By J.C. Parets & All Star Charts

Monday, 15th May, 2023

1/ Financial Stocks Test Support

2/ Homebuilders Lead the Way

3/ Software on the Verge of Breaking Out

4/ Dollar Bulls Have Work to Do

Investopedia is partnering with All Star Charts on this newsletter, which both sells its research to investors, and may trade or hold positions in securities mentioned herein. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice.

1/ Financial Stocks Test Support

Bank stocks staged a big rally today, with the S&P Bank ETF (KBE) up nearly 3%. This comes off the heels of KBE’s lowest weekly close since 2020 on Friday.

However, it wasn’t just the banks—the entire financial sector rallied today. And the bulls really needed it, as this group has been under significant selling pressure since March, with key levels of support currently being tested in a variety of indexes like the Financial Sector SPDR (XLF).

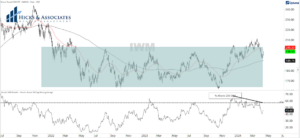

Here is another chart of a financial subsector that is testing a critical support zone. This is a daily candlestick chart of the SPDR S&P Capital Markets ETF (KCE):

While the bulls are holding their ground and defending the pivot lows for now, this is a classic bearish reversal pattern. Following a swift rally off the October lows, KCE has gone on to print a textbook head and shoulders formation. The December and March lows mark the neckline, or breakdown level, of this structure.

If the bears take control and force a downside resolution, we could see a retest of last year’s lows. If this happens, the entire financial sector will likely be experiencing heightened volatility.

2/ Homebuilders Lead the Way

Although major U.S. indexes remain stuck in their ranges, one group that has been trending higher is the Home Construction ETF (ITB).

These cyclical stocks are an excellent gauge of global growth and a leading indicator for the broader market.

As you can see in the above chart, when home construction is trending higher, it tends to happen in an environment conducive to risk-seeking behavior. The opposite is true when homebuilder stocks are under selling pressure. Notice how the S&P 500 (SPY) looks quite similar to homebuilders over time.

Seeing ITB press against 52-week highs suggests a risk-on tone for the market and risk assets in general. It is also supportive of the bullish price action we’re seeing at the index level.

3/ Software on the Verge of Breaking Out

Technology stocks have been in the driver’s seat, leading the way up on both absolute and relative terms for the past two quarters.

When we dive beneath the surface looking for strength, software stocks catch our attention.

The chart below shows the Dow Jones U.S. Software Index on the verge of breaking out from a bearish-to-bullish reversal pattern.

Not only is price pressing up against the upper bounds of the range, but the 200-day moving average is curling higher, indicating that a change in trend is likely underway.

4/ Dollar Bulls Have Work to Do

The U.S. Dollar Index (DXY) finished last Friday, posting its best week since peaking in late September 2022.

Risk assets sold off across the board to no surprise. But before we get carried away on the next leg higher for King Dollar, let’s zoom out on the chart to get a read on where the USD truly stands—in the middle of a short-term range.

The DXY might have gained 1.5% last week, but it is still well below a key retracement level at approximately 105. As long as it remains below that level, it’s range bound like much of the market.

On the other hand, the path of least resistance would be higher if DXY reclaims the upper bounds of its multi-month range. This is something stock market bulls likely want to avoid.

—

Originally posted 15th May 2023

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.