By J.C. Parets & All Star Charts

Friday, 30th September, 2022

1/ Bear Flags Are Breaking Down

2/ Three Quarters in the Red

3/ Rough Times for Real Estate

4/ Commodities Reach for Support

Investopedia is partnering with All Star Charts on this newsletter, which both sells its research to investors, and may trade or hold positions in securities mentioned herein. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice.

1/ Bear Flags Are Breaking Down

Yesterday, we discussed the bearish implications of the Dow Jones Industrial Average (DIA) consolidating below the June lows and pre-pandemic highs. Today, we’re looking at the Dow again, but with a more tactical view. Late last week, DIA printed a breakaway gap, taking out key potential support at the June lows.

Prices spent the majority of this week digesting the recent losses and coiling in a bear flag just below this critical level. During Wednesday’s rally, this former support zone was tested from beneath. After a lack of bullish follow-through yesterday, the Dow rolled over and resolved from this bearish continuation pattern today. This action suggests another leg lower for stocks could be upon us.

2/ Three Quarters in the Red

With both stocks and bonds finishing another week at new lows, it’s an appropriate time for a review of the overall environment. The chart below shows the quarterly return for both asset classes dating all the way back to 1976.

For the first time in the history of our dataset, both stocks and bonds have booked three consecutive quarters of negative returns.

As we’ve highlighted in red, it is not the first time either asset class has experienced a stretch of consecutive quarterly losses this bad. However, it is the first time that we’re seeing both of them record three straight down quarters at the same time.

This is an excellent illustration of the lack of alternatives for investors this year. As long as the dollar remains strong, we could expect this to continue.

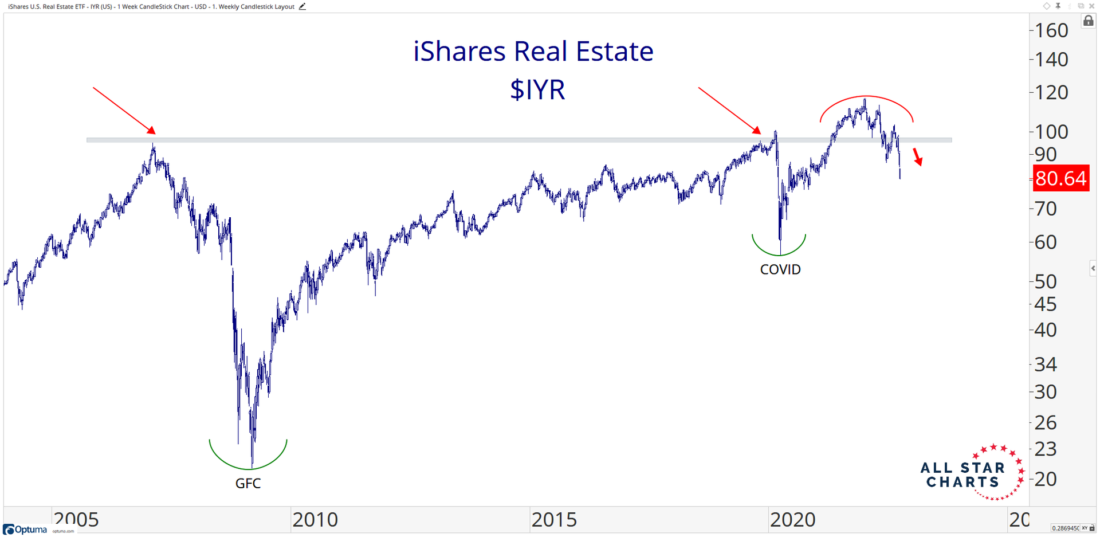

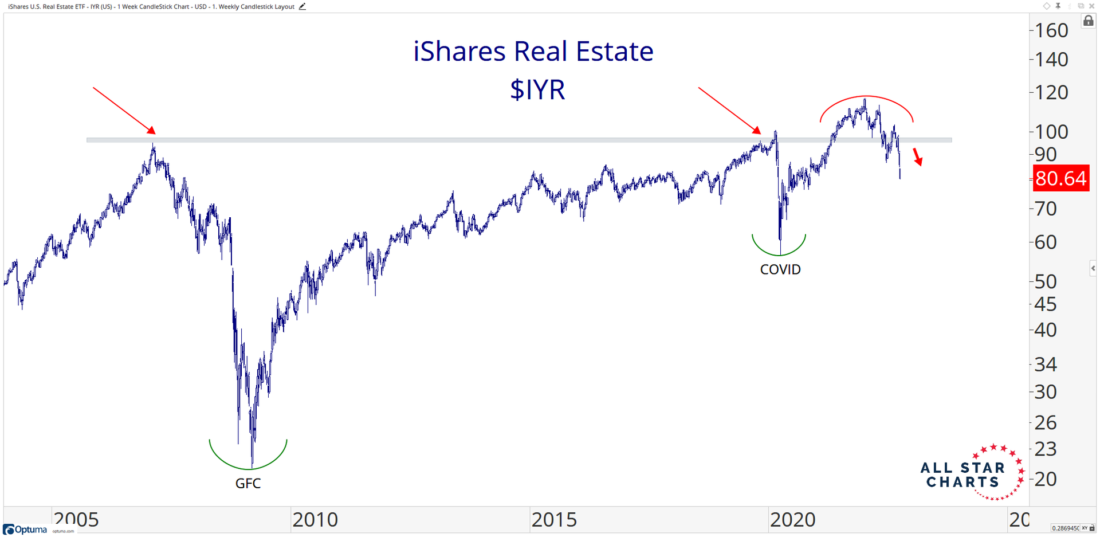

3/ Rough Times for Real Estate

With volatility picking up in the last days of the third quarter, weakness has spread across the market, pushing many indexes and sectors to new lows.

When it comes to U.S. equities, real estate (IYR) has been the worst sector during the trailing month, crashing 13.60% to its lowest level in almost two years.

With prices back beneath the pre-pandemic and financial crisis highs, there is structural damage to the primary trend. Like real estate, many other groups look vulnerable at current levels.

As long as IYR is below the 2007 highs, the path of least resistance could be lower.

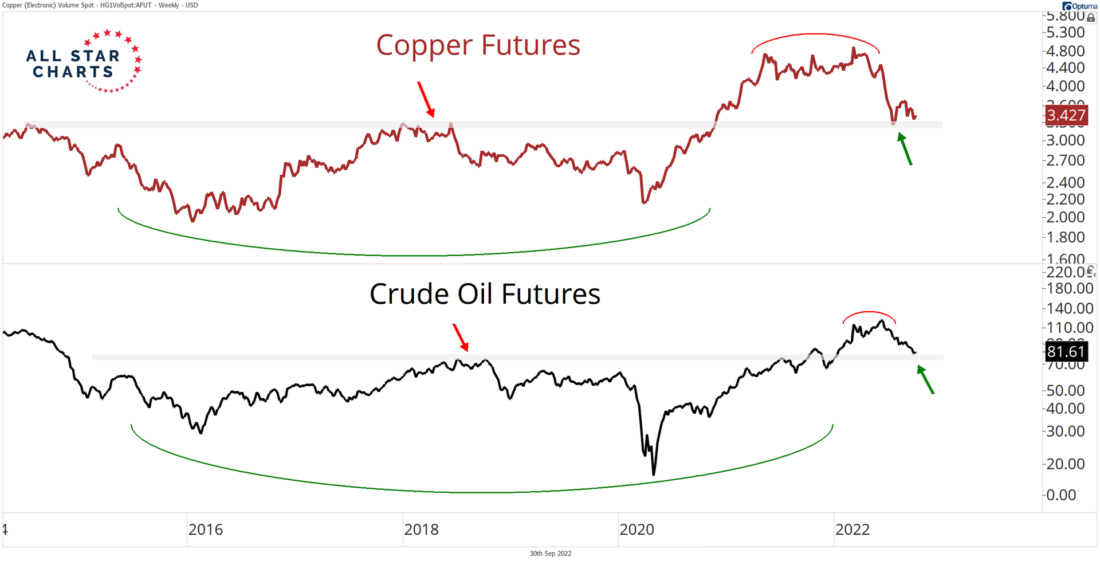

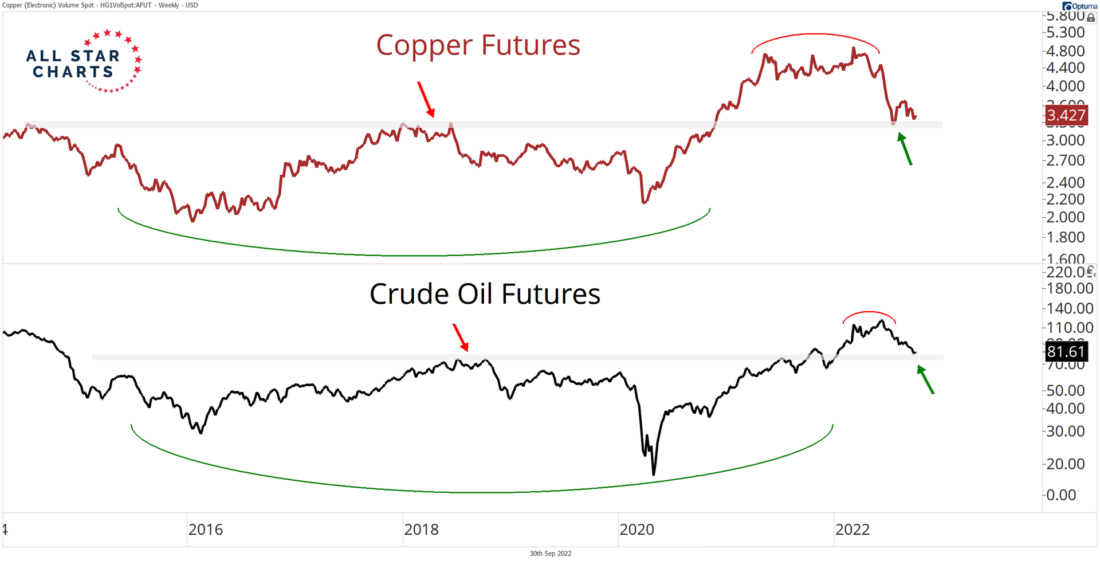

4/ Commodities Reach for Support

After months of selling pressure, the most economically sensitive commodity contracts are testing critical potential support levels.

More importantly, these polarity zones represent the prior cycle highs, marked by the 2018 peaks. If there was ever a place where the bulls needed to step in and repair the damage, this would be it.

Below is the dual-pane chart of copper and crude oil:

Both are digging in right where we could expect them to, defending those 2018 highs. Commodities and their related assets may carve out tradeable lows as long as the prior cycle highs hold. But if these levels fail, we might have to reconsider the structural uptrend in commodities and the outperformance of cyclical value sectors of the stock market.

—

Originally posted 30th September, 2022

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)