If you listen closely, just below the buzz of today’s headlines, there’s a burgeoning topic that’s about to explode on the scene. It’s been ringing in my ears for a couple of months. The next battle in the global populist war won’t be socio-economic, it’ll erupt from the growing friction between young and old.

The relentless murmuring started with a business trip to London and Tel Aviv. In London, I attended a panel discussion with two former prime ministers of the United Kingdom (UK), Tony Blair and David Cameron. The conversation naturally addressed the challenges the UK faces in the post-Brexit world. Sadly, the UK has suffered through at least three major disasters in the past 15 years — the Global Financial Crisis (GFC), Brexit, and the pandemic. As a result, there’s been some long-term scarring to the UK economy, politics, and society. Chatting with clients and colleagues following the panel, it became clear that as the UK attempts to find solutions to its problems, tensions between the young and old are rising.

Later, I met one of my closest friends for lunch. We were neighbors growing up and he now lives in London with his family. It didn’t take long for our conversation to turn to his 90-year-old mother and my 83-year-old father, both physically fit as fiddles but experiencing cognitive decline. So many people in my age group are wrestling with long-term care options for aging parents. A challenge that is only going to multiply for future generations.

Having lived in London for three years from 2008 to 2011, my visit felt like a homecoming of sorts, one that coincided with China’s lunar new year. Finally free of COVID-19 travel restrictions, more than 200 million unmarried Chinese had returned home to celebrate, only to be peppered with questions from parents and relatives about when they planned to marry and start a family. At the same time, Chinese authorities announced that in 2022, for the first time in 60 years, China’s population had declined.1 With fewer taxpaying workers to fund an already strained social welfare and healthcare system, China faces the frightening possibility of growing old before growing rich.

In Tel Aviv, the seemingly independent notes in my head started to form a more audible tune. I had been to Tel Aviv once before, more than a decade ago. Today, the horizon was filled with new skyscrapers and cranes developing more commercial and residential properties. On the drive from the airport to my hotel, the construction of the Tel Aviv Light Rail, a mass transit system for central Israel, caught my attention.

I couldn’t help but contrast the energetic vibe in Tel Aviv with the tension in London. My Israeli colleague reminded me that Israel is about the size of New Jersey and has its fair share of challenges too. But despite the daily disruption and considerable expense, Israel has committed to making the necessary investments to materially improve its infrastructure. And no surprise, almost a third of Israel’s population is under the age of 17 and the median age is about 30, nearly a decade younger than most developed market countries.2

That nagging ringing in my head didn’t go away when I returned home. In early January, it took 15 ballots to elect Kevin McCarthy as the Speaker of the House of Representatives — the most since before the Civil War. On January 19, the US breached the debt ceiling again, forcing the Treasury Department to start taking extraordinary measures to keep the government afloat and setting up another showdown between Republicans and Democrats this summer.

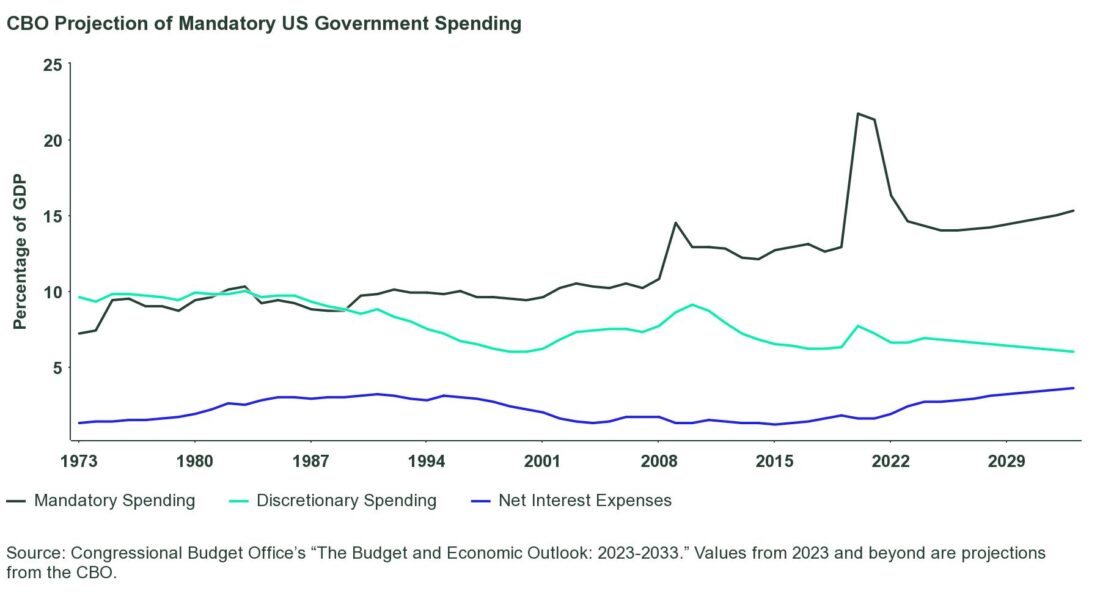

In mid-February, the nonpartisan Congressional Budget Office (CBO) released “The Budget and Economic Outlook: 2023-2033,” which warned that the Treasury Department would exhaust its ability to pay all its bills sometime between July and September. The report also forecast that US budget deficits will average $2 trillion between 2024 and 2033, approaching pandemic-era records by the end of the decade3 — which will likely fuel Republican demands for spending cuts.

On February 15, former South Carolina governor and United States ambassador to the United Nations, Nikki Haley formerly announced her candidacy for president. The Republican candidate immediately tried to drive home a major difference between herself and her two major competitors — President Biden and former President Trump — by controversially suggesting that politicians over 75 years old should be required to take a mental acuity test. Nikki Haley is 51 years old. In one fell swoop, Haley purposefully made age a major issue in US politics.

Finally, like a thunderbolt it struck me. That constant annoying humming in my head was the unsettling realization that the battle lines between young and old were being drawn.

I turn 50 years old later this year. That milestone — not quite young but not too old — places me almost perfectly to objectively explore the young vs. old dynamics and the potential implications for investors.

Aging Population Creates Fiscal Fissures

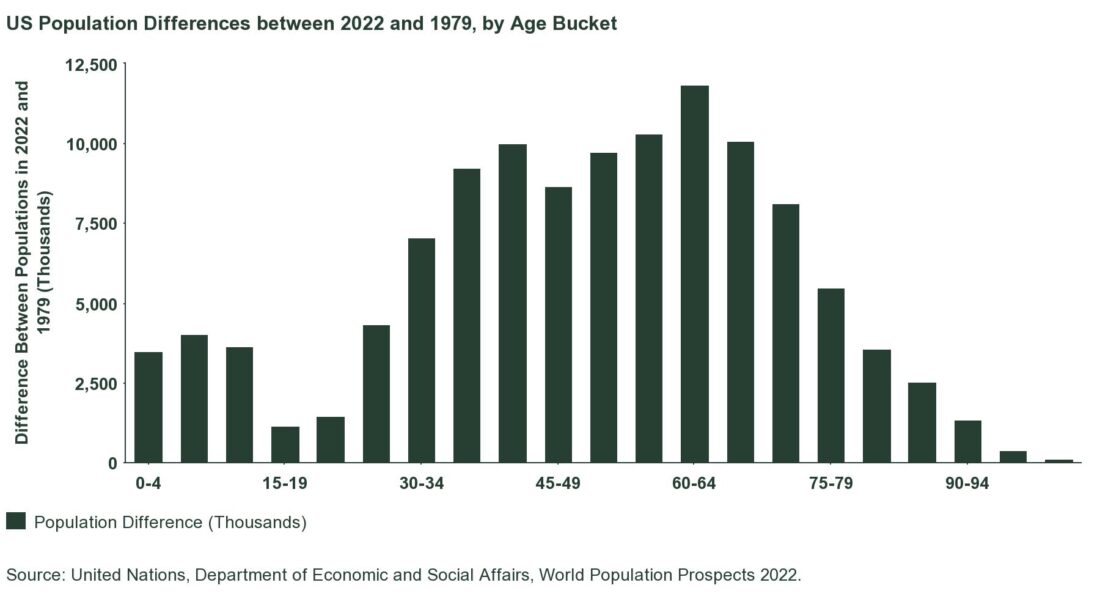

Americans are getting older. The statistics are staggering. In less than two decades older Americans will outnumber children for the first time in US history. According to the US Census Bureau, by 2060, nearly one in four Americans will be 65 years and older, the number of 85-plus will triple, and the country will add a half million centenarians.

The bigger challenge may be that there will be far fewer younger Americans to care for and support the elderly. For almost three decades, from 1980 to 2007, the US birth rate was stable at about 65-70 births per 1,000 women between the ages of 15 and 44. But, since the GFC, the US birth rate has fallen by 20%.4

Businesses are struggling to find qualified, skilled workers in today’s already tight labor market. Despite the demand for skilled workers, the supply of labor remains constrained with the unemployment rate at 3.4%, a 54-year low, and the labor force participation rate stuck in neutral.

As a result, there are far fewer younger workers contributing to ballooning entitlement programs like Social Security, Medicare, and Medicaid. These cracks in the foundation may lead to a Grand Canyon sized disaster in the future.

Meanwhile, the CBO’s report on the budget and economic outlook for the next ten years paints an equally bleak portrait of the US fiscal position. In the short-term, declining year-over-year government tax receipts combined with skyrocketing interest costs are further complicating an already difficult fiscal situation.

Generous fiscal policies from both Republicans and Democrats have left government spending above its long-term average. When this has happened before — mid-1980s, mid-1990s, and early 2010s — negotiations to raise the debt ceiling became a catalyst for deficit reduction.

It’s difficult enough to raise the debt ceiling in divided government. Adding in deficit reduction discussions makes the process more challenging and the potential impacts more significant for financial markets.

Click here to read the full article

Footnotes

1 Eleanor Olcott, “China’s singles fight family pressure to get married as population declines,” Financial Times, January 26, 2023.

2 “Over 3 million Israelis are younger than 17 – study,” I24 News, November 16, 2022.

3 David Lawder and Richard Cowan, :U.S. could face debt-ceiling crisis this summer without deal, CBO warns,” Reuters, February 15, 2023. Congressional Budget Office’s “The Budget and Economic Outlook: 2023-2033.”

4 Melissa Kearney, Phillip Levine and Luke Pardue, “The Mystery of the Declining US Birthrate,” Econofact, February 5, 2022.

5 Emily Brandon, Why Older Citizens Are More Likely to Vote, US News and World Report, October 20, 2020.

6 “Faith in democracy: millennials are the most disillusioned generation in living memory,”Bennett Institute for Public Policy, Centre for the Future of Democracy at the University of Cambridge, October 2020.

—

Originally Posted February 28, 2023 – Battle of the Ages: What Young vs. Old Could Mean for Investors

Disclosure

The views expressed in this material are the views of Michael Arone through the period ended February 26, 2023 and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward looking statements.

Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investing involves risk including the risk of loss of principal.

Past performance is not a reliable indicator of future performance.

All material has been obtained from sources believed to be reliable. There is no representation or warranty as to the accuracy of the information and State Street shall have no liability for decisions based on such information.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without State Street Global Advisors’ express written consent.

Disclosure: State Street Global Advisors

Do not reproduce or reprint without the written permission of SSGA.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

State Street Global Advisors and its affiliates (“SSGA”) have not taken into consideration the circumstances of any particular investor in producing this material and are not making an investment recommendation or acting in fiduciary capacity in connection with the provision of the information contained herein.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Investing involves risk including the risk of loss of principal.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing in high yield fixed income securities, otherwise known as “junk bonds”, is considered speculative and involves greater risk of loss of principal and interest than investing in investment grade fixed income securities. These Lower-quality debt securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

COPYRIGHT AND OTHER RIGHTS

Other third party content is the intellectual property of the respective third party and all rights are reserved to them. All rights reserved. No organization or individual is permitted to reproduce, distribute or otherwise use the statistics and information in this report without the written agreement of the copyright owners.

Definition:

Arbitrage: the simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.

Fund Objectives:

SPY: The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the index (the “Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the index.

VOO: The investment seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor’s 500 Index, a widely recognized benchmark of U.S. stock market performance that is dominated by the stocks of large U.S. companies. The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

IVV: The investment seeks to track the investment results of the S&P 500 (the “underlying index”), which measures the performance of the large-capitalization sector of the U.S. equity market. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index. It may invest the remainder of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the underlying index, but which the advisor believes will help the fund track the underlying index.

The funds presented herein have different investment objectives, costs and expenses. Each fund is managed by a different investment firm, and the performance of each fund will necessarily depend on the ability of their respective managers to select portfolio investments. These differences, among others, may result in significant disparity in the funds’ portfolio assets and performance. For further information on the funds, please review their respective prospectuses.

Entity Disclosures:

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

SSGA Funds Management, Inc. serves as the investment advisor to the SPDR ETFs that are registered with the United States Securities and Exchange Commission under the Investment Company Act of 1940. SSGA Funds Management, Inc. is an affiliate of State Street Global Advisors Limited.

Intellectual Property Disclosures:

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s® Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

BLOOMBERG®, a trademark and service mark of Bloomberg Finance, L.P. and its affiliates, and BARCLAYS®, a trademark and service mark of Barclays Bank Plc., have each been licensed for use in connection with the listing and trading of the SPDR Bloomberg Barclays ETFs.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

ALPS Distributors, Inc., member FINRA, is distributor for SPDR® S&P 500®, SPDR® S&P MidCap 400® and SPDR® Dow Jones Industrial Average, all unit investment trusts. ALPS Distributors, Inc. is not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds’ investment objectives, risks, charges, and expenses. For SPDR funds, you may obtain a prospectus or summary prospectus containing this and other information by calling 1‐866‐787‐2257 or visiting www.spdrs.com. Please read the prospectus carefully before investing.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from State Street Global Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or State Street Global Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.