By: Aneeka Gupta and Liqian Ren

Indian equities have started the year on weak footing (up 0.26%1) compared to global equities (up 7.22%).2

There is no denying that the allegations by Hindenburg regarding the Adani Group have soured sentiment. But India continues to have strong macroeconomic fundamentals, an enabling policy environment and buffers to deal with ongoing challenges.

Let’s take a look.

Budget’s Capex Boost Offers Strong Growth Impetus

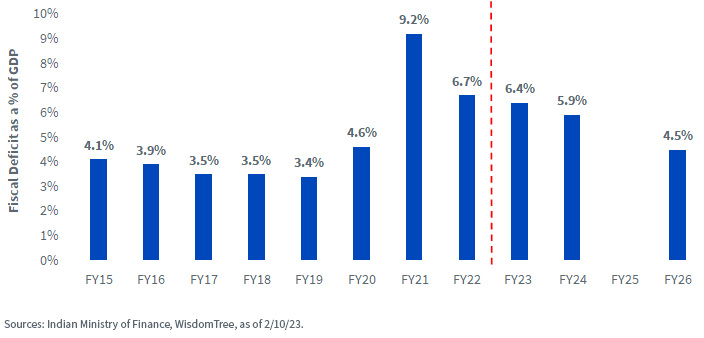

An element of India’s rapid recovery has been a concerted, tight fiscal policy, with the finance ministry focused on protecting the budget deficit.

At the start of February, the government delivered a balanced budget, treading the fine line between fiscal consolidation and growth.

Despite the consolidation, robust tax collection trends and a structural cut in subsidies (in the food and fertilizer subsidy bill) are likely to continue to drive robust capex. A 30% surge in capital spending, to $120 billion, should encourage investment and capacity building ahead of the 2024 elections.3

The Indian Government Continued Its Fiscal Consolidation

This could be beneficial for the industrial, cement, banking and consumer sectors. On the flipside, the insurance sector likely faces headwinds with the removal of tax exemptions on annual premiums above ₹500,000. The budget projected India’s real GDP to grow at 6.9% in fiscal year 2023, compared to 8.7% in fiscal year 2022.

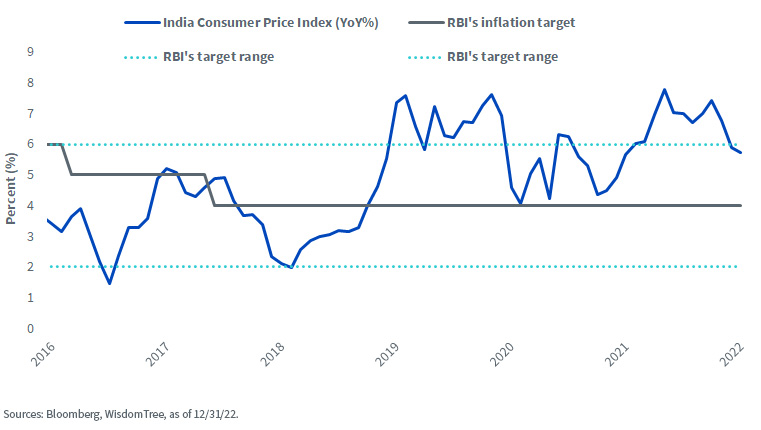

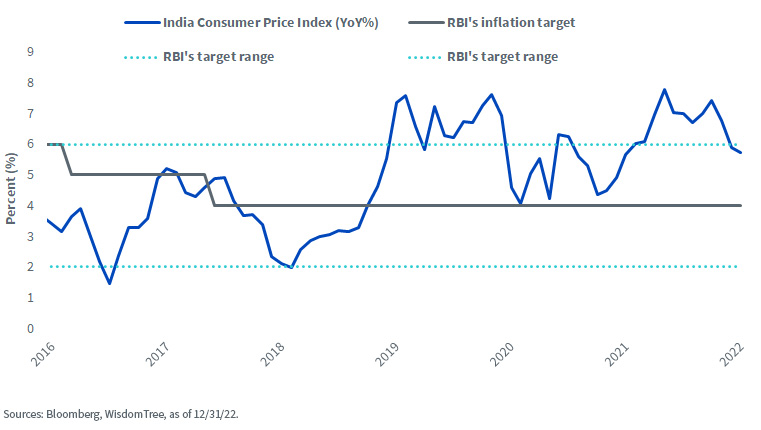

The inflation situation is expected to improve significantly in the next fiscal year, with headline inflation expected to fall from 6.5% in 2022/23 to 5.3%.

The monetary policy committee (MPC) of the Reserve Bank of India (RBI) raised the policy rate for the sixth consecutive time on February 8, taking the policy rate to 6.5%. We expect this rate hike to be the last in the current monetary tightening cycle. A key factor in the RBI’s inflation forecasts is an expected moderation of the crude oil price from $100 to $95. Both are higher than current energy prices.

Inflation Is within the RBI’s Target Range

The past tighter monetary cycle is likely to add to borrowing costs and restrain domestic growth. But at the same time it should lower vulnerabilities, such as high inflation. The past year has reminded us that India’s domestic growth has been far more resilient than broader global growth.

Earnings Weighted India: Emerging Market Value without Sacrificing Growth and Quality

India was recently in the headlines as its richest person—Gautam Adani and his affiliated conglomerate—was accused of accounting fraud.

While this continues to play out in capital markets, it’s important to remember that under the current geopolitical background of US-China economic competition, India is generally a benefactor. In the near term, India will continue its high-growth trajectory, benefiting from its relative cost advantage and younger demographics.

One company’s accounting demise, as people familiar with China’s Luckin Coffee saga know, seldom changes an overall investment case for a country, where ultimately economic and political fundamentals are main factors.

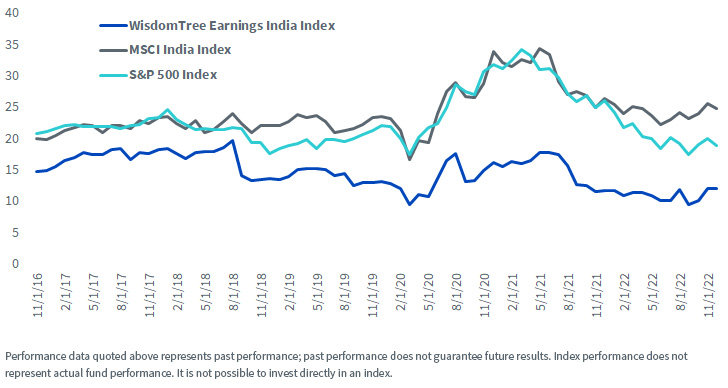

In the near term, when global growth is muted, investors will favor companies that consistently generate high earnings growth at reasonable valuations. Indian stocks are generally not cheap. Earnings weighting of Indian companies could offer investors significant valuation discounts without sacrificing growth and quality.

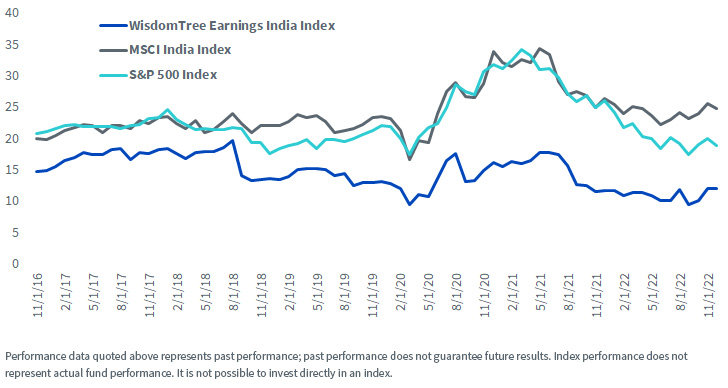

Contrary to other emerging market (EM) countries with discounted valuations, Indian equity price-to-earnings historical ratios were close to the S&P 500. However, when using earnings weighting instead of market cap weighting, the valuation discount is significant, at about 50%. In the case of Adani-affiliated companies, the WisdomTree India Earnings Index had a less than 1% exposure, while the standard MSCI India index had about 5% exposure.

Price-to-Earnings of S&P500 Value, WisdomTree Earnings India & MSCI India Indexes

For definitions of terms in the chart above please visit the glossary.

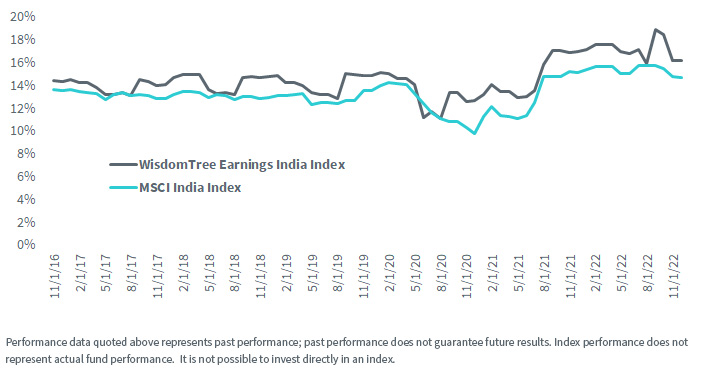

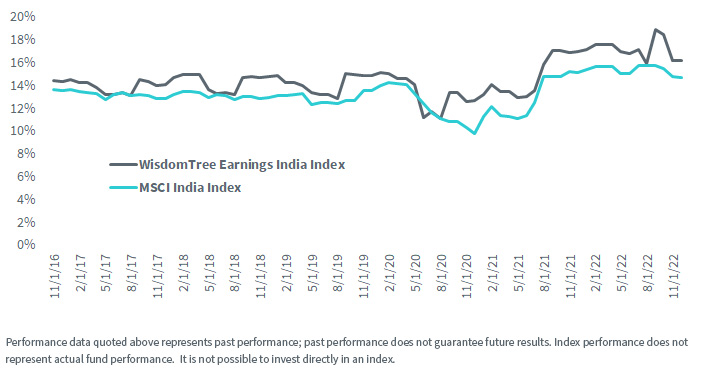

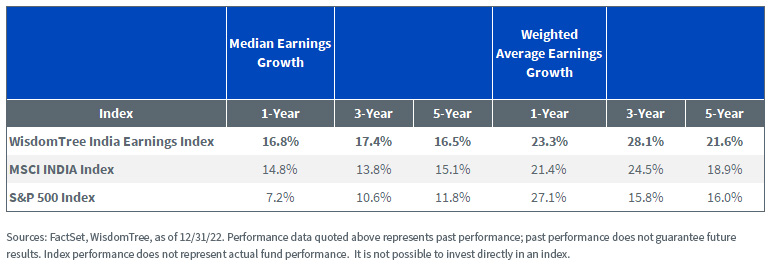

Most importantly, the earnings-weighted WisdomTree India Earnings Index has a valuation discount, without sacrificing earnings growth and quality characteristics. It also has higher a return on equity than the standard MSCI India index.

Historical Return on Equity (%)

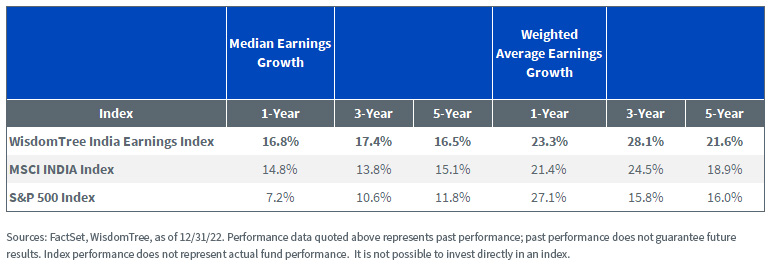

The earnings-weighted Indian Index also had higher earnings growth rates than the standard index over the last five years.

In summary, part of the current correction in Indian equity is due to some mean reversion following the significant run-up of last two years, as its biggest EM counterpart, China, experienced significant negative sentiment.

1 Bloomberg performance of Sensex Index, 12/31/22–2/10/23. It is not possible to invest directly in an index.

2 Bloomberg performance of MSCI World Index, 12/31/22–2/10/23.

3 Indian Ministry of Finance.

—

Originally Posted February 24, 2023 – India Remains a Compelling Investment Case amid the Current Storm

Important Disclosure Related to this Article

Aneeka Gupta is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)