By: subSPAC

EXECUTIVE SUMMARY

- Commodities have had a wild rally over the last two years, incentivising miners to go public amidst heightened investor enthusiasm.

- Despite this, markets have slept through the announcement of Glencore’s CSA Copper Mine being spun off through a $1.1 billion SPAC merger with Metals Acquisition Corp.

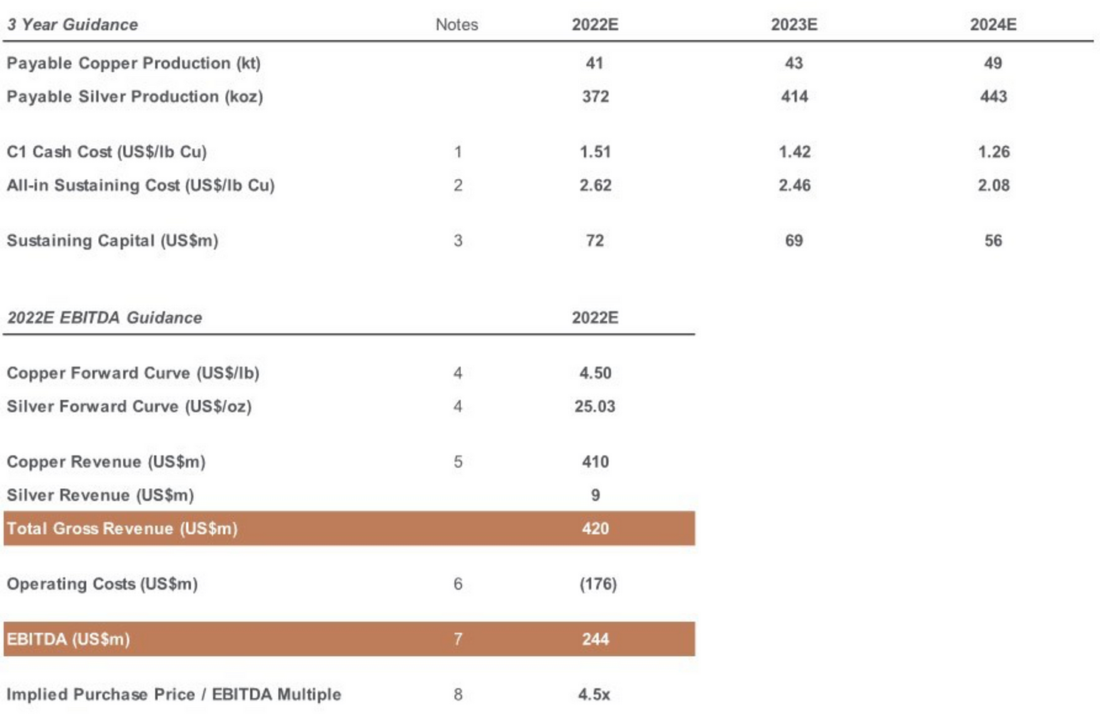

- The deal price implies a 4.5x multiple of 2022 EBITDA, which is a breath of fresh air in SPACland, where valuations have hovered at many multiples of sales that are three or four years out.

DETAIL

Commodities have had a wild rally over the last two years, incentivising miners to go public amidst heightened investor enthusiasm. Despite this, markets have slept through the announcement of Glencore’s CSA Copper Mine being spun off through a $1.1 billion SPAC merger with Metals Acquisition Corp. The deal price implies a 4.5x multiple of 2022 EBITDA, which is a breath of fresh air in SPACland, where valuations have hovered at many multiples of sales that are three or four years out. This, coupled with an experienced management team, a historical track record of strong copper production, and a potential shortage over the long term due to the global energy translation, all point towards success for CSA. However, a risk of oversupply, which could further be compounded by economic downturns across China and the US, could dampen sentiment for CSA’s debut. Can the company navigate its way through these challenges and maintain its growth?

The Global Copper Shortage

Before we look at the catalysts for the deal, let’s get some of the deal specifics out of the way. CSA is a high-grade copper mine located in Western New South Wales, Australia, and has been operating since 1967. In 2021, CSA produced 41 kt of Copper and 459 koz of silver. CSA estimates that the mine have an estimated mine life of over 15 years and could be extended with further exploration. Metals Acquisition, the SPAC merging with CSA said that it was merging with the company due to the increased copper requirements, expected shortages, and declining copper grades across the industry. Let’s unpack each factor to see CSA’s long-term demand and growth prospects.

Industry Experts anticipate a severe copper shortage by the end of the decade as demand for infrastructure, renewable energy power generation, and electric vehicles coincide into a megatrend. This could result in the industry requiring as much as 1 million tonnes of new supply per year.

The other end of the equation is the fragile supply and expected future shortage. Looking back, there were several reasons for the shortage of Copper during the pandemic years. This included continued Covid-19 restrictions, workforce absenteeism, and operational & geotechnical issues. Latin America also saw a decline in production due to strikes & water restrictions in Chile and Community Actions across Peru constraining production. Even when mines were able to produce Copper, it yielded lower grades.

The current copper market is running with inventories that cover 4.9 days of global consumption and is expected to finish the year at 2.7 days. All of this has sparked a spectacular rally that has resulted in Copper surging from $5000/ton to $10,500/ton in just twelve months. By going public now, CSA is betting that the price for copper in the pandemic years will be the norm rather than the outlier going forward.

From Boom to Bust

While the long-term prospects and catalysts remain intact for CSA, several challenges could depress sentiment over the near future. Copper Prices have now declined by more than 30% to $7,500 due to fears of a prolonged recession and a risk of oversupply in the market. The International Copper Study Group (ICSG) now expects a surplus of 155,000 tonnes of Copper in 2023, which is in stark contrast to the 325,000 deficit seen this year.

Supply is expected to ease going forward, with a 2.8% growth in 2022 and 3.3% in 2023. Greater supply will ease the pressures seen in the last eighteen months, but demand will be the major driver of the near-term copper price decline.

The global economic outlook looks grim due to elevated energy prices, high inflation, and geopolitical uncertainty. US and Europe could see a few quarters of GDP decline, while China continues to come under pressure due to their zero tolerance Covid-19 strategy. As demand for renewable energy installation and EVs drop across the West and the property market collapses in China, there is a risk of the market being flooded with excess Copper in the interim, crashing the prices further.

Financials and Valuation

As mentioned before, CSA is debuting at an FY22 EV/EBITDA of 4.5x, which seems reasonable considering the current market conditions. However, since the company’s earnings are highly sensitive to the change in Copper, a further decline in prices could suggest that the company could be overvalued. For instance, CSA assumes average copper prices to be close to $8253/ton to reach its FY22 targets of $420 million in revenues and $244 million in EBITDA. A much more conservative target of $7,200/ton (Copper prices were as low as 6,900 in June) would imply revenues of $376 million and an EBITDA of $190 million.

This would push the valuation from a 4.5x multiple to 5.8x. If Copper continues to decline and trades at its historical range (between $5000-$6000/ton), the stock could end up trading as high as 10x EBITDA. Still, secular tailwinds and a shortage in supply could lead to favorable price growth in the high single digits/low teens, resulting in the company achieving its revenue targets. Furthermore, CSA could increase its operating margins through planned productivity improvements in mining and transportation. The supply-demand dynamics in copper will be key factor driving CSA’s valuation in the future.

Bottom Line

Copper Mining Firm CSA is going public when demand for the metal is falling just as quickly as it rose over the last eighteen months. Inflation, weaker economic activity, and a property crisis in China could suggest weak demand, and increased production could lead to an oversupply of Copper and prices moderating in the short term. Despite these challenges, long-term tailwinds like increased EV adoption and Renewable Energy Generation could propel the commodity. This, coupled with a growing decline in the production of quality Copper due to regulatory and political headwinds, could propel prices to levels not seen by the end of the decade. CSA remains a lucrative investment opportunity from a risk/reward standpoint, albeit one where investors may need to be patient to reap the rewards.

—

Originally Posted October 24, 2022 – Can CSA SPAC Its Way Through a Commodity Crash?

Disclosure: Smartkarma

Smartkarma posts and insights are provided for informational purposes only and shall not be construed as or relied upon in any circumstances as professional, targeted financial or investment advice or be considered to form part of any offer for sale, subscription, solicitation or invitation to buy or subscribe for any securities or financial products. Views expressed in third-party articles are those of the authors and do not necessarily represent the views or opinion of Smartkarma.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Smartkarma and is being posted with its permission. The views expressed in this material are solely those of the author and/or Smartkarma and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.