Poland has stopped producing fertilizer. Natural gas is a key input into the production of nitrogen-based fertilizers such as urea and Urea Ammonium Nitrate (UAN). The European energy crisis has rendered their manufacture uncommercial because of high natural gas prices, which are likely to persist for at least another year or so. Poland produces 6 million tons annually. Elsewhere in eastern Europe another 3 million tons of capacity is idle. In aggregate, 20% of Europe’s fertilizer production is shut down.

That fertilizer production will still be needed. Last year Russia was the world’s biggest exporter of fertilizer, with a 15% market share. That should presumably drop with sanctions, although countries like India (#3 importer) will probably value feeding their population more highly. The US was #5 exporter with a 5% market share.

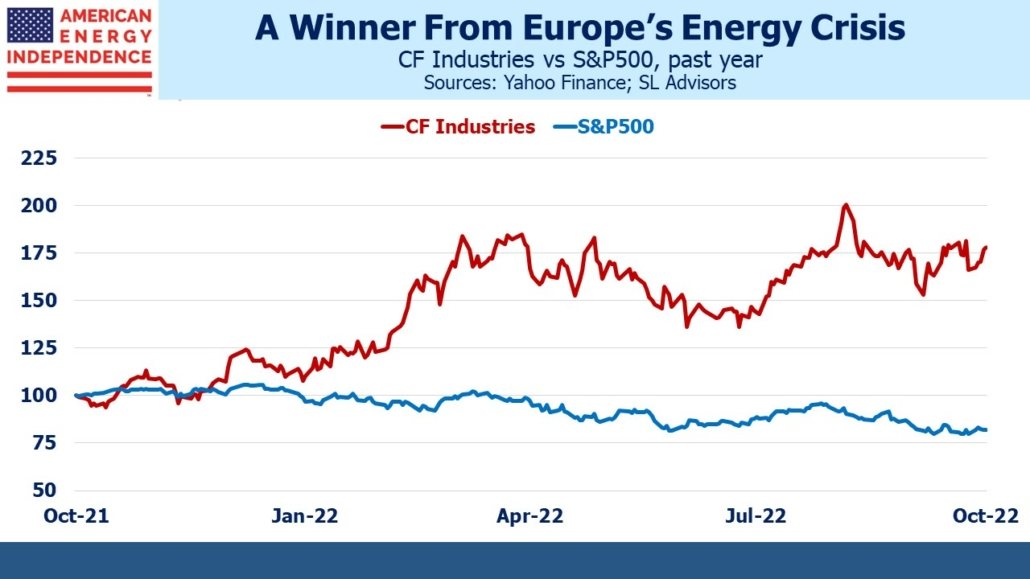

CF Industries has been a beneficiary of America’s comparative advantage in energy availability.

Zinc production throughout the EU has ben curtailed or stopped completely. Dutch company Nyrstar, the world’s biggest producer of zinc, has stopped output. 50% of primary aluminum production has ceased. Goldman Sachs estimates that 40% of Europe’s industry, “is at risk of permanent rationalization.”

Arcelor Mittal, Europe’s largest steelmaker, is idling blast furnaces in Germany. Alocoa has cut a third of its aluminum production in Norway. Hakle, a German makes of toilet rolls, is insolvent.

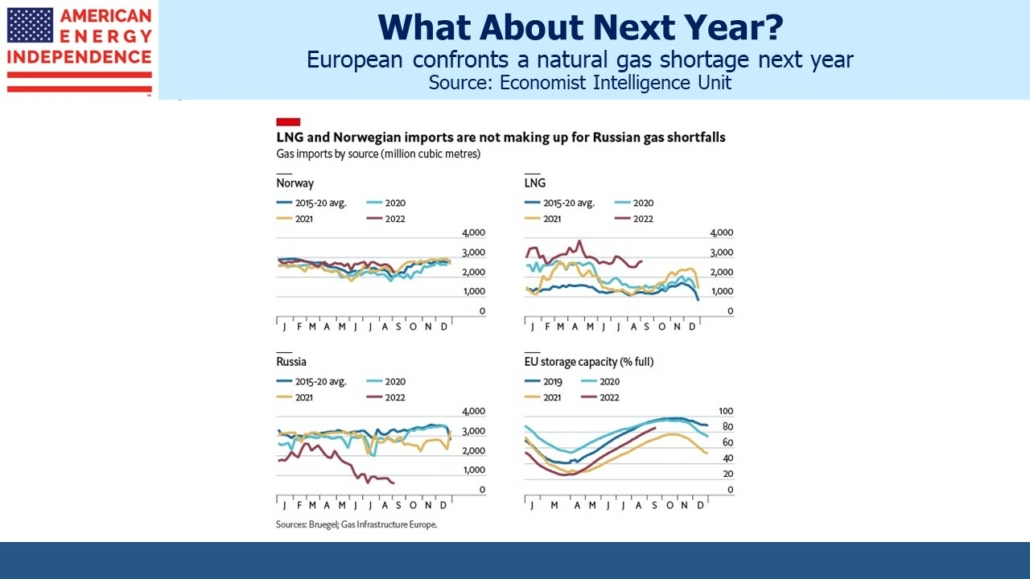

European winter storage levels of natural gas are on pace to be normal, thanks to conservation and increased shipments of Liquefied Natural Gas (LNG). But analysts warn that replenishing stocks next year will require 20% more natural gas than usual. This will present a potentially bigger challenge, since the partial supplies received from Russia in 2022 won’t be repeated in 2023.

This is why the EU is scrambling to add LNG import capacity. Germany has leased its fifth Floating Storage and Regassification Unit (FSRU). These vessels convert LNG from the chilled form in which it’s transported back into a usable state. They can be deployed relatively quickly, but have less capacity than a land-based, permanent LNG import facility. These can take three years or more to build. Italy hopes to build one by next year, with the government bypassing the normal permitting process, provoking fierce opposition from the local community.

The approach of EU policymakers to the energy crisis continues to regard it as a brief diversion on the way to a 55% reduction in greenhouse gas emissions (versus 1990). As a result, they have been reluctant to sign the 20-year LNG supply agreements that are common in the industry. Asian buyers have not hesitated, spurred on by the recognition that they face a new competitor.

Morgan Stanley calculates that agreements totaling over 60 Million Metric Tonnes per annum (MTpa) have been signed since Russia’s invasion in February. European buyers represent just 11 MTpa of this. The Dutch gasfield in Groningen is still scheduled to close by 2024, even though analysts believe it could provide up to half the gas Russia used to supply.

European manufacturers will respond to the energy crisis by overhauling their operations to use less energy. The region’s shift to renewables will receive a further boost from improved relative pricing. But manufacturing will also leave for other parts of the world where energy is cheaper and policies more supportive.

Svein Tore Holsether, chief executive of Norwegian fertilizer giant Yara International ASA, likes the “lower energy prices or green incentives currently offered in the U.S.”

Dutch chemicals firm OCI recently announced plans to expand its ammonia plant in Texas. They plan to use “blue” hydrogen, which is derived from natural gas. They further intend to capture the CO2 emitted in the process, claiming tax credits in the recently passed Inflation Reduction Act (IRA).

No Republican voted for the IRA in either the House or Senate, where VP Kamala Harris had to vote to ensure its passage. It’s ironic that many corporations believe the 45Q tax credits for carbon capture and sequestration are enough to pursue new business initiatives. This includes several midstream companies, generally a group that votes Republican (see Earnings and Pending Legislation Good For Pipelines).

The US stands to benefit from Europe’s energy crisis. It’s likely that manufacturing will receive a boost in parts of the country that offer easy access to energy and a pro-business climate. New England, whose energy policies look decidedly European, is unlikely to be a sought-after destination. Opposition to natural gas pipelines means they regularly import LNG at global rates, now enduring further competition from new European buyers (see Incoherent Energy Policies).

But many other parts of the US including southern states are set to benefit. This should add to demand for domestic natural gas. It shows that energy policy can make a difference.

—

Originally Posted October 23, 2022 – Energy Policies Will Drive Business From Europe

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Disclosure: SL Advisors

Please go to following link for important legal disclosures: http://sl-advisors.com/legal-disclosure

SL Advisors is invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from SL Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or SL Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)