E-mini S&P (March) / E-mini NQ (March)

S&P, yesterday’s close: Settled at 3956.50, down 19.00

NQ, yesterday’s close: Settled at 11,961.75, down 110.50

Fundamentals: E-mini S&P and E-mini NQ futures slipped precipitously through the Asian open last night, the second in a row, but this time there was not a robust slate of China data to quickly improve sentiment. In fact, last night was just the opposite as Tesla slipped as much as 7% after it’s Investor Day disappointed; the company announced more spending and no new models. The E-mini S&P and E-mini NQ were dialed in on Tesla’s weakness as well as the U.S. 10-year Note regaining 4.0% for the first time since November 10th and more or less ignored Salesforce earnings. The beleaguered software company blew out earnings expectations and is up more than 15% on strong guidance and buybacks. Salesforce has done some heavy lifting for the Dow, buoying it around unchanged for much of the overnight.

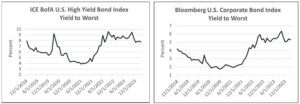

Price action in the E-mini S&P and E-mini NQ futures staved off a fresh low after a hotter-than-expected Eurozone CPI. Although the headline +8.5% y/y and record Core at +5.6% y/y is certainly jarring, expectations mounted in recent days from the individual country reports. However, surging inflation in Europe has helped underpin higher yields in the U.S., a direct headwind to risk-assets. It is worth noting German yields have retreated slightly. We will continue to watch the U.S. 2-year very closely, as well as the 10-year. It is no coincidence the 2-year yield took out its November high and reached the highest since July 2007 yesterday, as E-mini S&P futures hit a six-week low.

Do not miss our daily Midday market Minute, from yesterday.

From the U.S. economic calendar, Q4 Unit Labor Costs were revised higher in a shocking manner, to +3.2% from +1.6%. Nonfarm Productivity was as well, but lower, to 1.7% from +2.6%. In other words, labor costs more for less. Weekly Initial Jobless Claims also topped expectations at 190k versus 195k. Traders should keep an ear out for Fed speak as the day unfolds. Fed Governor Waller is due to speak at 3:00 pm CT, and Minneapolis Fed President Kashkari at 5:00 pm CT, both are known to be two of the more hawkish committee members.

Technicals: Price action has been under pressure, ultimately, since coming off at 5:00 am CT yesterday morning. Selling through the evening took E-mini S&P and E-mini NQ futures to a low of 3925 and 11,832, respectively. Each of these lows pierced strong areas of support, detailed below. However, the S&P continues to battle just off the overnight lows, ahead of the opening bell. Helping to buoy the poor sentiment are two critical areas of support within proximity at … Click here to get our (FULL) daily reports emailed to you!

Crude Oil (April)

Yesterday’s close: Settled at 77/05. Up 1.37

Fundamentals: Crude Oil is bleeding higher, underpinned by record U.S. Exports on yesterday’s weekly EIA inventory report. In December, the spread between WTI and Brent was below $4. Today, the spread is above $6. The relatively cheaper WTI versus Brent is a tailwind for U.S. Exports. The steady buoyancy for Crude has also diverged from the broader risk environment this week and Russian Exports are the elephant in the room. As the price climbs, we find technical landscape to be critical.

Technicals: Price action is trying to achieve its third straight day in the positive as it closes in on a critical area of resistance. First, the strength coming out of the European open has lifted Crude decisively above our momentum indicator, denoted as first key support below, and while above here it supports a continued buoyancy. As price has risen, it is closing in on major three-star resistance at … Click here to get our (FULL) daily reports emailed to you!

Gold (April) / Silver (May)

Gold, yesterday’s close: Settled at 1845.4, up 8.7

Silver, yesterday’s close: Settled at 21.095, up 0.024

Fundamentals: Gold and Silver have been under pressure from yesterday’s high due to climbing yields. The U.S. 10-year yield is now out above 4% and the 2-year is at the highest levels since July 2007. To make the path more difficult, we are seeing broad U.S. Dollar strength. Although hot inflation data out of the Eurozone underpins the yield story and should lift the Euro, it is also seen as drastically slowing European growth as the ECB attempts to cool the rising prices. Gold turned up on Tuesday, and steady day today would exude there is more under the hood than just a dead cat bounce.

Technicals: Price action hit a clear wall early yesterday, and the next two sessions will be crucial for a weekly close. Although Gold finds itself lower there are several levels of support for it to lean on. First, it is battling at our Pivot and point of balance, detailed below. We do see first key support at 1836.5, and ultimately do not want to see a break below 1831.6. As for Silver, it too stalled at major three-star resistance and now faces a battle at … Click here to get our (FULL) daily reports emailed to you!

—

Originally Posted March 2, 2023 – Inflation, Labor Costs, and Flying Hawks

Disclosure: Blue Line Futures

Futures trading involves substantial risk of loss and may not be suitable for all investors. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results. The information contained within is not to be construed as a recommendation of any investment product or service.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Blue Line Futures and is being posted with its permission. The views expressed in this material are solely those of the author and/or Blue Line Futures and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.