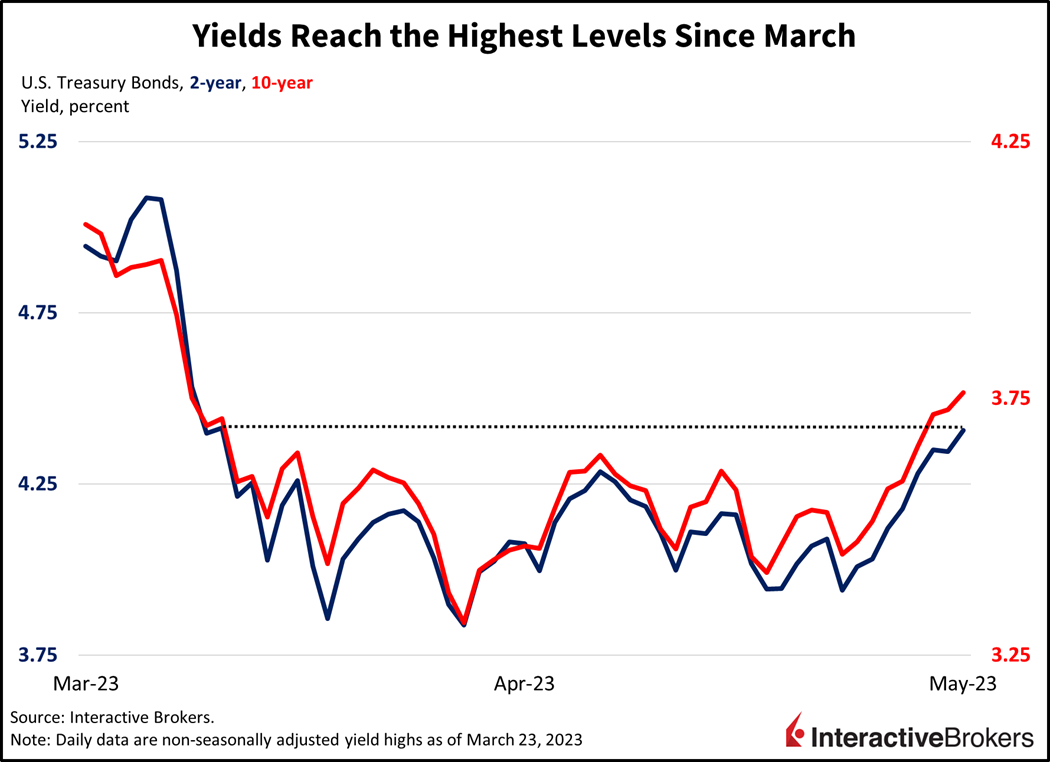

Market sentiment is plummeting after Democratic President Joe Biden and Republican House of Representatives Speaker Kevin McCarthy failed to reach a deal last night on raising the debt ceiling, just a few hours after Treasury Secretary Janet Yellen reiterated her stern warning that without a deal, the country could run out of cash on June 1, resulting in a default on Treasury securities. With the deadline only nine days away, Treasury yields are maintaining their upward momentum and are at their highest levels since regional bank troubles surfaced in March. Yields are being supported by a slew of factors, including the debt-ceiling standoff, hawkish Fed rhetoric and persistent inflation. Inflation fears, furthermore, were reinforced this morning by a disappointing S&P Global Flash Purchasing Managers’ Index (PMI) release.

While inflation is casting a downtrodden mood among investors, fears about the ongoing debt ceiling saga are dominating sentiment. Republicans are pushing for deeper cuts to domestic spending than Democrats appear willing to accept. The Grand Old Party also wants to extend spending cuts for multiple years. Democrats are opposed to reducing proposed spending levels for social programs and they want to reduce the proposed number of years in which spending would be cut. The party also wants to include defense spending limits in any agreement, which is an ongoing sticking point for Republicans, including McCarthy, who has said reducing spending on the Armed Forces isn’t an option.

While pandemic demand trends are boosting services spending amidst super charged appetites for travel, dining and other outdoor adventures, interest rate sensitivity is also a significant driver. While higher interest rates discourage consumer spending on durable goods that are often financed, services aren’t pressured as much by the headwind.

Economic data this morning depicted the ongoing spending shifts away from goods and towards services. While pandemic demand trends are boosting services spending amidst super charged appetites for travel, dining and other outdoor adventures, interest rate sensitivity is also a significant driver. While higher interest rates discourage consumer spending on durable goods that are often financed, services aren’t pressured as much by the headwind.

This morning’s Flash PMI release from S&P Global illustrates this trend. Manufacturing re-entered contraction territory after strengthening modestly in response to lower interest rates following the regional bank debacle in March. Manufacturing notched a reading of 48.5, much lower than the 50 expected and the 50.2 from last month. Services meanwhile, were on fire, expanding solidly by reaching a reading of 55.1, dwarfing forecasts calling for 52.6 and higher than the previous month’s reading of 53.6.

For manufacturing the decline in new orders and prices weighed on the headline number. Services were propelled higher by new orders, prices and employment, which are driving investors to reconsider their Fed tightening expectations. Services are labor-intensive and drive core inflation, which is the most challenging kind of inflation to subdue.

Markets are lower this morning in response to the of lack of progress on the debt-ceiling and hawkish Fed rhetoric from a slew of Regional Fed Presidents including Kashkari, Bullard, Barkin, Daly and Bostic. The S&P 500 Index is down 0.3% after failing to conquer the 4200 level for the third day in a row. Cyclical and small-cap stocks are providing some relief however, as strong economic data from the service areas are quelling recession concerns while tech stocks get hit from higher rates. The Dow Jones Industrial Average is unchanged while the small-cap Russell 2000 Index is up an impressive 0.9%. Yields haven’t provided relief in a while, however, with the 2 and 10-year Treasury yields up 6 and 2 basis points (bps) to 4.38% and 3.74% respectively. Higher Fed tightening expectations are also driving the dollar higher, with the Dollar Index up 0.3% to 103.46. Comments from Saudi Arabia’s Oil Minister, Prince Abdulaziz bin Salman, are pushing oil prices higher this morning as he hinted that OPEC + may cut output again at its June 4 meeting. His comments were directed at short sellers that may be piling on bets against the commodity. WTI Crude Oil is up 1.4% to $73.06 per barrel as a result.

Businesses Embrace Technology as Consumers Curtail Spending

While businesses appear to be cautiously spending on technology, consumers are scaling back spending. These trends are illustrated by the following examples:

- Zoom Video Communications reported first-quarter net income attributable to shareholders of $353.3 million and adjusted earnings per share (EPS) of $1.16, exceeding the consensus estimate of $0.99. For the same quarter last year, the company generated $315 million in net income, or $1.03 a share. Revenue for the quarter ended April 30 was $1.11 billion, while analysts expected revenue of $1.08 billion. The revenue climbed 3% year-over-year (y/y). Without the adverse currency exchange rate, revenue would have increased 5% y/y. Revenue benefited from the company adding approximately 215,900 enterprise clients and a y/y decline in the client churn rate. Zoom increased its revenue forecast for the current fiscal year ending in January to between $4.47 billion and $4.49 billion. It previously estimated revenues would range from $4.44 billion to $4.46 billion. It also increased its EPS estimate to between $4.25 and $4.31 for the fiscal year, up from its earlier estimate of $4.11 to $4.18. Last February, Zoom announced that it would lay off 1,300 workers.

- Lowe’s posted adjusted EPS of $3.67 and net earnings of $2.3 billion, exceeding the analyst consensus EPS expectation of $3.33. The company’s revenues of $22.35 billion exceeded the consensus expectation of $21.60 billion, but fell 5.5% y/y. Additionally, comparable same store sales declined 4.3% while analysts anticipated a 3.4% decline. In a similar manner to Home Depot, which reported earnings last week, Lowe’s says sales were hurt by a decline in homeowners taking on large renovation projects and a significant decline in lumber prices. Lowe’s reduced its fiscal year 2023 guidance ranges for adjusted EPS to $13.20 to $13.60 from $13.60 to $14.00 and sales to $87 billion to $89 billion from $88 billion to $90 billion. It also estimated that same-store sales will decline 4%. It previously said it expected same-store sales to drop only 2%.

- AutoZone reported diluted EPS of $34.12 compared to the year-ago quarter EPS of $29.03. Analysts expected an EPS of $31.51. AutoZone’s net sales for the period of $4.09 billion climbed y/y from $3.8 billion but missed analysts’ forecast of $4.12 billion. The company’s 1.9% increase in same-store sales also missed the consensus expectation of a 4.1% increase. The company’s inventory increased significantly during the quarter because higher prices dampened consumer spending.

As the debt-ceiling standoff remains top of mind, it isn’t the only headwinds investors are facing. JP Morgan Chase CEO Jamie Dimon told a group this morning that everyone should be prepared to see higher rates, because even though Fed rate hikes have been significant, markets remain flushed with liquidity due to the unprecedented surge in monetary and fiscal injections as a result of the pandemic. With the marketplace and current generation of investors having become conditioned to expect low rates after more than a decade of easy money, continued inflationary pressures and Fed hawkishness are likely to impose an uncomfortable adjustment in sentiment and valuations.

Visit Traders’ Academy to Learn More Purchasing Managers’ Index and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.