Several Federal Reserve officials have made comments recently suggesting that rate hikes will continue well beyond the 25-basis point increase expected later this month, with the theme being high inflation. There are several data points that gauge US inflation, with the most well-known being the producer price index (PPI), which measures inflation at the wholesale level, and the consumer price index (CPI), which measures inflation at the retail level.

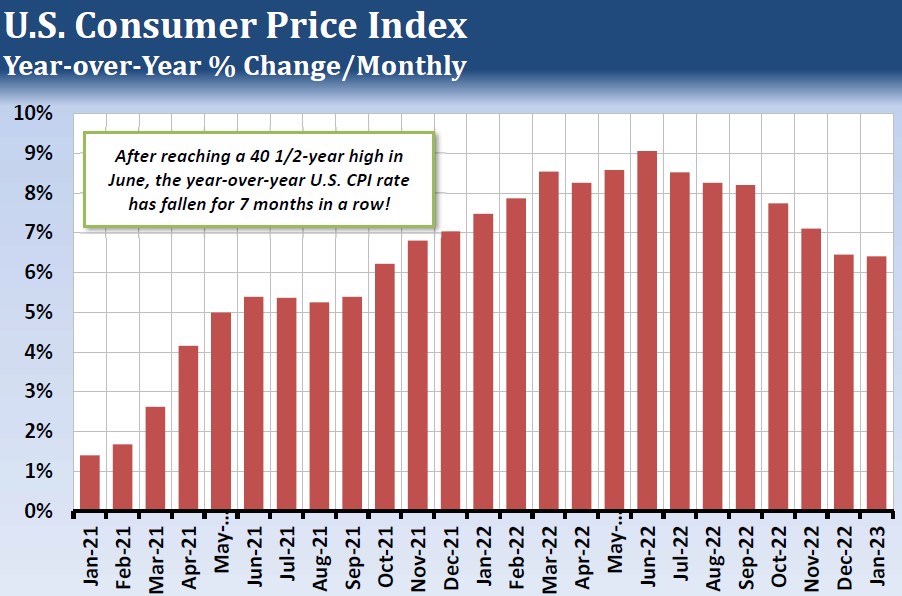

Source: US BLS

While the PPI is seen as a leading indicator, the CPI tends to have a bigger impact on market sentiment. As higher prices reach the retail level, consumers are forced to spend more money on regular purchases, and they tend to hold off on buying discretionary items. This demand contraction tends to become broad-based, and it has a wide-reaching impact on the commodities that are negatively impacted by lower demand at the wholesale and retail levels.

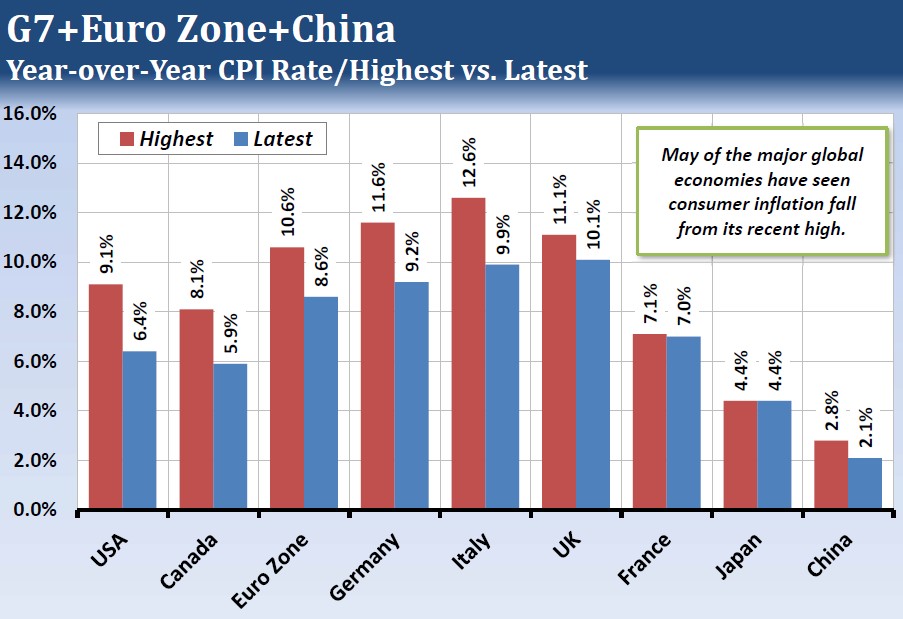

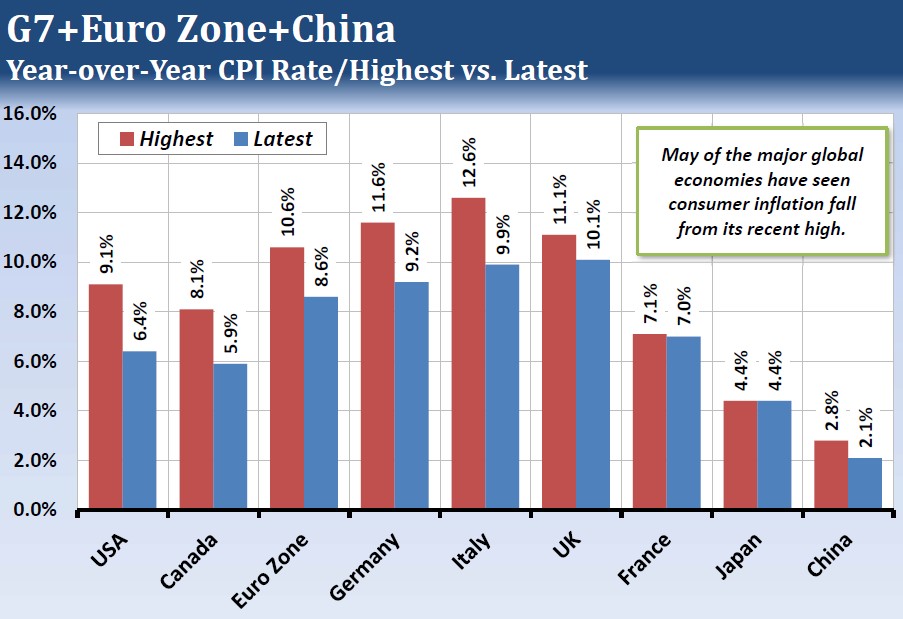

Source: Reuters

From June 2012 until March 2021, the US CPI stayed below the 3% year-over-year rate, and inflation became an afterthought for many consumers. As the US and global economies emerged from COVID, there was an upsurge in inflation for many developed economies. This continued for more than a year, with the June 2022 US CPI showing a 9.1% year-over-year increase, the highest since November 1981. Consumer inflation reached even higher levels in Europe, with CPI readings for the EU, Germany, UK, and Italy posting double-digit year-over-year rates.

Since mid-2022, there has been a pullback in consumer inflation. In the January reading, US CPI came in 2.7% below its June 2022 peak and marked the seventh month in a row with a decline in the year-over-year rate. The EU, Germany, and Italy are more than 2% below their peak readings.

While a 6.4% year-over-year rate is still high for US CPI, there has been a trend towards lower consumer inflation. If this continues over the next few months, it could encourage the Fed to hold off on additional rate hikes. Commodities such as cocoa, coffee, cattle, hogs, cotton and RBOB gasoline would benefit from stronger consumer demand, and a trend of declining inflation could be a benefit to commodity and markets across-the-board.

—

Originally Posted March 8, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)