CMT Association’s Market Insights features timely technical analysis of current global markets by veteran CMT charterholders. Each post appears on www.tradingview.com/u/CMT_Association/ in an effort to explain process, tools, and the responsible practice of technical analysis. Shared content and posted charts are intended to be used for informational and educational purposes only. The CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. The CMT Association does not accept liability for any financial loss or damage our audience may incur.

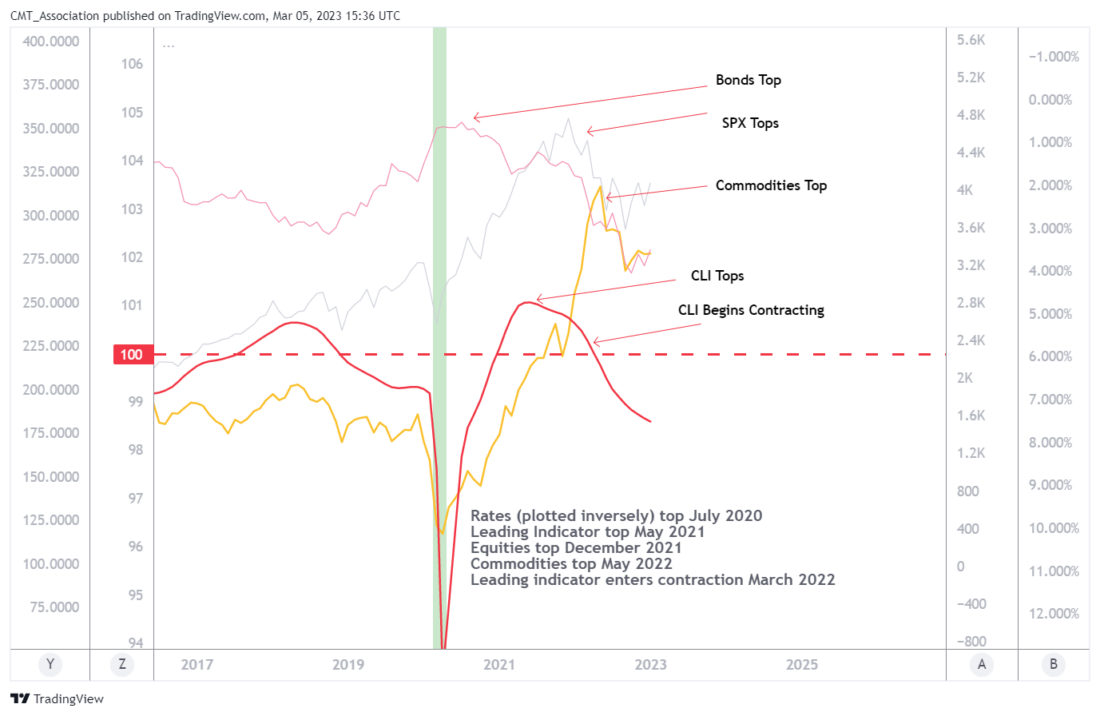

I begin each year with a macro assessment of what I refer to as the big four markets: Bonds, Equities, Commodities , and the Dollar index . Over the last six weeks we have examined monthly and weekly charts of the big four, and developed our thoughts around how the next year might unfold. Those more detailed pieces are linked below.

Late last year we presented a tutorial on using momentum to visualize the business’ cycle from a market perspective (series linked below). We also produced a series covering credit conditions (also linked below).

In this piece, we will combine all the things in an attempt to develop our trading views for the year.

Bond Monthly:

While there is still more work to be done to confirm the trend change, I believe the bond trend is finally changing as the world moves from the low inflation backdrop of the last several decades to a more inflationary backdrop. I intend to be a better seller into rallies and bearish technical setups in the weekly/intermediate perspective.

S&P Monthly (Log):

In the absence of overtly bearish behaviors and with the primary trendlines intact, I would be hard pressed to conclude that the macro trend has changed. In short, the secular bull remains intact and it should be given at least some of the benefit of the doubt. But my suspicion is that the secular trend is changing and that a primary bear market is unfolding. While still willing to take bullish trades in the daily and weekly perspectives, I am much more interested in opportunities to sell solid technical setups into weekly perspective strength.

Commodities Monthly:

I am a better seller of strength and will prioritize bearish setups. This chart continues to support the idea that the business cycle is weakening/topping.

Dollar Index Monthly:

The 70.70 – 121.02 trading range has defined the Dollar trade over most of the last 4 decades. Even at the August 2022 high, DXY remained well within this range. Since correcting from the August 2022 high, the market is now in the upper center of this range. Moves inside the bounds of the range are primarily noise and while they present trading opportunities, they mean little in macro terms. If the market does test the top of the broader range, my expectation is that a major shorting opportunity will develop.

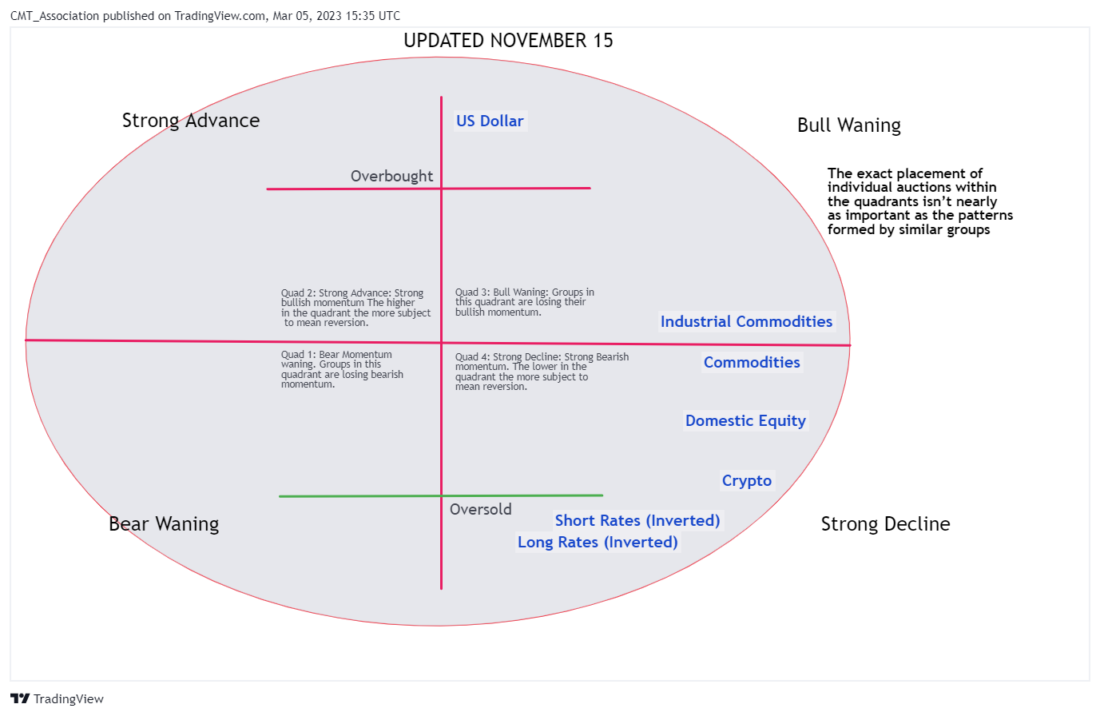

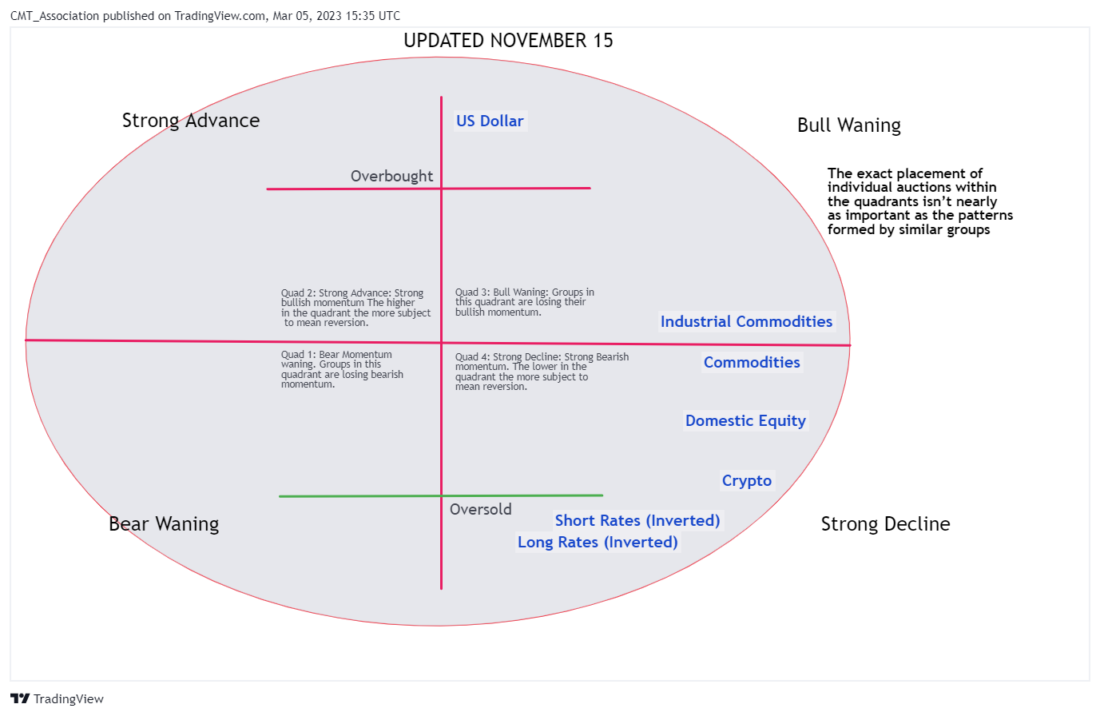

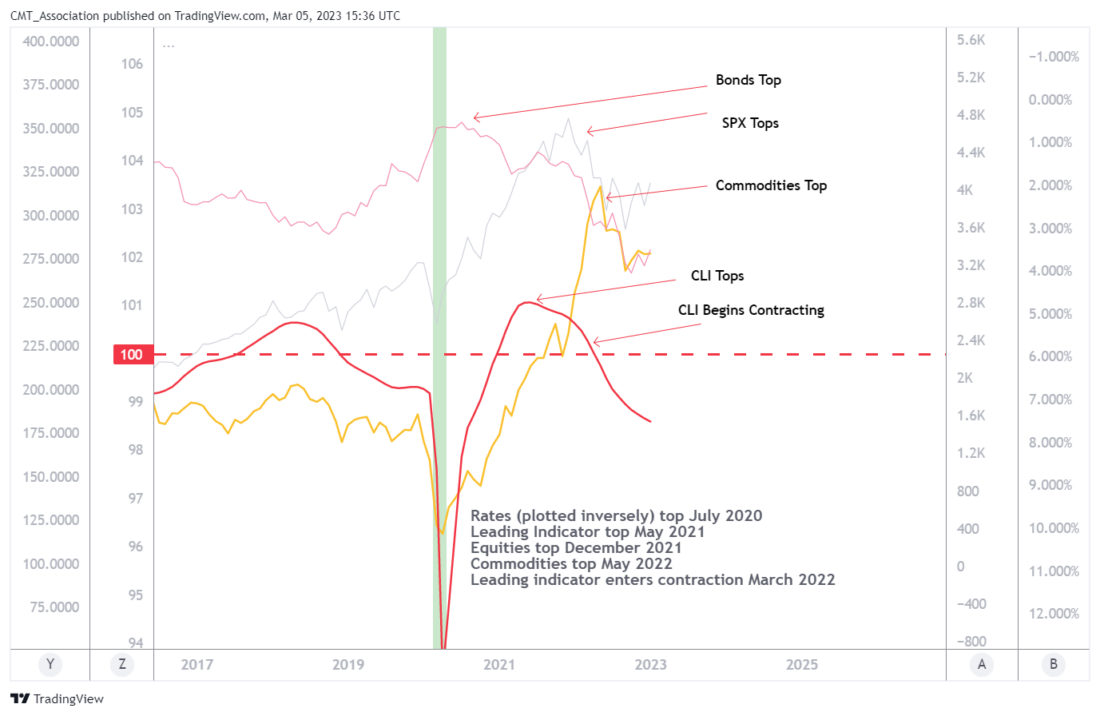

Business Cycle Matrix:

The matrix is entirely consistent with a weakening business cycle that has yet to trough. Over the last two years rising short and long rates led the cycle lower. Equities, responding to higher rates, turned lower this year and both industrial and agricultural commodities are now weakening as economic demand wanes. The outlier is the Dollar. It has benefited from global flight to quality, carry and the aggressiveness of our central bank verses other central banks. But, of the asset classes, the Dollars relationship to the business cycle is the least consistent.

Rates clearly led this cycle lower and it is likely that they will lead the next cycle higher. It is important to note that short rates have risen more than long rates. This has created the type of highly reliable yield curve inversion that signals a coming recession.

High Yield Option Adjusted Spread – Investment Grade Option Adjusted Spread Monthly: If there is any one thing, other than a collapse in inflation , that would induce a Fed pivot it would be a rapid deterioration in credit conditions. A collapse would show up in this chart (series linked below). A spread moving back into the 500-600 bps area would get the Feds attention and begin to set the stage for a rapid pivot .

Conclusions:

1. The business cycle is likely to weaken over the coming months.

2. The weaker cycle should produce lower equities ( earnings will finally begin to deteriorate).

3. A recession should put in a temporary top for bond and note yields.

4. A sharply steeper curve, led by short rates falling more rapidly than long rates, would suggest that the recession was here.

5. A weaker business cycle should produce lower commodities and a lower Dollar.

For myself, I like to have a blueprint of expectations to trade and position around. But it is also important to be flexible. In highly financialized and interlocked economies things change quickly and plans must be adapted to the new situation. I suspect that risk management and flexibility will be needed this year.

Many of the topics and techniques discussed in this post are part of the CMT Associations Chartered Market Technician’s curriculum.

—

Originally Posted March 5, 2023 – Big Four: 2023 Macro Conclusions

Disclosure: CMT Association

Shared content and posted charts are intended to be used for informational and educational purposes only. The CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. The CMT Association does not accept liability for any financial loss or damage our audience may incur.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CMT Association and is being posted with its permission. The views expressed in this material are solely those of the author and/or CMT Association and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.