Equity bears are gaining momentum and narrowing the bull’s 2023 lead as March increasingly presents unsettling economic news. A resurgence in inflation, soaring interest rates and weakening consumer sentiment have sent equity investors to the bunkers in early trading. However, intraday buying has propelled indexes strongly off earlier lows. Still, after a negative February, investor sentiment seems to have shifted from optimism towards caution early in the new month.

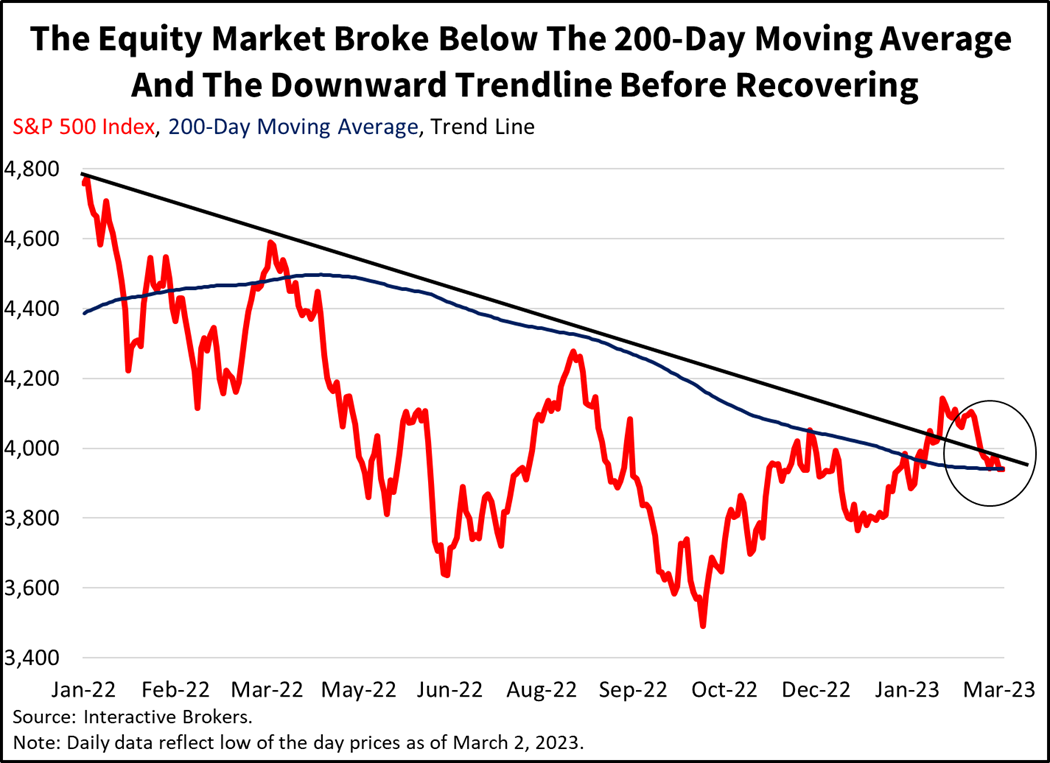

This morning’s news on hotter inflation from the eurozone has caused markets to respond negatively. Yields reached new 2023 highs, led by the long-end, as inflation expectations bounced. The 10-year Treasury is up six basis points (bps) to 4.06%, while the 2-year is up two bps to 4.91% as bets on Fed tightening expectations mount. In yet another example of a shocking equity market reversal, the S&P 500 Index is only down 0.1% after being down as much as 0.6%, knocking out the 200-day moving average at 3940. The Dollar Index is attracting attention as well with traders increasingly believing that the Federal Reserve will match the European Central Bank’s anticipated 50 bps hike this month. The index is up 0.5% to 105.

Eurozone inflation hit a painful rate of 0.8% month-over-month (m/m), much hotter than expectations of a 0.6% increase, erasing progress from January’s 0.2% decline. On a year-over-year basis (y/y), consumer prices rose 8.5%, slightly slower than last month’s 8.6% reading due to high base effects from lofty energy prices. Core prices led the advance last month as we eclipsed the one-year mark of Russia’s invasion of Ukraine. The food, alcohol and tobacco category, services, and industrial goods were the largest gainers, up 1.6%, 0.9%, and 0.8% m/m, respectively. Energy fell 1.1% during the period as slower demand, a cooler than expected winter, and ample supplies provided relief to consumers.

Inflation’s impact continues to echo across the retail industry, with Best Buy and Macy’s kicking off the day with negative outlooks for consumer spending in the coming months.

- Best Buy’s sales during the company’s fiscal fourth quarter ended January 28 of $14.74 billion exceeded the Refinitiv analyst consensus expectation of $14.72 billion. However, revenues declined 3% from the company’s most recent fourth quarter before the COVID-19 pandemic, which caused consumers to splurge on home office equipment and other electronics while social distancing. In a sign of weakening consumer spending, Best Buy expects same-store sales to decline between 3% and 6% in its current fiscal year.

- Macy’s provided an encouraging update for its fourth quarter, but the company estimates that net sales during its current fiscal year will decline between 1% and 3% relative to its most recent fiscal year. Macy’s fourth-quarter revenue of $8.26 billion met the Refinitiv consensus expectation, and its earnings of $1.71 per share trounced the expected $1.57 earnings number. Unlike many other retailers, Macy’s inventory has declined significantly, allowing the company to limit promotional pricing, which supported the company’s earnings. Looking forward, Macy’s CEO Jeff Gennette said this morning that discretionary consumer spending is under pressure, and consumers are continuing to shift spending from goods to services.

The shift to focusing on entertainment drove mixed results for Six Flags, an amusement park operator. In the fourth quarter, revenues declined by 12% y/y as park attendance decreased due to the company’s decision to increase ticket prices, eliminate free tickets and heavily discounted passes. The company also had fewer operating days compared to the same period in 2021. On an encouraging note, spending per capita increased $6.60 for admission and $5.55 for in-park purchases.

While consumers are tightening their purse strings, the secular trend of businesses digitizing their operations and embracing cloud computing has supported revenues and sales for Salesforce, which said sales during its fourth quarter ended January 31 climbed 14% y/y to $8.38 billion, driven in part by better results for MuleSoft, a program that integrates applications and data. The company also reported earnings of $1.68 per share, substantially exceeding the $1.37 a share expected by analysts and up from 84 cents a share in the fourth quarter of 2021.

Despite an eventful start to the month resulting from hot inflation readings from the ISM and the eurozone, the next three weeks are likely to provide even more fireworks.

Despite an eventful start to the month resulting from hot inflation readings from the ISM and the eurozone, the next three weeks are likely to provide even more fireworks. Jobs data on March 10 and the Consumer Price Index on March 14 are likely to provide the marketplace with sparklers as Powell and the Fed spectate from the Skybox or from front row seats. The week after on March 22 will feature Powell and the Fed on the field, as they release their Summary of Economic Projections and rate hike decision in the first inning, while the pivotal press conference occurs 30 minutes later. Investors will be closely watching and listening to terminal rate expectations and the committee’s opinion on economic and market conditions. Buckle up; I’m expecting a volatile March.

Visit Traders’ Academy to Learn More about the Harmonised Index of Consumer Prices and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)