By: Jean-Baptiste Berthon, Senior Strategist & Montassar Jamai, Hedge Fund Analyst

Since early September, risky assets have corrected as investors priced in a peak in global growth, broadening impacts from supply-chain bottlenecks, inflation data questioning the “transitory” narrative as well as the spike in energy prices, and central banks becoming more hawkish and preparing to taper their purchases. While China continued its regulatory crackdown, markets also had to digest the (managed) collapse of Evergrande and deepening power shortages. Finally, in the U.S., the political stalemate concerning infrastructure spending and the increasing of the debt ceiling added extra uncertainty.

As a result, global equities headed south and sovereign yields surged in response to more hawkish central banks and firming inflation, with the ‘stagflation’ narrative gaining support. Higher risk-aversion and the Fed’s nearing tapering supported the dollar, while credit spreads widened. Depleting inventories also boosted energy assets. Below we assess how hedge funds navigated increasingly challenging markets and discuss how they are currently positioned.

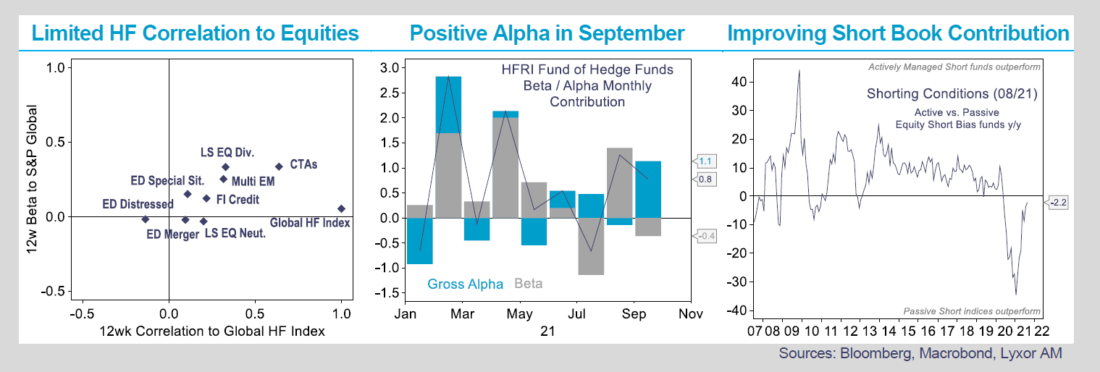

L/S Equity managers have decently navigated these markets, generating small positive alpha (especially on their short positions) but their implicit stance is diverging across regions. U.S. managers detracted only marginal alpha. They maintained their modest overall exposures throughout September and further reduced them early October, keeping limited factor tilts. They steadily reweighted the energy and rate-sensitive sectors, consistent with soaring energy prices and yields.

Also, they just started to buy the dip on tech stocks that have corrected the most, as well as sectors negatively impacted by the pandemic. While they took profits on financials, they did not add much on defensive stocks. U.S. managers do not appear to be overly concerned by the macro backdrop, but higher tail risks, especially in the U.S., keep them in wait-and-see mode. Meanwhile, they are increasingly turning tactical and opportunistic.

Click here to read the full report

—

Originally Published on October 13, 2021

The views and opinions expressed in this document are those of the authors and are not given or endorsed by the company. This document is for the exclusive use of investors acting on their own account and categorized either as «eligible counterparties» or «professional clients» within the meaning of Markets in Financial Instruments Directive 2014/65/EU. See important disclaimer at the end of this document.

Disclosure: Lyxor Asset Management

Lyxor Asset Management S.A.S. (“Lyxor S.A.S.”) is a French investment management company authorized by the Autorité des Marchés Financiers and registered as a commodity trading advisor and commodity pool operator with the CFTC.

The information in this material is for illustration and discussion purposes only. It is not intended to be, nor should it be construed or used as, investment, tax or legal advice, a recommendation or opinion regarding the appropriateness or suitability of any investment or strategy, or an offer to sell, or a solicitation of an offer to buy, an interest in any security. Any decision to invest in a product should be made only after reading the offering document for that product, conducting such investigations as the prospective investor deems necessary after consulting with the prospective investor’s own independent investment, legal, accounting and tax advisors in order to make an informed determination of the suitability and consequences of an investment in such product. Any recommendation or opinion regarding an investment in a product managed by Lyxor S.A.S. or one of its affiliates, as opposed to another product with a similar investment program, is subject to potential conflicts of interest.

The information displayed in this document may change from time to time without notice. Certain information presented herein has been obtained from other sources believed to be reliable. Such information has not been verified for purposes of this material and no representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of such information, nor does Lyxor S.A.S. accept any liability arising from its use. Any opinions expressed herein are statements of our judgment on this date and are subject to change without notice. The information contained herein is strictly confidential and may not be reproduced, in whole or in part, nor may its contents be disclosed to any other person (other than the recipient’s confidential advisers) under any circumstances without the prior written consent of Lyxor S.A.S.

Securities in certain funds mentioned herein which are managed by Lyxor S.A.S. are offered and sold to U.S. investors through SG Americas Securities, LLC (“SGAS”), an affiliate of Lyxor S.A.S. and Lyxor Inc. and a member of the U.S. Financial Regulatory Authority, the U.S. Securities Investor Protection Corporation and the New York Stock Exchange. Lyxor S.A.S. may pay a placement fee to, and provide compensation for expenses to SGAS in connection with its services provided in connection with such funds.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Lyxor Asset Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Lyxor Asset Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Hedge Funds

Hedge Funds are highly speculative, and investors may lose their entire investment.

Disclosure: OTC Securities

An investment in an OTC security is speculative and involves a high degree of risk. Many OTC securities are relatively illiquid, or "thinly traded," which tends to increase price volatility. Illiquid securities are often difficult for investors to buy or sell without dramatically affecting the quoted price. In some cases, the liquidation of a position in an OTC security may not be possible within a reasonable period of time.

Disclosure: Margin Trading

Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)