By J.C. Parets & All Star Charts

Monday, 3rd April, 2023

1/ Fueling Up

2/ Sector Rotation

3/ Embarking on a Bullish Month

4/ Europe Resolves Higher

Investopedia is partnering with All Star Charts on this newsletter, which both sells its research to investors, and may trade or hold positions in securities mentioned herein. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice.

1/ Fueling Up

Energy stocks have rallied more than 10% in just over a week. In the middle of March, we were discussing the damage to the structural trends in the energy sector and watching the 2018 highs for signs of further downside.

These stocks have reversed course over the past week, shifting from short-term laggards to leaders. With bulls coming out to defend the 2018 highs in crude oil near $75 per barrel, we want to shift our focus to shorter timeframes to analyze the tactical trends:

When we draw Fibonacci retracement lines based on the second half of the 2022 rally, we obtain logical levels that coincide with pivot lows.

After falling roughly 20%, the energy sector ETF (XLE) appears to have found support at its 61.8% retracement last month. Coming into the new week, we’re seeing bullish follow-through as price gapped higher by 4.5% today, taking out a shelf of recent lows at the 38.2% retracement.

This recent strength from energy stocks is just the latest example of the constructive sector rotation that has been taking place since late last year.

2/ Sector Rotation

Sector rotation is the lifeblood of a bull market.

The bubble chart below shows each large-cap sector fund’s 2022 performance on the y-axis and the quarter-to-date return on the x-axis:

As you can see, technology (XLK), communications (XLC), and consumer discretionary stocks (XLY) have recorded a solid gain over the past quarter. However, when we look at the returns of the value-oriented and defensive sectors, they have performed slightly lower to unchanged during this time.

This tells us that the stocks that were laggards last year are now the leaders in 2023.

3/ Embarking on a Bullish Month

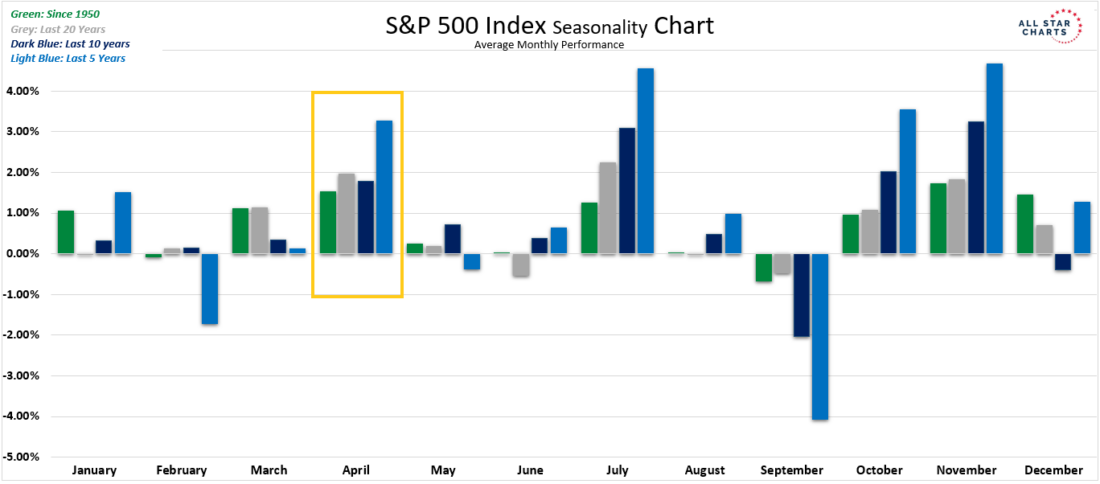

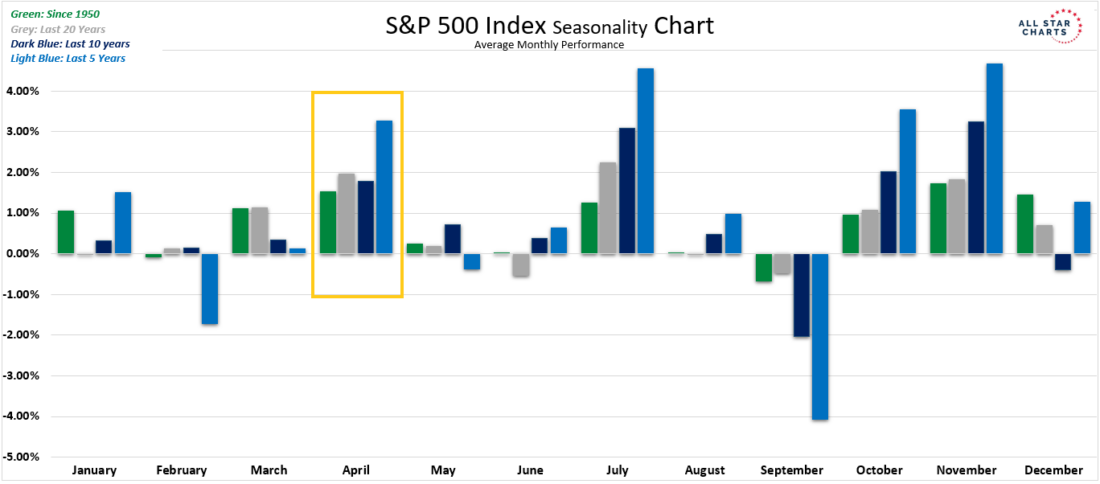

From a seasonality perspective, we are now entering one of the best months of the year for the stock market.

Based on historical seasonal trends since 1950, April has been the second-best month of the year for equities, averaging a 1.53% return for the S&P 500. It also ranks fourth best over the trailing decade and 5-year period.

This tells us that seasonality remains a tailwind for equities. We could expect April to be a strong month for stocks, adding to the bullish developments of the trailing two quarters. However, if the bulls do not appear, it could be a warning sign of further turmoil or a return to the volatility that plagued much of March.

4/ Europe Resolves Higher

Throughout the past six months, European equities have outperformed their U.S. counterparts.

The Euro Stoxx 50 ETF (FEZ) has risen almost 50% from its lows, reaching new 52-week highs last week:

As you can see in the above chart, price has not only rallied in a near-vertical line since October, but buyers have taken control and reclaimed a shelf of former lows from 2021. If this breakout sticks, the bias could remain higher for European stocks.

—

Originally posted 3rd April 2023, 2023

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.