“How long will the shift to the outdoors last?”

Overview

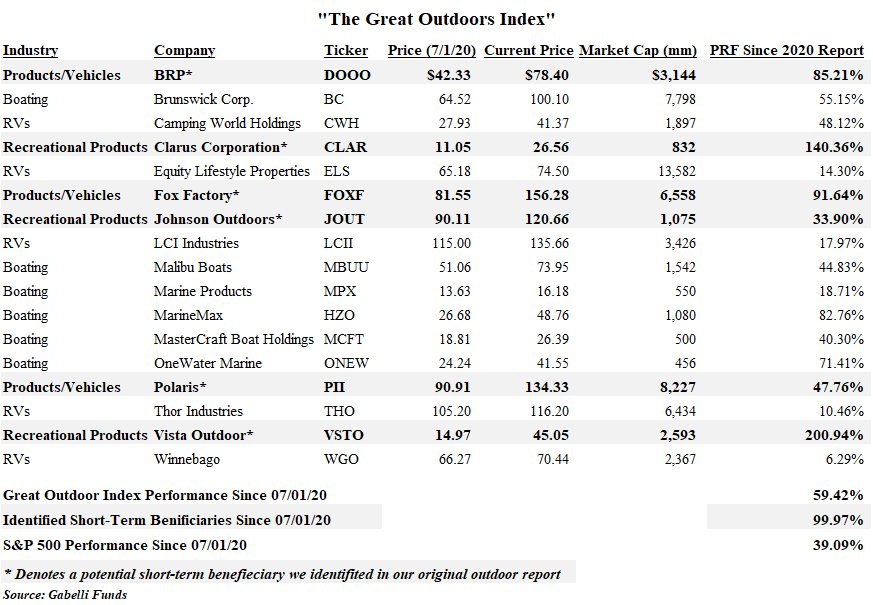

On July 2, 2020, in our “Great Outdoors Whitepaper” we laid out the thesis that outdoor leisure companies would benefit greatly from the COVID-19 pandemic and related social distancing measures. It has now been a year since our report and we think it is a good time to reflect on the outperformance of our “Great Outdoors Index” as investors have increasingly become aware of the long-term ramifications of the consumer shift to the outdoors. In this whitepaper, we lay out various highlights that have occurred over the past year in the industry and offer further insights into what we believe the future of the spaces holds, especially with widespread vaccine availability pushing consumers back to normalcy. Additionally, we review how our identified short-term beneficiaries have tracked since our original report and re-highlight our thoughts on the potential long-term winners in the industry (short-term winners denoted by * next to company name in Table 1). It is important to note that this update serves as an overview of the industry itself and does provide deep dives into specific companies. The majority of the companies mentioned in this report have enjoyed record earnings over the past year and are also seeing record order backlogs that in many cases extend out to the 2022/2023 selling season. We provide some commentary from various management teams to highlight what industry participants are discussing to offer a glimpse into the health of the industry and the various companies in our index.

Table 1

US Outdoor Recreation Industry Highlights 2020

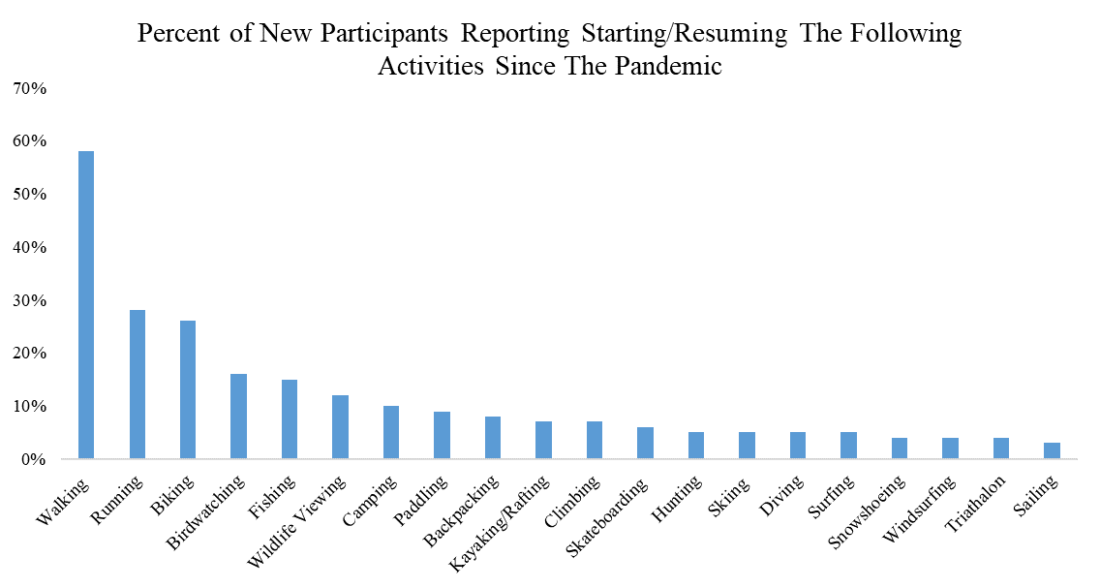

Total outdoor participation in the US grew to 53% of the population, up from 50.7% in 2019 and 50.5% in 2018. Major categories of outdoor activities include: boating, hiking, camping, fishing, hunting and running.

- The 2.2% growth in overall outdoor participation was the largest annual increase the Outdoor Industry Association has seen since it began tracking data ten years ago.

- Camping participation grew 28% YOY, equating to 7.9M additional participants in 2020. Camping equipment sales were up 31% YoY as a result.

- Hiking participation grew 16% YoY, with 8.1M more Americans hiking in 2020 than in 2019.

- Freshwater Fishing participation grew by 3.4M participants YoY, resulting in a 9% increase.

- There was a 12% YoY increase in hunting licenses in 2020.

- Cycling equipment sales saw a 63% YoY increase, while golf equipment sales grew over 40%.

The average age of a new participant in 2020 was 45, as compared to 54 in 2019. Additionally, a new participant was more likely to live in an Urban Area than in 2019 (36% vs 29%).

- New participants to the outdoors in 2020 were also much more diverse.

– 58% of new participants were female (49% previously).

– 41% of new participants had income over $100K (46% previously).

– 36% of new participants lived in urban areas (29% previously).

Exhibit 1

Source: Outdoor Industry Association

Click Here to Read the Full Article

—

Originally Posted on July 2, 2021 – Huntin’, Fishin’ and Lovin’ Every Day!

IMPORTANT DISCLOSURES

This whitepaper was prepared by Alec M. Boccanfuso. The examples cited herein are based on public information and we make no representations regarding their accuracy or usefulness as precedent. The Research Analyst’s views are subject to change at any time based on market and other conditions. The information in this report represent the opinions of the individual Research Analyst’s as of the date hereof and is not intended to be a forecast of future events, a guarantee of future results, or investments advice. The views expressed may differ from other Research Analysts or of the Firm as a whole.

As of June 30, 2021, affiliates of GAMCO Investors, Inc. beneficially owned 3.66% of Marine Products and less than 1% of all other companies mentioned.

This whitepaper is not an offer to sell any security nor is it a solicitation of an offer to buy any security.

Investors should consider the investment objectives, risks, sales charges and expense of the fund carefully before investing.

For more information, visit our website at: www.gabelli.com or call: 800-GABELLI

800-422-3554 • 914-921-5000 • Fax 914-921-5098 • info@gabelli.com

Disclosure: Gabelli Funds

Please note that Gabelli Funds and its affiliates are clients of Interactive Brokers LLC

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Gabelli Funds and is being posted with its permission. The views expressed in this material are solely those of the author and/or Gabelli Funds and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.