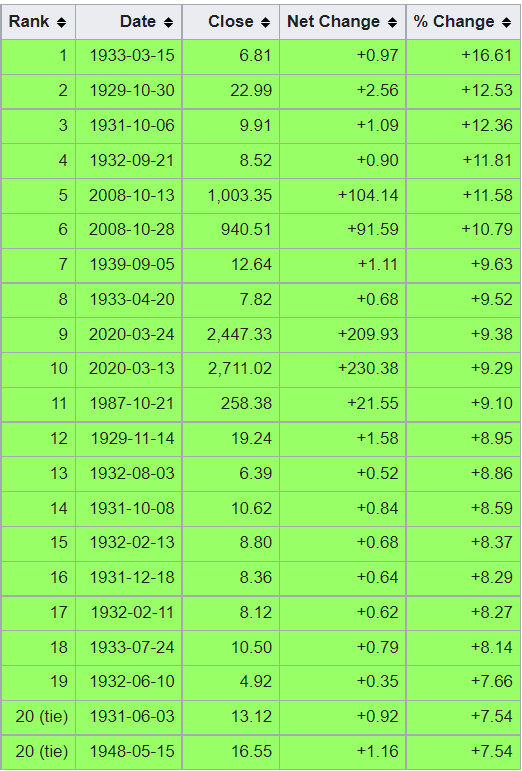

Most investors fare better in bull markets than in correcting or bear markets. It’s a simple premise. Many more investors are long rather than short at any given time. Would it then surprise you to find that almost all the S&P 500 Index’ (SPX) best days occurred during bear markets? Here is the evidence:

Largest Positive Percentage Changes for SPX

Source: Wikipedia

We see that the majority of those dates occurred in the 1930’s, aka the Great Depression. Anyone who bought from late 1929 through mid-1932 were undoubtedly disappointed after chasing the stellar one-day rallies that occurred during that period, as seen below:

10-Year Weekly Chart, SPX, 1929-1939

Source: Bloomberg

We see that the market bottomed in July 1932, but didn’t really find its footing until the New Deal was introduced in 1933. Similar disappointments were felt by those who chased the rallies in October 2008. Massive government intervention fueled the big jumps in March 1933, March 2009 and March 2020 as well.

The key for investors is to discern whether a big rally is being caused by a fundamental turning point or simply an oversold bounce. To be fair, that is easier said than done. When I think about some of the most important market bottoms that I have seen, they were somewhat evident at the time, but more clearly so in hindsight. Those include August 1982, when the Volcker Fed eased off its inflation fighting stance; March 2009, when it was clear that we’d seen the worst of the global financial crisis; and, as mentioned above, March 2020. Though the first two of those dates do not appear in the table above, they were the largest rallies for their respective years.

Two of the dates in the table above came immediately after market crashes. It is clear that there is some sort of financial inertia at work. While those actions were not met with equal opposite reactions, they clearly resulted in oversold bounces. It is human nature to buy the dips, and those were literally the biggest dips in history. The two-day period of October 28th and 29th of 1929, October 19th, 1987, and March 16th, 2020 rank first, second and third on the percentage decliners list. Unfortunately, the rallies on October 30th, 1929 and October 21st, 1987 fizzled out shortly afterwards. The crashes of the day prior were indeed the turning points, not the subsequent rallies.

Why do we see these sharp rallies during bear markets? They are largely caused by fear of missing out (FOMO) and hope. It is human nature for people to want to see a light at the end of a tunnel, and for investors to want to jump in if they think that the end is indeed in sight. Times like that are when it is important to consider whether one should be selling the rips after buying the dips. There is an old saying that reminds us that sometimes the light in the tunnel is an oncoming train. It is easy to get seduced by a rally, even if it is ephemeral.

At this point, you may wonder why we’re discussing this topic today, when we are not in a bear market in equities. That is true for SPX, but the NASDAQ 100 (NDX) and Russell 2000 (RTY) are more than 20% below their recent highs. That is the accepted definition of a bear market, and sure enough, both had solid bounces last week. Neither made the top 20 list, but there were certainly elements of FOMO after oversold conditions were reached.

Furthermore, we saw real bear market rallies in a wide range of cryptocurrencies in the past few days. Bitcoin and Ethereum are up over 25% from their recent lows – though well below recent highs – and we are seeing even bigger gains in smaller currencies and so-called “meme” cryptos like Dogecoin. As noted above, ask yourself whether we have seen a turning point over the past week to drive cryptos higher, or whether this is an oversold bounce. It can be seductive and quite profitable to play a rally that follows an oversold market. It is also crucially important to know whether this is a trading opportunity or an investable rally. It’s quite hard to tell the difference, and to believe it’s the latter when it’s actually the former.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: Margin Trading

Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)