the latest episode of bank woes, and the markets continue to grapple with the aftereffects. What started out as more of a U.S.-centric regional bank concern has now moved across the Atlantic to infect some well-known bank names in Europe.

If you’re looking for any silver lining in the current situation, global central banks, led by the U.S. Federal Reserve, have acted quickly to try and stem potential systemic damage. The debate will certainly continue as to how it could have gotten to this point, but this blog post is going to focus more on the action the Fed has taken and how it is playing out thus far.

Although the Fed did ultimately raise rates by another 25 basis points (bps) at the March FOMC meeting, there was considerable debate about whether the voting members would refrain from any further rate hikes, given some of the dislocations created by the banking woes.

In fact, as of this writing, Fed Funds Futures have removed the possibility for another increase at the May FOMC gathering for just this reason. However, from the Fed’s point of view, an important distinction needs to be made. The U.S. policy makers view tools, such as Fed Funds, from more of a monetary policy perspective, i.e., for economic and/or inflation considerations. Dislocations in markets, specifically for funding purposes, can be addressed by using other tools and facilities, such as the recently announced Bank Term Funding Program (BTFP), which itself represents an enormous amount of potential lending availability for banks/depository institutions.

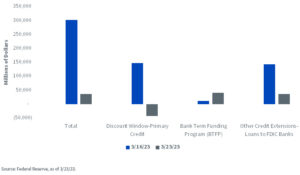

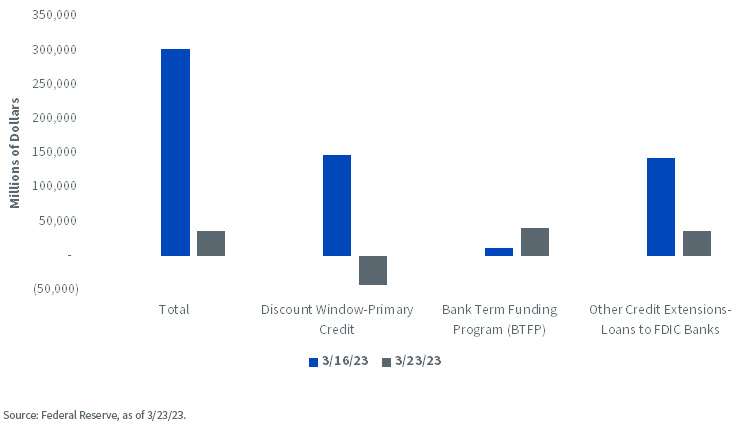

Fed Balance Sheet: Dollar Change in Lending Facilities

So, let’s take a look at how things are panning out from this perspective. The Fed releases their balance sheet every Thursday at 4:30 p.m. ET, and this is where investors can find insights into how these types of lending facilities are being utilized. There are three key items on the Fed’s balance sheet where this information can be found: the discount window for primary credit, BTFP and other credit extensions for loans to FDIC banks.

There is no doubt that in the immediate aftermath of the Silicon Valley Bank (SVB) failure, banks and depository institutions took advantage of what the Fed was offering. The total amount of these three areas of bank lending surged by $303 billion in the week of March 16. To provide perspective, in the pre-SVB world (March 9), this total amount was only $219 million. All three aforementioned line items rose as well, but the more notable increases came from the discount window ($148.3 billion) and the other credit extension component ($142.8 billion). Use of the ‘new’ BTFP facility was much lower at $11.9 billion.

For the just completed week of March 23, there was noticeably less usage of these facilities. The total increase dropped to $36.1 billion, as gains of $41.7 billion for BTFP and $37.0 billion in other credit extensions was partially offset by an outright decline in borrowing at the discount window of -$42.6 billion.

Conclusion

If you are looking for a silver lining at this stage of the game, the drop-off in usage of the Fed’s lending facilities falls into that category. Without a doubt, it’s still early in the process, and I’m well aware of how things can change quickly and not necessarily for the good. However, the Fed’s tools on this front are working like they are supposed to, and that is good news.

—

Originally Posted March 29, 2023 – The Fed’s Lending a Hand

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)