Quick read:

- In a world of high inflation and tightening monetary policy, expansionary fiscal policies have catalyzed sizable bond selloffs and weighed on global risk assets. The GTAA team believes this is because markets now expect expansionary fiscal policy to exacerbate the need for further monetary tightening.

The September turmoil in UK bond markets has shifted the market’s focus back to fiscal policy. In contrast to positive market reactions to expansionary US fiscal announcements of 2020 and 2021, announcements of expansionary fiscal packages in the UK and Germany in 2022 have catalyzed sizable bond selloffs and weighed on global risk assets. The GTAA team believes this is because markets now expect expansionary fiscal policy to exacerbate the need for further monetary tightening. We have positioned portfolios, particularly within fixed income, with a view that fiscal sustainability and borrowing constraints are likely to remain a concern for global bond investors. Across portfolios we are outright short European government bond markets.

Europe opens the purse strings

Russia’s invasion of Ukraine continues to be pivotal to policy developments across Europe. The supply constraints related to Russian sanctions earlier in the year accelerated inflation pressures and monetary tightening across the region. More recently, shortages in the wholesale electricity markets and shutdowns of piped natural gas deliveries have forced governments to enact large fiscal packages to tame electricity prices. The recently announced, open-ended fiscal commitments by the UK and Germany stand out in an otherwise austere Europe and have proven to be quite disruptive to markets.

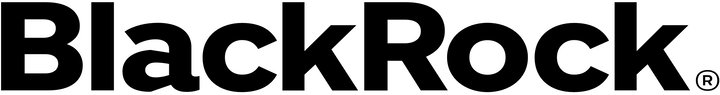

In the UK, the larger-than-expected fiscal announcements by the new Truss administration led to a sharp sell-off in the currency and temporarily broke the long-end of the government bond market as leveraged players found themselves unable to meet margin requirements. Despite intervention by the Bank of England and some less expansionary modifications by the government, UK Gilts continued to sell-off into early October as can be seen in the visual below.

Though the UK disruptions have dominated the new headlines, bond markets have also taken note of a succession of ever-larger German fiscal announcements. To insulate German households from potentially catastrophic energy price rises this winter, the German government announced at the end of September a very large (€200bn, or over 5% of GDP) and unfunded fiscal expansion. This policy should remove the tail risk of skyrocketing inflation, but it comes at the cost of greater government debt issuance. The market reaction has been a sharp sell-off in German Bunds as debt markets reprice for greater bond supply and a more aggressive European Central Bank policy response.

European government bonds have led the global sell-off

Source: BlackRock, Bloomberg as of 10 October 2022. Chart shows total returns of government bonds from 31 July 2022 – 10 October 2022. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

US fiscal policy set to shift expansionary again into 2023

In early 2022, a prevailing narrative was that a reduction in fiscal support in the United States would weigh on GDP growth following record expansions in 2020 and 2021. However, more recent developments suggest that fiscal policy will likely contribute positively to overall GDP growth again in 2023. At a federal level, the Biden Administration unexpectedly passed a large infrastructure package (the Inflation Reduction Act, or IRA) and introduced a student loan debt forgiveness plan this summer. Though the exact timing and budgetary impact of these packages are uncertain, the Congressional Budget Office has estimated that the IRA will add $100 billion in fiscal expenditures through 2023 and the student loan executive order will add ~$400 billion to the federal deficit.1 US state-level fiscal policy should also be expansionary heading into 2023.2

What does this mean for investors?

Higher inflation and the associated monetary response have shifted yields higher throughout 2022. More recent moves higher in European bond yields have had a different catalyst – market concerns about excessive fiscal policy and debt sustainability. To us, the signs point to expansionary fiscal policy continuing into 2023 and potentially leaving monetary policy behind the curve. In that environment we view the go-forward risks to bond markets to be the resilience of high nominal growth and the associated necessity for further monetary tightening.3

—

Originally Posted October 20, 2022 – Fiscal Policy to the Forefront

© 2022 BlackRock, Inc. All rights reserved.

1 Source: Congressional Budget Office, September 2022. https://www.cbo.gov/system/files/2022-08/hr5376_IR_Act_8-3-22.pdf, https://www.cbo.gov/system/files/2022-09/58494-Student-Loans.pdf.

2 Source: Pew Trusts, September 2022. https://www.pewtrusts.org/en/research-and-analysis/articles/2022/09/07/tax-revenue-in-most-states-surpasses-pre-pandemic-growth-trend.

3 Consistent with Jay Powell’s characterization in the September 2022 FOMC press conference, “this is a strong, robust, economy, people have savings on their balance sheet from the period when they couldn’t spend and where they were getting government transfers, they’re still very significant savings out there, although not as much at the lower end of the income spectrum, but still, some savings out there to support growth that the states are very flush with cash, so there’s good reason to think that this will continue to be a reasonably strong economy.”

Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and, if available, the summary prospectus contain this and other information about the fund and are available, along with information on other BlackRock funds, by calling 800-882-0052 or at blackrock.com. The prospectus and, if available, the summary prospectus should be read carefully before investing.

Important risks: The fund is actively managed and its characteristics will vary. Stock and bond values fluctuate in price so the value of your investment can go down depending on market conditions. International investing involves special risks including, but not limited to political risks, currency fluctuations, illiquidity and volatility. These risks may be heightened for investments in emerging markets. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Asset allocation strategies do not assure profit and do not protect against loss. The fund may use derivatives to hedge its investments or to seek to enhance returns. Derivatives entail risks relating to liquidity, leverage and credit that may reduce returns and increase volatility.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change.

Prepared by BlackRock Investments, LLC, member FINRA.

© 2022 BlackRock, Inc. All Rights Reserved. BLACKROCK, iSHARES and ALADDIN are trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.

USRRMH1022U/S-2471934-5/5

Disclosure: BlackRock

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)