As additional regional banks experience turbulence and curtail credit availability, Federal Reserve Chairman Jerome Powell is likely to stick to his hawkish inflation policies today rather than seek to prevent additional bank failures at the expense of allowing future price gains to occur unchecked.

Powell will approach the pitching mound this afternoon while navigating a highly troubled playing field, including persistent inflation, a debt ceiling debate that could result in the U.S. running out of cash by June, a recent 400 point drop in the Dow Jones Industrial Index, growing fears of a recession, a tight labor market, and a growing list of troubled regional banks.

A few highlights to the challenging landscape include the following:

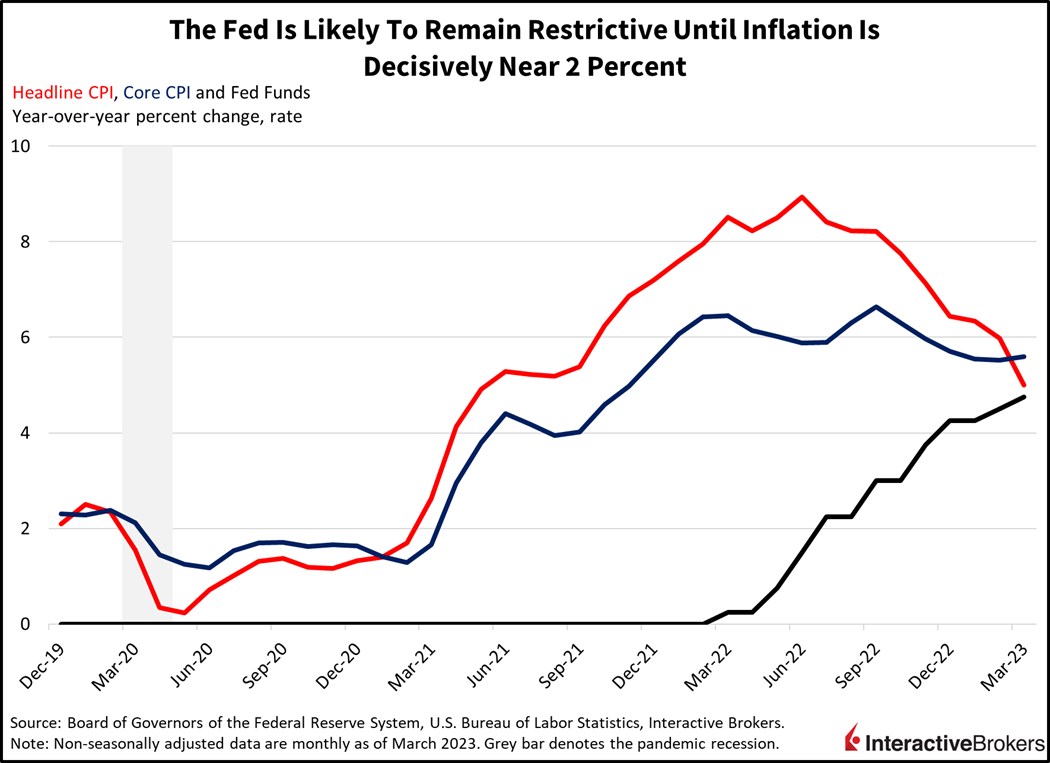

- Inflation is continuing, with the price component of the ISM’s Manufacturing Purchasing Manager’s Index increasing to 53.2 in April, reversing March’s 49.2 level of contraction. Moreover, the Fed’s preferred inflation gauge, the Core PCE, was 4.6% for March, nearly two and a half times the Fed’s 2% target.

- U.S. debt limits and an apparent inability of elected officials to reach a compromise on increasing the limit could cause the U.S. to run out of cash by June 1, according to Treasury Secretary Janet Yellen, who surprised markets by announcing the sooner-than-anticipated date.

- Markets have tanked in reaction to debt ceiling concerns and fears of a recession later this year with the Dow Jones Industrials dropping more than 400 points yesterday and bond yields cratering as investors rushed to safe-haven assets.

- Markets also declined yesterday in response to fears that the job market is still too tight. Yesterday’s Job Openings and Labor Turnover Survey (JOLTS) showed 9.59 million job vacancies for March, a decline from 9.97 million in February and below the consensus estimate for 9.64 million. March’s job vacancy number was the lowest since April 2021 but still represents a vacancy-to-worker ratio of 1.6 to 1. Moreover, this morning’s employment report from ADP showed strong April job growth. The 296,000 jobs added during April exceeded both the 148,000 expected and the 142,000 added in March.

- The combination of the Fed tightening monetary policy, a tight labor market and the banking crisis has led to two-thirds of economists and certain members of the Fed staff predicting a recession this year.

- Banking issues have extended to Phoenix-based Western Alliance, New York-based Metropolitan Bank and Los Angeles-based PacWest as investors shift money from bank deposits to higher yielding Treasuries and money market funds. PacWest, Western Alliance and Metropolitan Bank shares fell at least 19% yesterday and trading was halted briefly for PacWest and Western Alliance shares.

Will the Other Shoes Drop?

Turmoil at regional banks and the resulting tightening of credit is estimated by some analysts to have the same drag on the economy as 100 basis points (bps) of fed funds rate increase. Deposit withdrawals have moderated since the depths of earlier bank runs, but regional banks still have large challenges ahead, including exposure to commercial mortgages. Trepp, which maintains a database of securitized mortgages, reports that the CMBS Delinquency rate declined to 3.09% in March, down 64 basis points year-over-year (y/y). Delinquency rates declined for most categories but increased y/y from 1.58 to 2.61 for office buildings. While office vacancies have increased because of work from home arrangements and a broader slowing of the economy, the commercial real estate industry is facing the sizeable challenge of increasing rates from interest rate caps required for floating-rate mortgages. Rates for a three-year cap at 3% for a $100 million loan have climbed from $98,000 to $3.48 million, according to the Wall Street Journal and Chatham Financial. As existing caps expire, building owners will have to absorb the costs of substantially higher premiums. Many commercial property owners, furthermore, may be ineligible to refinance with fixed-rate mortgages.

Powell Will Likely Stick to His Inflation Fighting Guns

Powell is unlikely to coddle banks by being less hawkish. The following factors are at play:

- The Fed faces criticism for delaying its monetary tightening policy based on its mistaken belief that inflation was transitory as a result of stimulus spending and events related to the Covid-19 pandemic.

After the Fed got a late start to fighting inflation, it’s unlikely that Chairman Powell will turn dovish prior to producing a resounding defeat of inflation.

- Additionally, the Fed already threw the banking industry a lifeline when it reversed its policy of allowing its balance sheet to decline shortly after the start of the banking turmoil. In doing so, it increased its portfolio of assets by roughly $392 billion in only two weeks, therefore helping to maintain liquidity within the financial system. Throughout the current economic cycle, however, the loosening of financial conditions, including the Fed’s expanding balance sheet and mixed messaging at times, have been accompanied by renewed bursts of inflation. It’s unlikely the Fed is ready to do that again.

- Powell may also believe that curtailing inflation requires eliminating excessive speculation within the markets, including speculation by regional banks that took on riskier commercial loans and invested in long duration bonds that are susceptible to rising interest rates.

Precedent for Allowing Bank Failures

Policymakers have precedent for allowing poorly managed banks to fail during inflationary episodes. As chairman of the FDIC from 1980 to 1985, Bill Isaac oversaw approximately 3,000 bank failures. By doing so, he eliminated banks that engaged in speculative practices. His actions contributed to the quelling of price pressures across the economy.

Consumers Are Splurging on Entertainment and Travel

The Fed’s war on inflation has driven disinflation in consumer goods prices but the services sector is still ridden with price gains. Consumer goods sales soared during the pandemic when Americans worked from home and sheltered in place to help slow the spread of Covid-19. As the economy re-opened, demand dropped for consumer goods following American’s strong buying of such items. Today, consumers have pent up demand for travel, dining out and other forms of entertainment, which is supporting inflation as illustrated by the following examples.

- Marriott International, which operates hotels, posted first-quarter adjusted earnings of $2.09 a share, exceeding the consensus expectation of $1.85, with consumers paying premium rates for weekend bookings, helping to offset weaker results from business travelers. Impressively, revenue per available room climbed 34% y/y and Marriott expects strong demand to continue for the remainder of the year. It has increased its earnings per share guidance from $7.23 to $7.91.

- Starbucks, which has coffee shops across the globe, reported $0.74 of adjusted earnings per share (EPS) for its fiscal second quarter, significantly beating the consensus expectation of $0.65. Its net income totaled $908.3 million, or 79 cents per share, up from $674.5 million, or 58 cents per share, for the year ago quarter. The company experienced strong growth in China because the country has reopened its economy after implementing dramatic measures to curtail the spread of Covid-19, but it also enjoyed a 12% increase in U.S. same-store sales with traffic increasing 6%.

- Yum Brands, which operates Pizza Hut, Taco Bell and KFC restaurants, reported adjusted EPS of $1.06, missing expectations of $1.13; however, the company’s revenue of $1.65 billion exceeded analysts’ estimate of $1.62 billion. Yum Brands’ domestic same-store sales increased 8% in the quarter with all three of its major brands outperforming. Earnings were hurt by unfavorable currency exchange rates and the loss in value of unidentified investments.

In addition, more than half of the jobs added in April were in the leisure and hospitality sector, which created 154,000 of the 296,000 jobs gained during the period.

Waiting for Powell Commentary

As we await Powell’s 2:30 p.m. presentation, markets are relatively quiet, and their destination at the end of the day lays at the mercy of Powell.

Assuming the Fed is consistent with investors’ expectations and bumps up rates 25 bps, the big news today will be the tone of Powell’s commentary. With growing fears of a potential recession and other challenges within the economy, investors will sit on the edge of their seats as they listen to see if Powell leaves the door open for future rate hikes as he sheds light on the future path of monetary policy. It will also be important to assess how hard Powell pushes back against expectations for the Fed to cut rates during the rest of the year. As we await Powell’s 2:30 p.m. presentation, markets are relatively quiet, and their destination at the end of the day lays at the mercy of Powell.

Happy Fed Day.

Visit Traders’ Academy to Learn More about Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.