KEY TAKEAWAYS

- The metaverse is a virtual, shared space in which people and organizations can communicate, play games, attend virtual events, shop, and even work or learn together.

- Rising public interest and technological capabilities are prompting tech, consumer, and media firms to pour billions into development across user content, user hardware, digital platforms, governance protocols, and infrastructure hardware.

- Investors seeking exposure to the metaverse may want to consider ETFs that target its value chain, from companies developing enabling technologies to those using the metaverse to innovate their business models.

WHAT IS THE METAVERSE?

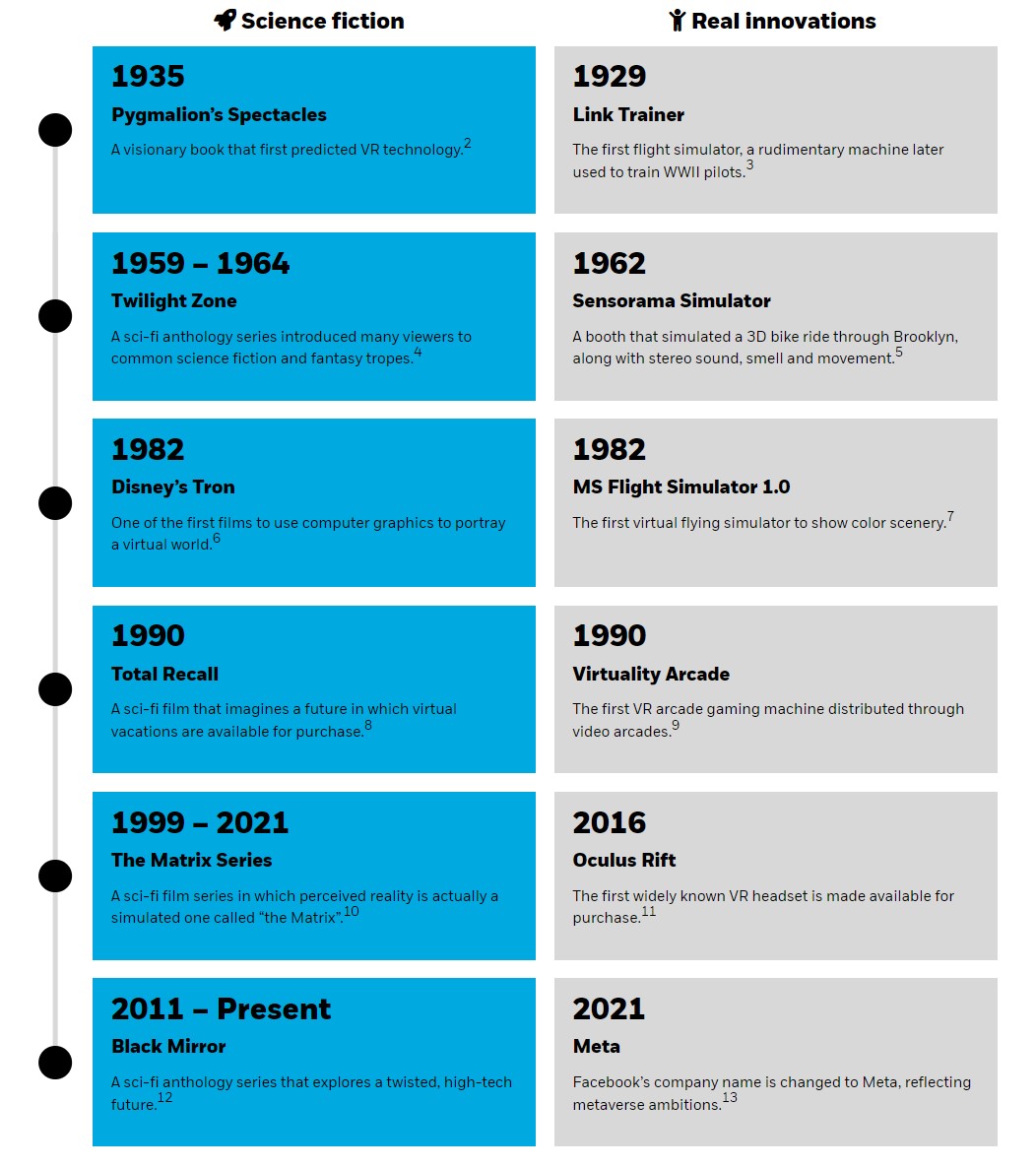

A metaverse is a shared space that uses virtual reality (VR) and/or augmented reality (AR) to bridge the divide between the physical and the digital worlds. The word “metaverse” first appears in Neal Stevenson’s 1992 novel, Snow Crash — a story that depicts a future in which characters can access a digital world through user-worn goggles. But the concept of bridging virtual and physical realities has deeper roots, both in science fiction and the physical world, going back to the first flight simulators used to train pilots in the late 1920s.1

When science fiction meets real life

The above timeline does not represent all innovations and fictional representations of virtual reality between 1929 and 2022. For illustrative purposes only.

Description: The timeline shows milestones in both real life and science fiction, such as Pygmalion’s Spectacles (1935), Sensorama (1956), Microsoft Flight Simulator (1982), and Oculus Rift (2016), just to name a small fraction of respective cultural milestones in each category.

While the metaverse is still being defined, both on paper and in practice, advancements in virtual reality, 3D rendering, simulation software, and wearable technology suggest a potential new wave of digital disruption is possible. Facebook changing its name to Meta in 2021 — and committing $10 billion to its Reality Labs division (which makes user hardware such as VR goggles) — is just one, highly visible, example of the investments being made.14

All told, year-over-year investment in the metaverse has grown from $1.5 billion in 2020 to $57 billion in 2021 and $120 billion in 2022.15 A recent report by Citigroup claims that, at this rate, the metaverse addressable market could reach $13 trillion by 2030.16 Private equity and venture capital firms comprise 6% of total deployed capital, internal corporate investment — e.g., organic software development — sits at about 16% of all metaverse investments; the vast majority, 78%, or $100 billion in 2022, has come through acquisition.17

KEY TERMS FOR UNDERSTANDING THE METAVERSE

Metaverse

A shared space that uses virtual reality (VR) and/or augmented reality (AR) to bridge the divide between the physical and the digital worlds.

Virtual Reality (VR)

Any simulated experience that immerses the user in a digital setting. While this is commonly used to describe visual immersion, all five senses are fair game — “VR goggles” and surround sound have been the first foray into this world, with haptic feedback devices — wearables that offer physical feedback like vibration — quickly following, and taste and smell within reach.

Augmented Reality (AR)

Unlike virtual reality, which immerses the user in a world other than his or her present, physical location, augmented reality adds virtual layers to that physical location — visual, auditory, or otherwise. AR-based visualizations, like determining if that sectional will actually fit through the doorframe or those filters that make Snapchat users’ eyes look so big and beautiful, are just the beginning.

The fact that mega-cap firms are driving the bulk of metaverse spending via acquisitions and internal investment can be a red herring for equity investors. Some of these companies have the focus and resources to be metaverse leaders in the mid- to longer-term; however, small- and mid-sized companies that focus all or most of their business on the metaverse should be most sensitive to the theme in the short-term. Therefore, diversified exposure to the metaverse requires owning a range across the market capitalization spectrum.

Investors interested in accessing companies at the frontier of metaverse use and construction may want to consider ETFs which hold firms contributing to the full range of its development, as well as the potential opportunities detailed below.

HOW IS THE METAVERSE BEING USED?

It is difficult to predict just how vast the set of use cases for the metaverse will become over the next five to ten years. Imagine a vast, interconnected network of virtual environments where people can communicate, play games, attend virtual events, shop, exchange goods, and even work or learn together. These environments can range from realistic simulations of real-world locations (your office) to entirely fantastical worlds (your office if it were located on the surface of Mars and your coworkers all looked like Martians). Users can navigate the metaverse using avatars, which are digital representations of themselves, and interact with the virtual world and other avatars using hand gestures, voice commands, or specialized controllers — e.g., gloves or body suits.

Whatever our wildest imaginations can conjure, there are plenty of tangible, real-world use cases emerging today:

Gaming

With more than three billion users globally, and a total value of more than $200 billion, the gaming sector is one of the core adopters and investors in the metaverse.18 The online gaming platform Roblox reached over 55 million daily active users in 2022, Microsoft acquired Activision Blizzard for $69 billion, while Andreessen Horowitz, a leading venture investment firm, earmarked $600 million in funding for metaverse infrastructure and gaming.

Aside from immersive gaming — and the appeal of bridging our own reality with visual characters and artifacts — the metaverse can also offer gamers a play-to-earn option. By giving users the ability to earn in-game items or rewards that hold value in real life, the metaverse has the potential to revolutionize the incentive structure for game development and player adoption.19

Commerce

Augmented reality can add layers to your physical setting and your physical self. This means that consumers will no longer have to choose between the convenience of around-the-clock, at-home online shopping and the benefits of experiencing goods prior to purchase at a brick-and-mortar location. Being able to try on an outfit in your living room at 3:00 AM or seeing how a table would look in your dining room before committing to white or red oak has major implications for consumers and suppliers alike.

Remote work and life

What if your work-from-home days and in-office days were not mutually exclusive? By offering simulated office spaces and hyper-realistic digital representations of ourselves, and our coworkers, the metaverse can break down barriers of physical distance to enable new forms of collaboration, interaction, and productivity. Simulated reality has the added benefit of offering scaled learning experiences to students in remote areas that were previously impossible to experience digitally, like lab or field work.

Healthcare

Hyper-realistic patient avatars, and a medical professional’s ability to see or feel them in real time and diagnostic services across the globe. It can also widen access to the hands-on educational experiences needed to train new medical professionals, which could help address the global medical professional shortage.

6 AREAS FOR METAVERSE INNOVATION AND VALUE CREATION

A fully realized metaverse exceeds our current computing and network capabilities; for investors, this creates a range of opportunities to invest in the firms looking to change that. Graphics and concurrency limitations (constraints on the number of users within one virtual world), for example, offer a significant opportunity for firms leading advances in graphics processing unit (GPU) manufacturers and 3D rendering services. High latency and low-bandwidth buffering highlight the need for enhanced edge computing capabilities alongside cloud and 5G expansion. Perhaps most critically, metaverse access today exists primarily through monitors (tablets, smartphones, and PCs) — meaning there is massive room for growth amongst AR/VR technology and the next wave of haptic immersion.

We identify six areas that offer the most exciting opportunity for innovation and value creation:

Metaverse platforms

Metaverse platforms provide infrastructure and tools to create, operate, and monetize virtual worlds and experiences. They allow creators and developers to build and manage virtual environments; they provide users with a seamless way to access and interact.

Enhanced social media

Social media platforms provide users with a way to connect, communicate, and interact. Enhanced social media features, such as avatars, chat, and shared virtual spaces, are necessary for creating a sense of presence and community.

Immersive gaming

Immersive gaming provides users with engaging and interactive experiences. These experiences can range from simple games to complex simulations and can be used to explore and learn in a variety of fields including education, entertainment, and occupational training.

3D rendering and simulation software

3D rendering and simulation software are critical for creating realistic and immersive virtual environments. These tools allow creators and developers to build and manipulate 3D models, textures, and animations, and to simulate physics and other real-world phenomena.

Wearable technology & AR/VR

Wearable technology and AR/VR are essential for providing a fully immersive experience. These technologies allow users to interact with virtual environments in a natural and intuitive way, providing a sense of presence and immersion that is not possible with traditional screen-based interfaces.

Digital assets & Payments

Digital assets and payments are necessary to support the economy within the metaverse. Users will need to be able to buy and sell virtual goods and services, as well as exchange digital assets. Without a robust system for digital assets and payments, the metaverse would not be able to sustain an economy at scale.

CONCLUSION

In short, there are few corners of the world that will potentially remain unchanged as metaverse capabilities advance and adoption accelerates. Holding a diverse basket of names can help provide investors pure-play access to the value being created without the concentration risk associated with individual stock selection.

—

Originally Posted February 15, 2023 – How to invest in the metaverse

© 2023 BlackRock, Inc. All rights reserved.

1 Forbes, “A Short History of the Metaverse”, Bernard Marr, March 2022.

2 Pygmalion’s Spectacles was published in 1935 by American science fiction writer Stanley G. Weinbaum. “Pygmalion’s Spectacles: A Fictional Model for Virtual Reality”, Medium.com, Lizzie Metcalfe, July 2022.

3 Naval Air Station Fort Lauderdale Museum (NASFLMuseum.com), August 2010. Accessed in February 2023.

4 National Communication Association, “The Twilight Zone and the Power of Ideas”, Brant Short, October 2009.

5 Engadget.com, “The sights and scents of the Sensorama Simulator”, Jon Turi, February 2014. Accessed in February 2023.

6 The Guardian, “‘Frankly it blew my mind’: how Tron changed cinema – and predicted the future of tech”, Steve Rose, July 2022.

7 MeridianOutpost.com, “Microsoft Flight Simulator Evolutionary History – Illustrated Timeline”, Accessed in February 2023.

8 “Mars, Membranes, and Memories: The Science Behind ‘Total Recall’”, Glenn McDonald, September 2018.

9 The Independent, “Virtuality Ties up Atari Deal”. Horsman, Matthew, March 1995.

10 Vox.com, “Why The Matrix never stopped being relevant”, Emily St. James, December 2021.

11 Kickstarter, “Oculus Rift: Step Into the Game“, Accessed in February 2023.

12 Griffith University, “The Moral Uncanny in Black Mirror”, Margaret Gibson, 2021.

13 CNBC, “Facebook changes company name to Meta”, Salvador Rodriquez, October 2021.

14 CNBC, “Facebook changes company name to Meta”, Salvador Rodriquez, October 2021.

15 McKinsey, “Value Creation in the Metaverse – The Real Business of the Virtual World”, June 2022.

16 Oracle Connect, “Accenture: 5 Data-Driven Forces will Define the Future”, Justine Kavanaugh-Brown, July 2022.

17 McKinsey, “Value Creation in the Metaverse – The Real Business of the Virtual World”, June 2022.

18 ExplodingTopics.com, “How Many Gamers Are There? (New 2023 Statistics)”, Josh Howarth, January 2023.

19 McKinsey, “Value Creation in the Metaverse – The Real Business of the Virtual World”, June 2022.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

Technologies perceived to displace older technologies or create new markets may not in fact do so. Companies that initially develop a novel technology may not be able to capitalize on the technology.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cboe Global Indices, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA® ”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell, S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index, FTSE EPRA Nareit Developed Green Target Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

©2023 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH0223U/S-2724956

Disclosure: iShares by BlackRock

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Markit Indices Limited, nor does this company make any representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with Markit Indices Limited.

©2022 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from iShares by BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or iShares by BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)