The main points of interest in the May 8 week for the US are likely to be the cluster of reports on inflation – CPI on Wednesday, PPI on Thursday, and import prices on Friday – and the release of the Fed’s senior loan officer survey on Monday.

The loan officer survey is taken four times a year in January, April, July, and October. Its publication date is not part of the regular release calendar, but typically it is made public at 14:00 ET the Monday after the FOMC meeting at which it is presented. Chair Jerome Powell got a question about this survey at his May 3 press briefing in relation to the tightening of credit conditions associated with problems managing risk at some banks. Powell indicated that the report will be out this coming Monday. It is likely to be unusually interesting. The net percentage of domestic banks tightening standards for commercial and industrial lending has been climbing and was at levels consistent with recession in the last three reports. Another increase would confirm fears that conditions would weigh heavily on economic activity even if the US isn’t technically in a recession.

Powell didn’t receive as many questions about the inflation outlook last Wednesday as he has in more recent appearances. With the 25 basis point rate hike announced after the May 2-3 FOMC meeting concluded, most analysts expect the Fed to pause on further restricting monetary policy via higher interest rates while tighter credit conditions do the work of lowering demand and improving imbalances in the labor market. The inflation data have been more consistent in trending lower, although Powell warned that the path has been and will be choppy. Nonetheless, should the general easing trend for inflation continue – especially at the core and for non-housing services – it enhances the argument that monetary policy is sufficiently restrictive to get the job done in taming inflation if left in place to allow the “long and variable lags” to have their impact.

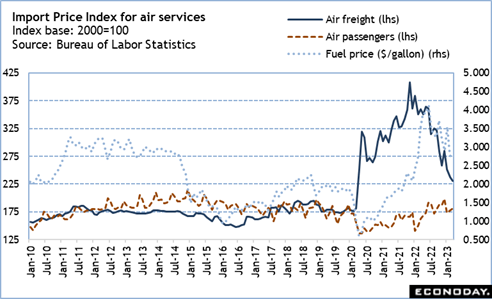

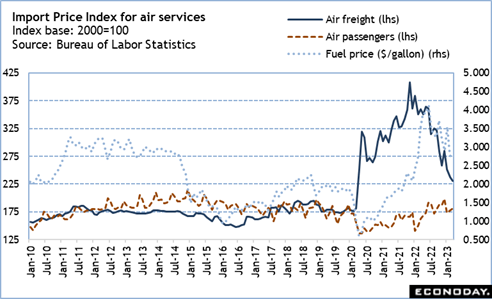

The April CPI report at 8:30 ET on Wednesday and PPI at 8:30 ET on Thursday will get most of the attention in terms of the outlook for inflation. Elsewhere, the data on air transportation services for April in the report on import and export price indexes at 8:30 ET on Friday should be able to confirm that one source of upward price pressures has eased significantly as the supply chain improved. Some businesses turned to air transport when other means of getting critical goods were too slow. The situation has righted itself and the costlier air transport services have subsided in use.

—

Originally Posted May 7, 2023 – High points for economic data scheduled for May 8 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.