Yesterday was a fun congressional hearing – if you held puts.

“How many times did the economy fail to fall into a recession after raising the unemployment rate by 1%, as you want to?” asked Senator Warren (edited for clarity).

“I think the number is zero.” replied Chairman Powell. To his credit, he did not try to run circles around the question and gave a straightforward answer.

The rest is history, as the market took a nose-dive and closed -1.53% down.

We highlight two takeaways from this.

First, it’s a range-bound market. We’ve been saying this over and over. Own equities when S&P 500 has a P/E above 17x at your own risk.

Second, the risk of a recession is still here. Powell can hike the front-end but the back end seems anchored and 10y US Treasuries are looking more and more attractive.

What stocks are doing well today?

This section is powered by Open AI connected to TOGGLE AI

Thanks for all your feedback! This section is paused for a week as we take in all your ideas and come back with a new and enhanced version!

TOGGLE Leading Indicators: So it was a dead cat bounce…

And now we’re in limbo. Indicators are all neutral, so let’s watch where the market goes.

One would be tempted to buy straddles, but our VIX Valuation indicator is showing vols are expensive.

- TLI: flashed red again last week, and is now turning towards positive

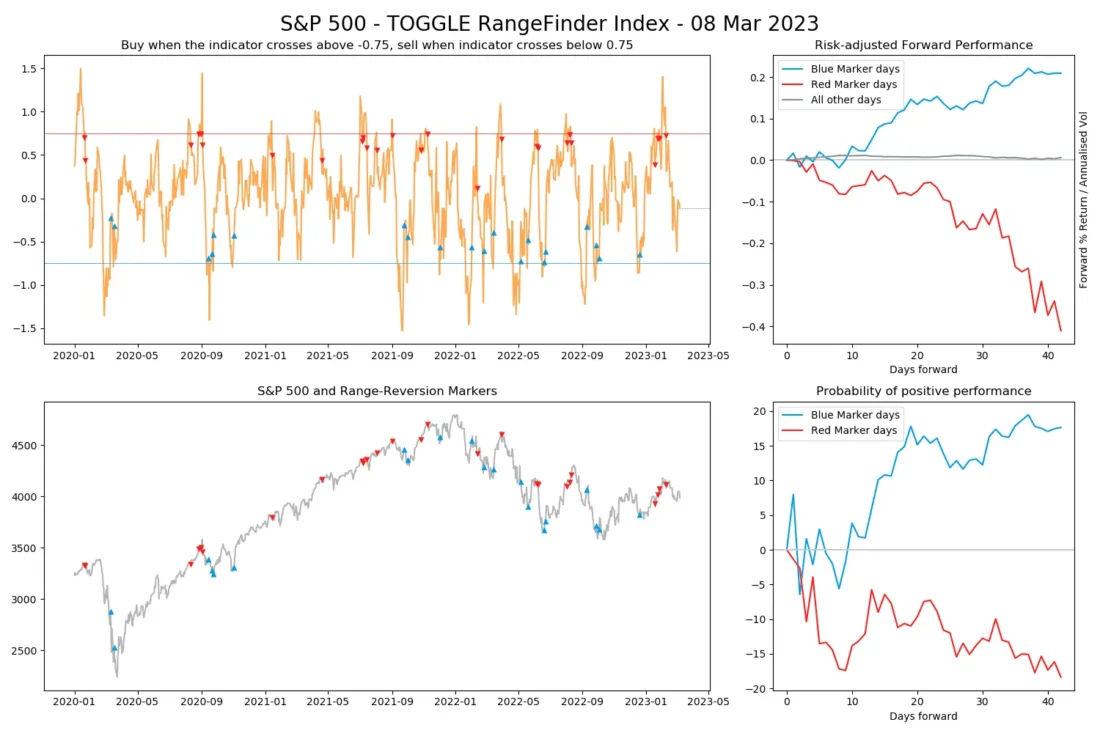

- Rangefinder Index: flirted with the bullish threshold but reverted

- Peak Probability Indicator: flirting with an anti-peak (i.e. a trough)

- Trough Probability Indicator: There comes the first bullish signal

- Candle Breadth: shied away from the border of a bullish signal

- Market Phase Shift Indicator: still not active, this is a longer-term indicator

Learn more about the Leading Indicators in the Learn Center!

Upcoming Earnings: Oracle releases tomorrow

Click here to test what to expect when CPB releases earnings tomorrow.

Discover how other companies could react post earnings with the help of TOGGLE’s WhatIF Earnings tool.

Asset Spotlight: Time for Value to shine?

TOGGLE analyzed 17 similar occasions in the past where entry point indicators for Dollar Tree dropped and historically this led to a median increase in the stock price over the following 3M. Check it out!

General Interest: Black holes are watching us

Yesterday we were posting Musk memes so bear with us if today we go a bit sciencey. Trust us, this is really cool.

In short, it appears black holes are observing the universe.

As a refresher, in quantum theory you need to observe a particle to make it “real”.

An undisturbed particle is here but it’s also there, it exists as a superposition of probabilities. Then you observe it and – bang! – the wave function collapses and the particle is in a specific spot.

Guess what, the event horizon of black holes seems able to do what we as observers do: it can collapse the wave function. Space-time itself plays the role of the observer. The Universe is watching itself!

Read more about it here on Quanta.t

—

Originally Posted March 8, 2023 – “How many times did the economy fall…”

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ