E-mini S&P (June) / E-mini NQ (June)

S&P, yesterday’s close: Settled at 4205.00, up 0.25

NQ, yesterday’s close: Settled at 13,902.50, up 44.50

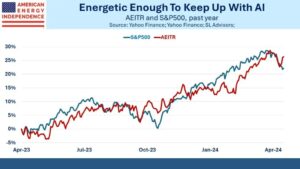

Fundamentals: A market’s memory can fade from week to week, and sometimes, like an old car in the thick of a Chicago winter, it takes a moment to get the engine running. We certainly are not sitting here forecasting another week of +1.6% for the E-mini S&P futures and +3.4% for the E-mini NQ, but we will give the nod to a healthy consolidation that unfolds through midweek. We often talk about digesting gains and find it important to consolidate early in a week following a strong one (like last). Furthermore, we believe such a healthy consolidation could set the table for a strong finish this week. On Friday, stock benchmarks held ground terrifically despite reports that debt ceiling negotiations broke down. The deadlock continues, with a possible default on June 1st being the worst-case scenario. If no true deal is struck, there are remedies of course, but at what cost and to what degree of market angst? Yesterday’s talks between President Biden and House Speaker McCarthy did not yield anything, but both sides are expected to remain in close contact. We do not envision a worst-case scenario. In fact, we believe the market has begun discounting a proverbial ‘can’ being kicked down the road at minimum. What if an actual deal is struck? Does this pave the way for a true bull leg breakout in the S&P? Although we do not want to ignore those worst-case scenario risks and what could equate to a swift correction, by some considerations, there is an equal risk to the upside. What would create a bull leg breakout above 4300 in the E-mini S&P? The wall of worry is being climbed right now, and under-positioned managers, coupled with the AI narrative, have brought that buying punch. NVIDIA, the leader in AI, reports earnings Wednesday after the bell. We believe it is very possible the company not only beats expectations for the prior quarter but raises guidance significantly. In actuality, the market may be a bit disappointed if guidance is not raised. Regardless, some combination of positive movement on the debt ceiling ahead of the holiday weekend, coupled with a strong showing from NVIDIA is not only in the cards, but could become the likely scenario that no one is talking about.

Dallas Fed President Logan speaks again at 8:00 am CT. U.S. Flash PMIs for May are then due at 8:45 am CT. The focus will likely be on Manufacturing which is expected right at the expansion-contraction line of 50.0. This comes after NY Empire State Manufacturing plummeted, nearly matching the worst since the onset of the pandemic, and Philly Fed contracted, but was less-worse than feared. Services PMI is expected at 52.6. New Home Sales follow at 9:00 am CT, and the U.S. Treasury will auction $42 billion 2-year Notes at noon CT.

Technicals: E-mini S&P and E-mini NQ futures spiked to start the session but began slipping through Asian hours and have slipped to slightly negative ahead of the U.S. opening bell. Price action responded to major three-star support overnight Sunday and put in a higher low after the false reports of an explosion at the Pentagon yesterday morning. This draws the line at 4185.75-4188.50 in the S&P and 13,756-13,791 in the NQ; we must be more Bullish in Bias while out above here. However, we will use our Pivot and point of balance, a pocket surrendered this morning, continued action below here will keep the tape soft at a minimum and gear it up for a direct test into major three-star support. If support goes, our next level comes in at … Click here to get our (FULL) daily reports emailed to you!

Crude Oil (July)

Yesterday’s close: Settled at 72.05, up 0.36

Fundamentals: Crude Oil futures are retesting the $73 mark this morning after the Saudi Energy Minister warned speculative shorts, “they will be ouching, they did ouch in April.” This comes one week before OPEC+ meets to discuss its production plans. His comments created a bullish tailwind, creating fresh speculation the cartel will again move to support prices. Today’s focus will shift to the U.S. economic calendar, which includes Flash PMIs at 8:45 am CT, and weekly inventory data. Early estimates ahead of today’s API survey and tomorrow’s official EIA data point to -0.92 mb Crude and -0.695 mb Gasoline.

Technicals: We remain cautiously Bullish in Bias and believe that multiple tests of major three-star resistance, previously rare major four-star, at 73.40-73.80 will wear it down. The stage is now set for a close above here, though another failure could prove catastrophic in the near-term. In order to keep the rally constructive, we must see price action remain buoyant out in front of our Pivot and point of balance at … Click here to get our (FULL) daily reports emailed to you!

Gold (June) / Silver (July)

Gold, yesterday’s close: Settled at 1977.2, down 4.4

Silver, yesterday’s close: Settled at 23.861, down 0.199

Fundamentals: Gold and Silver futures plunged again overnight. Whereas Gold responded in front of last Thursday’s low, Silver stretched to a fresh two-month low (March 28th). The landscape remains extremely choppy, but last week’s trend from midweek has regained the reins. The bulls made a valiant effort on the heels of Fed Chair Powell’s less-hawkish comments Friday, coupled with deadlock in Washington. However, it is China weakness that is dominating the tape as the USDCNH is back to Friday’s early higher, the strongest the U.S. Dollar has been against the Yuan since November, when Gold rallied through $1700. Flash PMIs are on deck for 8:45 am CT, followed by New Home Sales at 9:00 am CT. With Treasury weakness a headwind to precious metals, the U.S. Treasury is set to auction $42 billion 2-year Notes at noon CT.

Technicals: The overnight weakness confirms a Neutral trend, but a high low in Gold (so far) is seen as constructive as long as price action continues to respond favorably. Silver is also peeling itself off the overnight low. Both face strong resistance, just to repair the overnight break, and this starts with resistance at … Click here to get our (FULL) daily reports emailed to you!

—

Originally Posted May 23, 2023 – Are Tailwinds For S&P 4300+ Brewing?

Disclosure: Blue Line Futures

Futures trading involves substantial risk of loss and may not be suitable for all investors. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results. The information contained within is not to be construed as a recommendation of any investment product or service.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Blue Line Futures and is being posted with its permission. The views expressed in this material are solely those of the author and/or Blue Line Futures and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.