Yesterday, we posted a quick reaction piece to Federal Reserve Chair Powell’s Senate testimony. We noted the sharp initial drops in both stocks and bonds and the modest bounces after the knee-jerk reactions. Quite frankly, we didn’t foresee the full extent of yesterday’s sell-off, though it was well within the range of likely outcomes.

As we meander around the unchanged line on the S&P 500 Index (SPX), digesting yesterday’s moves in stocks and bonds, here are a few takeaways:

- Even though we gave back all of Friday’s big gains, we never re-tested Thursday’s lows As a result, the technical factors that have been supporting this year’s advance in stocks – and a good portion of the bulls’ case – remain in place. The chart below shows how the 50-day moving average remains a magnet for SPX, while the 200-day and major trendlines remain in place.

SPX 6 Month Daily Bars (red/green), 50-Day (yellow) and 200-Day Moving Averages (blue)

Source: Interactive Brokers

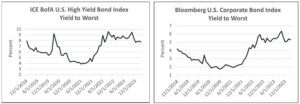

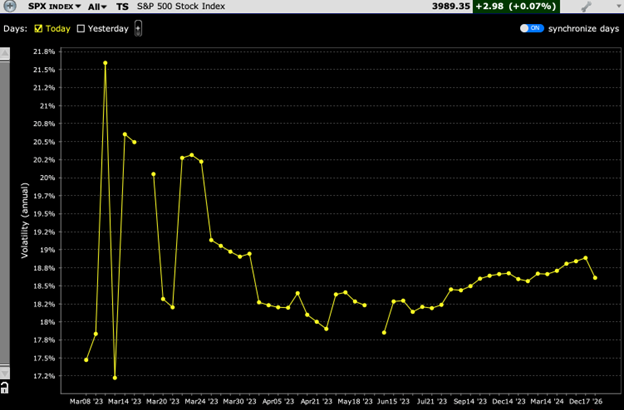

- It would be fascinating, if not concerning, to see what might follow if those supportive levels are clearly broken. For now, while they hold, there is still a general lack of concern. We noted the tepid rise in VIX yesterday, and there is no apparent rush for volatility protection today. The term structure of implied volatility for SPX shows some spikes around Friday’s Payrolls report, CPI/PPI next week, and the FOMC rate announcement two weeks from today but these are not levels that imply major concern. The 21.6% peak for Friday implies a 1.35% move around the Payrolls data, and all the subsequent peaks imply smaller moves. To be fair, the current levels are well above those of a week ago – the implied volatility for this Friday was 18 – but one might reasonably expect more concern about volatility surrounding a Fed meeting that is now considered “in-play”.

SPX Implied Volatility Term Structure

Source: Interactive Brokers

- Speaking of an “in-play” Fed meeting, Fed Funds futures now show a 70% chance for a 50bp hike. On Monday, that chance was only 25%. We saw 2-year Treasury notes pierce 5% in response, though we saw a modest dip in yields on 10-year notes and 30-year bonds. That widened the already concerning yield curve inversion. If the Fed is indeed ratcheting up its fight against inflation, it makes sense that long bonds might incorporate lower inflation expectations over time. That same logic was a drag on gold prices, though it is allowing the NASDAQ 100 Index (NDX) to outperform SPX today. If tech stocks are considered the ultimate long-duration assets, then lower long-term rates are a boon to their prices.

The key takeaway was the Chair reaffirmed the notion of a data-dependent Fed. The magic word “disinflation” has gone by the wayside after a trifecta of higher-than-expected inflation reports. That is why I have a difficult time wrapping my mind around the relatively low levels of VIX and other implied volatility measures as a series of key data points approaches. Traders’ risk-on mentality remains in place as long as the technical remain in place.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.