The early results are in: markets are not at all fans of Federal Reserve Chair Powell’s prepared remarks ahead of his Senate testimony (grilling?) today. The two key headlines are:

- POWELL SAYS PREPARED TO INCREASE PACE OF RATE HIKES IF NEEDED

- ULTIMATE RATE HIKE LIKELY TO BE HIGHER THAN EXPECTED

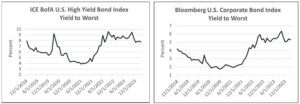

The immediate response by stock and bond traders was predictable. Both asset classes sold off quickly and sharply. The S&P 500 fell by just under -1%, 2-year rates flirted with 5%, and Fed Funds futures began to price even odds for a 50-basis point hike at the FOMC meeting that begins two weeks from today.

These comments are completely in line with a data-dependent Fed. Every major inflation report in February was both up over January and above expectations. Meanwhile, the other recent economic reports were generally positive – especially regarding employment. In that light, if he hadn’t taken a hawkish tone about rates, we would have been concerned that the idea of Federal Reserve data-dependence would have been, um, not truthful.

As with most initial reactions, they tended to overshoot somewhat. Each of those moves was cut in half once traders heard Powell’s dulcet tones during the early part of the question-and-answer portion. I’d like to think that the bounces were based upon sober reflection about data dependency, but they more likely resulted from the equity market’s love of technical analysis and momentum that has induced traders to resume their persistence about buying dips. As I write this, about a half-hour after the testimony began, it is impossible to know where we ultimately finish the day.

A fairly substantial “tell” about the equity market’s response to the testimony was the general lack of response by the Cboe Volatility Index (VIX). VIX “spiked” from 18.60 to 19.32 before returning to 18.95 as I type. On the face, it implies that traders are not aggressively seeking volatility protection. In general, that is my explanation for why VIX seems to be mired in a 18-23 trading range. The key institutions that utilize VIX may have largely de-risked their portfolios to the point where they don’t need to use options as a hedge to the degree they needed to at this time last year.

But it is important to remember how VIX is constructed. According to the Cboe, “The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX℠) call and put options.” The 23-37 day options that are used in the calculation should be incorporating the events that are likely to occur during those time periods. We’ve just had a volatility-inducing event pass today. Powell’s testimony is now behind us. One can assert that the volatility associated with the upcoming FOMC meeting has just increased now that we have an open question about 25-50 basis points and some uncertainty about whether the expectations that the chair referred to were market expectations or those implied by the most recent “dot plot.”

Obviously, the increased concern about the potential volatility surrounding the next FOMC meeting are relatively muted. Quite frankly, we don’t see too much concern about this Friday’s Payroll report either – even though it is certainly a key data point for a data-dependent Fed. Markets might remain relatively calm in the short-term, but it is hardly a foregone conclusion that the calm will persist.

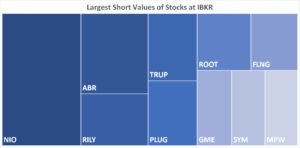

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ