For most of the last two years, the dollar steadily strengthened against most major currencies with little interruption. Record inflation in the U.S. prompted the Federal Reserve to embark on its most rapid pace of interest rate hikes that many in our industry have ever seen, and the dollar followed suit. It peaked in late 2022, more than two standard deviations above its median price over the past three years.

Bloomberg U.S. Dollar Spot Index

While higher rates extinguished risk appetite for investors and sent the dollar soaring, emerging market (EM) equities continued their downtrend. Although the region caught a brief reprieve when China announced the end of its “Zero Covid” policy last fall, providing renewed optimism for the region’s largest growth engine, EM remains hamstrung by the U.S. economic and policy landscape and their attendant effects on the dollar.

Recently, the dollar has slipped from last year’s highs but remains elevated compared to recent history, as U.S. economic data continues to surprise to the upside, complicating the future path of monetary policy for the Fed.

To be clear, however, we’re not dollar bearish. The early 2023 economic data and commentary from Fed officials imply that more rate hikes are virtually certain over the near term to temper the stubbornly resilient U.S. economy.

Our view is that the dollar may eventually fall closer to a more reasonable level, off last year’s highs, as the path of U.S. interest rates becomes clearer. That forces us to consider what assets may benefit most. In this scenario, we think EM may receive a modest tailwind, potentially benefiting from supportive relationship dynamics with the USD.

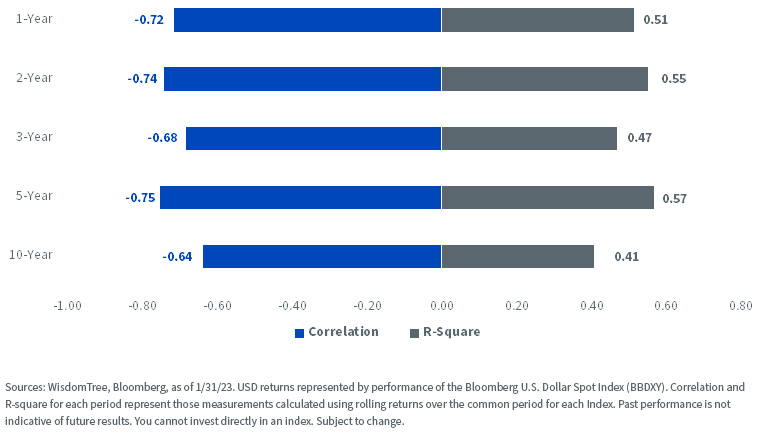

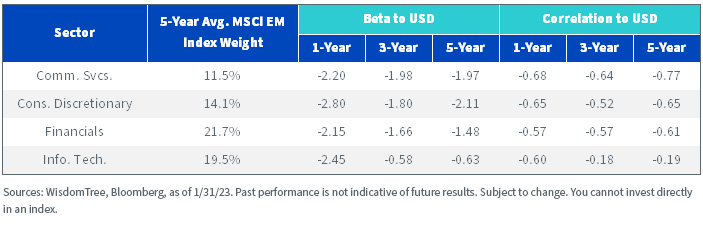

Correlations Point to EM Upside in a Weak Dollar Environment

EM equities and the dollar have long displayed an inverse relationship. There are myriad reasons for this, both technical and sentiment-driven.

At a business level, EM companies often borrow in dollars, which creates difficulty in servicing that debt during periods when the U.S. dollar is strong and local currencies are weak, challenging the prospects of businesses themselves.

EM equities are also an explicit barometer of investor risk appetite across global markets. The dollar often tends to rally as a safe haven during risk-off periods when investors sell EM assets to reduce risk exposure.

The magnitude of the inverse correlation suggests that even a slight decline in the dollar can improve EM returns, especially over the short and medium terms.

Rolling Return Relationships – MSCI EM vs. USD

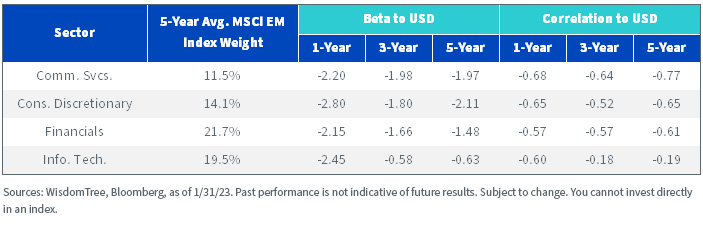

Sector Composition May Compound These Effects

Emerging markets resemble a partial hybrid of both the U.S. and developed markets. Sizable footprints in “growthy,” consumer-focused areas such as Technology, Communication Services and Consumer Discretionary are reminiscent of the U.S. equity market, while an even larger allocation to Financials resembles a heavyweight from the developed market universe. These four sector concentrations comprised exactly two-thirds of the MSCI Emerging Markets Index over the past five years, on average.

Most notable, however, are their respective relationships to the trajectory of the dollar. Beta and correlation measures over the last several years indicate that each sector tends to move emphatically in the opposite direction of the greenback.1

This could also benefit the EM region if we see reduced volatility in the dollar.

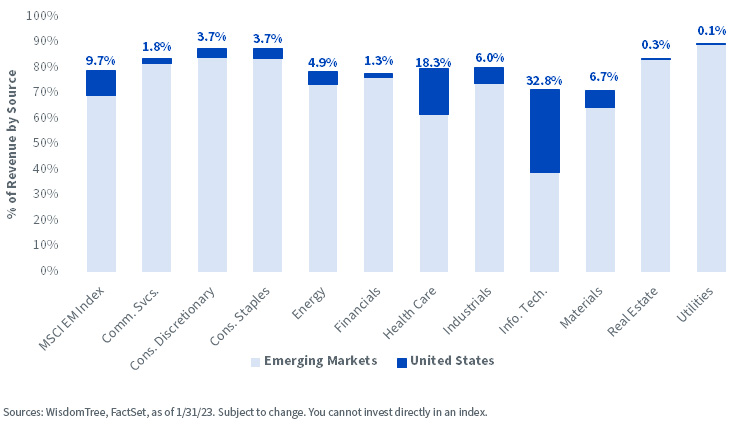

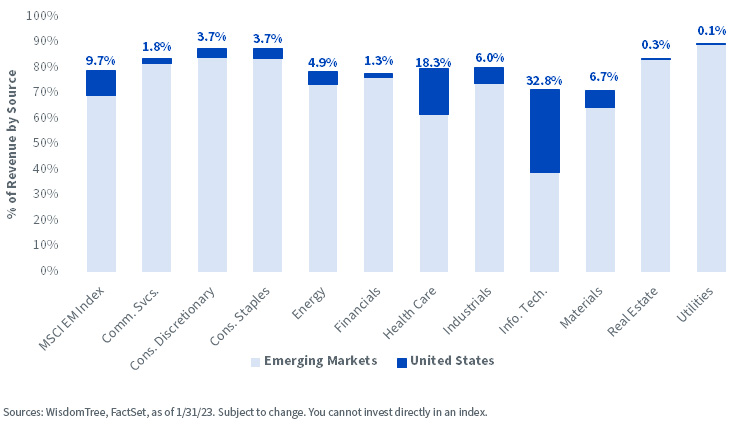

Weak USD Poses Little Threat to Revenue

Currency fluctuations impact trade competitiveness and relationships, and emerging markets exports are no exception. However, geographic revenue data suggests that although the broader region is globally interconnected, its relationship with the U.S., and therefore the dollar, is less significant.

Geographic Revenue Exposure

The headline EM Index only generates about 10% of total revenue from the U.S. market. Excluding Information Technology once again, where the U.S. is a significant consumer, every other sector generates a majority of revenue from within the greater EM region.

This introduces more favorable currency dynamics into the viability of EM as a whole since the region is not beholden to U.S. economic growth or the path of U.S. monetary policy from a revenue standpoint. Instead, regional economic interrelationships and local currency fluctuations may be more deterministic, especially in anticipation of U.S. economic weakness.

EM Assets Would Welcome a Dollar Downtrend

While the surge higher in the dollar last year was at times both a symptom and a cause of investors’ agony, the dynamic of its relationship with emerging market equities suggests that even a slight weakening would offer a reprieve. A softening may provide a much-needed tailwind to EM equities without threatening revenue prospects for the region as well since the U.S. is only a modest consumer of EM goods.

As we look further into this year or next year, rate cuts that would reduce the U.S. policy gap with the rest of the world and moderate the dollar could create renewed risk appetite for EM equities.

1 Information Technology had the least negative beta and correlation of the four sectors mentioned over the 3- and 5-year periods.

—

Originally Posted March 21, 2023 – Can a Weaker Dollar Be an Antidote for EM?

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)