We’ve managed to pack quite a bit into the shortest month of the year. The first week featured an amazing about-face in both stocks and bonds thanks to market perceptions of a friendly Fed followed closely by some unpleasant economic reports. Fixed income investors paid close attention to the combination of solid employment and higher-than-expected inflation. Stock investors noticed but spent much of the month consolidating January’s gains rather than showing true concern.

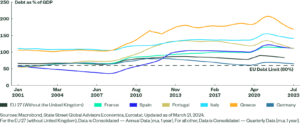

With major US equity indices down between roughly -1% to -2.5% this month but still up solidly on a year-to-date basis, it is illustrative to compare this modest consolidation with the moves in other financial markets. When January ended, 2-year Treasury Notes yielded 4.20%. As I write this, they’re flirting with 4.80%. The rise in 10-year rates was not as dramatic, going from 3.51% to 3.95%. That also means that the 2-10 inversion, viewed by many to be a classic recession indicator, widened from 69 to 85 basis points. This is the biggest inversion we’ve seen this century, with current levels continuing to surpass the peak inversions of 2000 and 2007. On the plus side, I guess we can note that we first surpassed those lows months ago, and that we’ve improved from the 91bp that we saw on the 15th of this month.

The move in 2-year yields was clearly the result of significant changes in perceptions about Fed policy. We ended last month with Fed Funds futures showing a peak rate of 4.92% in June, with rate cuts pushing January to 4.22%. On February 2nd, the day after the FOMC meeting, those levels had dipped further to 4.90% and 4.17% respectively. The current peak is now in July-September, at 5.40%, and the January rate is now 5.16%. The USD followed suit, with DXY up about 2.5% this month and now flat on the year.

If stocks are supposed to be discounting future events, generally 6-12 months ahead, how do we reconcile the idea that stocks have been relatively unconcerned with the idea that the hoped-for rate cuts have essentially evaporated? As we started the month, futures indicated that rates would be lower within a year. Now we think they will be likely to retain most of the extra 2 hikes that they futures are now anticipating. Stocks should be concerned, no?

A wide range of strategists and other market pundits have registered the same sort of concerns that we just did. They find it similarly difficult to explain how equity investors can seemingly fight the Fed with impunity. Many share my opinion that rule #1 of investing is “Don’t Fight the Fed.” With the FOMC signaling further hikes rather than a pause and pivot and continuing its commitment to quantitative tightening, sanguine investors nonetheless appear to be engaging in that battle. The various bearish commentaries tend to reflect that notion is one way or another.

Yet seeming bearish consensus leads to an important paradox. The “pain trade” is likely to the upside. If a wide range of so-called smart money publicly expresses negative views, then presumably their portfolios and clients are underweight equities. That leaves them susceptible to FOMO if the market continues to advance. Maybe it’s possible that corporate stock buybacks and dividends can provide enough ballast to equities to keep them from capsizing. Or maybe the economy can allow companies to post profits for longer then we think. Or maybe the public will continue to invest in stocks even though there are indeed valid alternatives for idle cash.

That said, I still refuse to fight the Fed and remain surprised at the equity market’s seeming willingness to do so. Rocky, potentially downward markets seem to be the base case. But the hedge under this scenario is to the upside.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)