The news flow about inflation keeps intensifying this week. All of our research analysts heard companies talk about pushing through price increases to overcome cost increases related to global supply chain disruptions. The fixed income market reacted sharply to increased inflation expectations and by the end of the week, the market had priced in two rate hikes by the end of 2022.

One would think that such a sharp increase in rates should a) result in lower bond prices and b) increase concern of an outcome where the Fed has to modify its intended policy path. This could create outflows and sharply negative returns in fixed income products like corporate bonds.

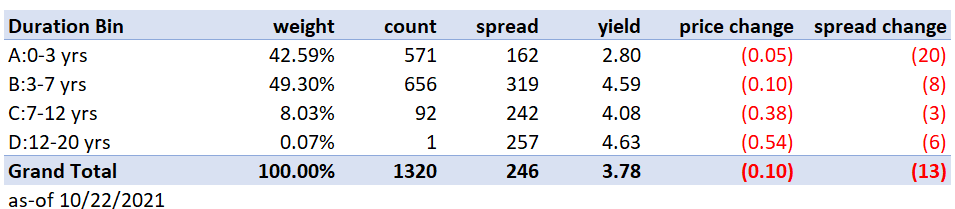

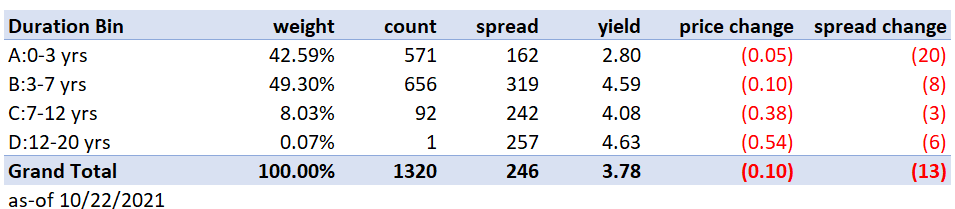

We looked at the bond portfolio underlying the HYG ETF (a proxy for the US high yield credit market) and found the weekly changes in price and spreads to be very modest. In fact, spreads, which are ostensibly a barometer of credit risk, actually tightened.

Source: Aperture Investors LLC, Bloomberg

Spreads tightened more in the short end of the curve – almost perfectly compensating for the move wider and flatter in the treasury yield curve. The credit markets seem to be telling the macro community that it is business as usual and that risky asset investors are not too fussed about the Fed losing control of the narrative as the macro/rates markets. So who is going to be proved correct in the next 3 to 6 months?

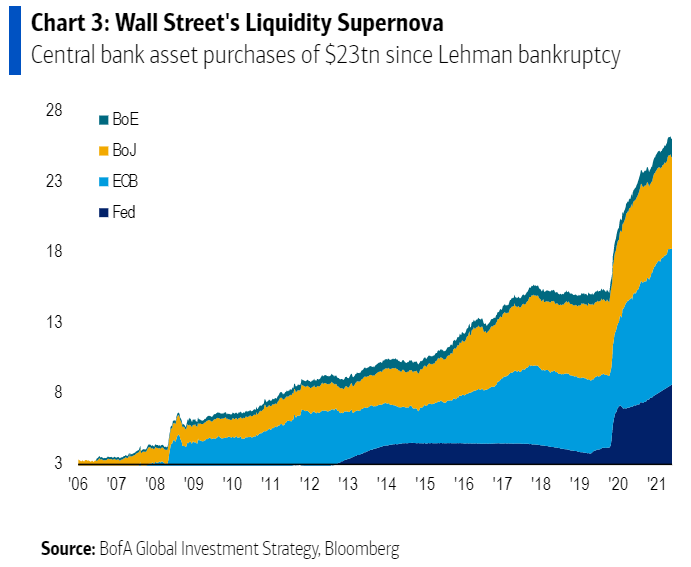

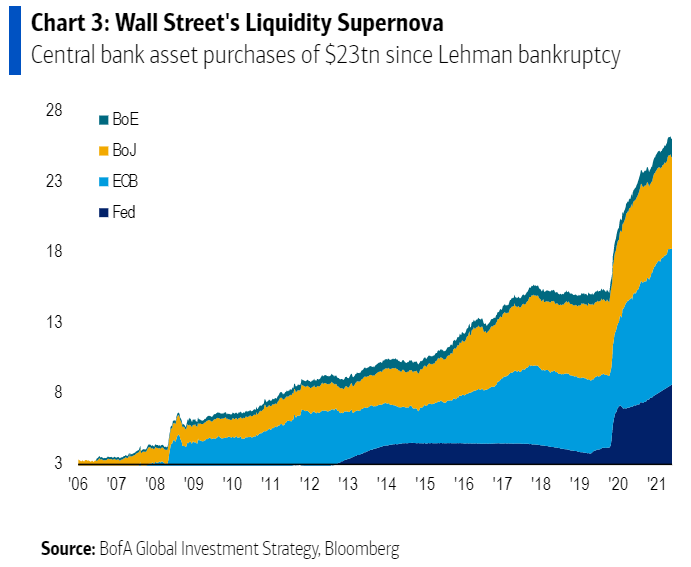

For now, there is an incredible amount of liquidity still in the system and there is a lot of cash on the sidelines to dampen the effect of rates adjusting to these new levels.

Absorbing such a sharp widening in rates last week should be quite reassuring for credit investors, but it is undeniably the case that we are approaching the end of the spread compression. 2022 promises to be a more trendless volatility regime for credit investors than the post-COVID-19 period has been.

—

Originally Posted on October 26, 2021 – Inflation vs. Liquidity

Disclosure: Aperture Investors

This information does not constitute an offer to sell, or a solicitation of an offer to purchase Aperture Investors investment products or services. Any view expressed by Aperture or its employees are for information purposes only and should not be considered investment advice or a recommendation to invest in any security or to adopt any investment strategy.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Aperture Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or Aperture Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)