This morning, St. Louis Fed President Bullard published a piece entitled “What Do Financial Conditions Indexes Tell Us?” This is a topic that has been front of mind for many after the recent bank failures. Unfortunately, Mr. Bullard’s answer is similar to mine: financial conditions indexes can be helpful, but they can tell different stories that depend upon how each index is constructed.

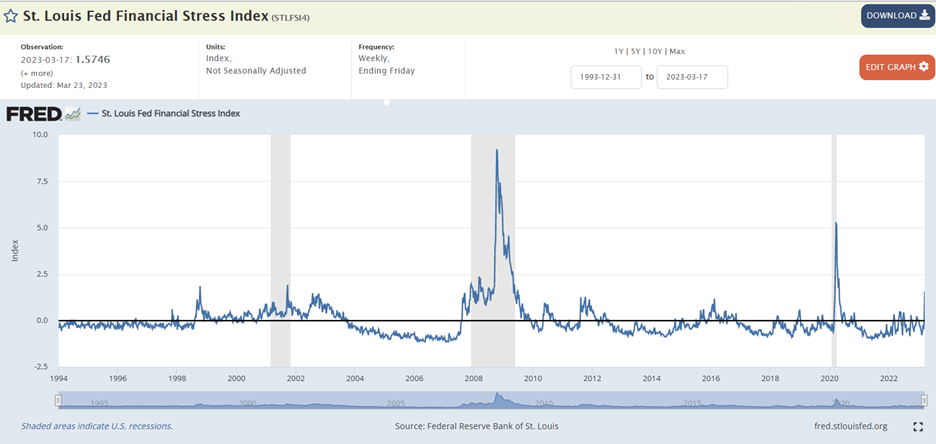

Not surprisingly, Bullard’s piece highlights an index constructed under his purview, the St. Louis Fed Financial Stress Index. If you look very carefully at the right side of the graph below (you can get more detail if you click on the link), you can see the last reading spiking to levels not seen since the onset of the pandemic, and before that, during the global financial crisis (GFC). Perhaps ominously, the current level is on par with the beginning of the GFC, which hardly portended the trouble to come.

Source: St. Louis Fed Financial Stress Index (STLFSI4) | FRED | St. Louis Fed (stlouisfed.org)

The current spike in no way portends that conditions will worsen to the peaks seen in either of the past two severe crises, but we are now at levels on par with 9/11 and the failure of Long Term Capital Management.

Each of those crises was met by quick action from the Federal Reserve to ensure minimal effects on the broader economy, with each crisis getting ever-larger rounds of accommodation. This is analogous to a patient who has become accustomed to a certain medication and thus requires larger doses to get the same relief. Investors have come to expect that central banks will offer some sort of analgesic to markets suffering from financial stress. It is well within their purview to do so.

Yet it is important to remember that assuaging market concerns is not part of the Fed’s so-called “dual mandate.” Their role is to foster maximum employment and price stability. But that price stability does not refer to asset prices – it refers to the prices of goods and services in the economy. Inflation is now above the levels seen at any time during the thirty year period covered by the graph above. The Fed could do their best to enable the smooth functioning of markets without too much risk to their price stability mandate. That is not the case now.

Investors hoping for a dovish Fed response, featuring an imminent end to rate hikes and subsequent cuts should then be disheartened by Bullard’s conclusion:

In my view, continued appropriate macroprudential policy can contain financial stress in the current environment, while appropriate monetary policy can continue to put downward pressure on inflation.

In other words, we can treat the maladies in the banking system without changing our stance on inflation. This fits with Bullard’s hawkish view, expressed late last week, that he sees rates peaking at 5.625%. Granted, he is only one of several regional Fed Presidents, and not a voting member of the FOMC, but if his view is anywhere close to the committee’s mainstream, short-term rates seem to be well ahead of the Fed when it comes to cutting rates.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.