A significant increase in layoffs and a renewed run on deposits at PacWest Bancorp are triggering a broad equity market selloff this morning. At the same time, this morning’s Producer Price Index (PPI) release depicting slowing headline inflation but persistent services price increases has failed to boost investor sentiment.

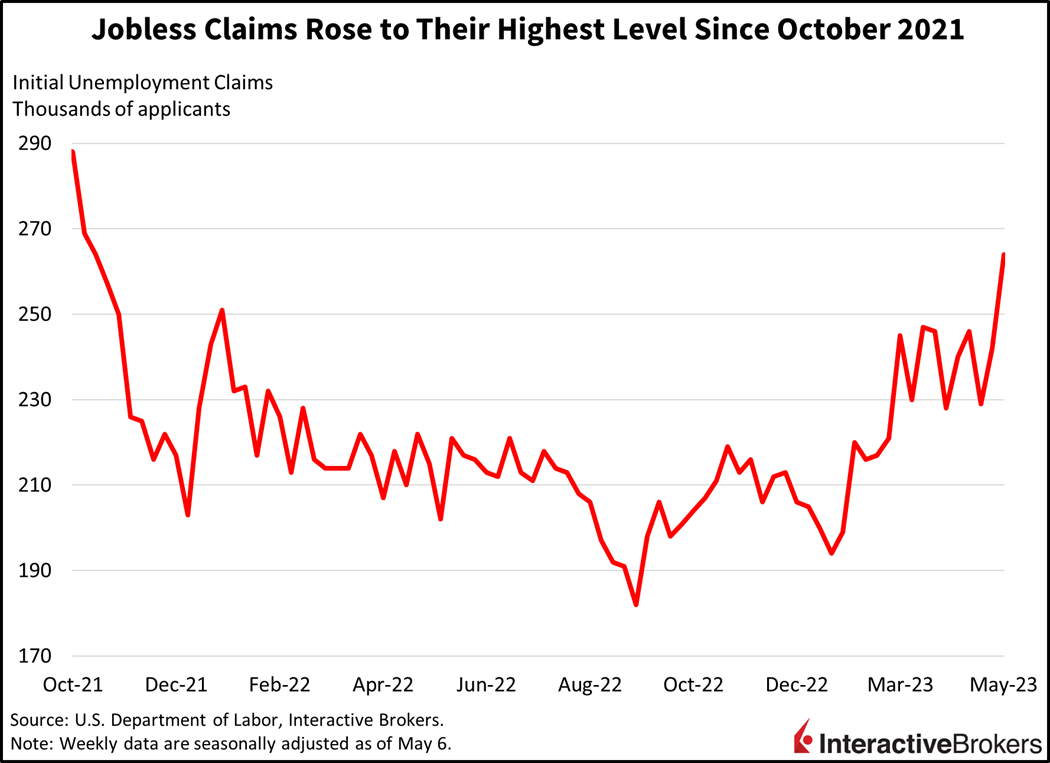

As companies look to sustain profit margins amidst a looming recession, initial unemployment claims rose sharply to 264,000 for the week ended May 6. It was the highest level in nineteen months and above the 245,000 consensus expectation. The number of weekly layoffs surpassed the previous week’s level of 242,000. Continuing claims have also been rising, hitting 1.813 million for the week ended April 29 and up from 1.801 million during the preceding week.

Investors this morning are also assessing news that PacWest’s deposits recently declined 9.5% after the troubled bank said it is exploring options such as selling assets. PacWest has also pledged more assets to the Federal Reserve to shore up its borrowing capacity. The shares are down more than 40% this month and the latest disturbing news from PacWest pulled down share prices of other regional banks such as Western Alliance Bancorp, KeyCorp and Zions Bancorp between 2.4% and 8% as investors fear that banking troubles may spread to other financial institutions.

Today’s PPI data failed to support sentiment the way yesterday’s Consumer Price Index did. The PPI shows that wholesale prices rose 0.2% month-over-month (m/m) and 2.3% year-over-year (y/y) during April, lighter than expectations calling for 0.3% and 2.4% increases, respectively. The core PPI, which excludes food, energy and trade, rose 0.2% m/m and 2.3% y/y, the former coming in as expected while the latter came in lighter by a tenth of a percent. Throughout this economic cycle, inflation for services has been persistent and the PPI index shows this trend is continuing, with the services category propelling wholesale prices up the most during the period while goods moved up to a lesser degree.

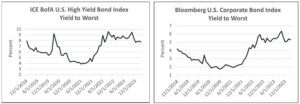

Those same fears of recession are weighing on bond yields and supporting calls for a Fed pause while helping to minimize the impact of the market selloff on the interest-rate sensitive Nasdaq Composite Index, which is down only 0.1% while the S&P 500 Index is down 0.6% near an important support level at 4100.

Markets are responding negatively this morning as regional bank concerns alongside a spike in initial unemployment claims overshadow progress on inflation. Cyclical segments of the equity market are underperforming as recession fears mount, with the Dow Jones Industrial Average down 1.1%. Those same fears of recession are weighing on bond yields and supporting calls for a Fed pause while helping to minimize the impact of the market selloff on the interest-rate sensitive Nasdaq Composite Index, which is down only 0.1% while the S&P 500 Index is down 0.6% near an important support level at 4100. While bulls are looking to engineer another massive reversal like the one we experienced yesterday off of the 4100 support level, yields are falling across the curve with the 2- and 10-year maturity yields down 7 basis points (bps) each to 3.82% and 3.37%, respectively. The 1-month yield is unchanged, however, as bond investors look ahead to risks regarding the debt ceiling in June. Lower yields in Asia on the back of slower-than-expected inflation data from China are pushing the dollar higher, with the Dollar Index up 64 bps to 102.12. Recession risks and fears of a global economic slowdown are weighing on energy markets amidst an uncertain demand outlook with WTI crude oil declining 2.3% to $70.91 per barrel. Weaker data from China and rising layoffs in the U.S. are to blame.

Corporations, meanwhile, are continuing to report strong demand for certain forms of entertainment as spending on consumer goods weakens. The following earnings results illustrate this trend:

- The Walt Disney Company reported diluted earnings per share (EPS) of $0.93, down from $1.08 in the year-ago quarter and below consensus expectations of $0.94. Its revenues, however, climbed 13% to $21.8 billion and met consensus expectations. The results reflect consumers’ pent up demand for out-of-home entertainment after sheltering in place to mitigate the impact of Covid-19. With more individuals venturing out for entertainment, Disney’s parks, experiences and products revenue of $7.78 billion exceeded the consensus expectation of $7.67 billion. The company’s parks generated operating income of $2.17 billion, exceeding the expected operating income $2.14 billion and up from $1.76 billion in the year ago quarter. In comparison, subscribers for Disney’s streaming services fell from 161 million at the end of 2022 to 158.8 million, failing to meet the consensus expectation of 163.1 million as consumers have become more cost conscious at a time when the entertainment company raised its fees.

- MasterCraft Boat Holdings, which is a boat manufacturer, posted adjusted EPS of $1.36 for its fiscal third quarter, matching the results of the year-ago quarter and exceeding the consensus estimate of $1.04. While the results were unchanged y/y, the company’s year-ago quarter was a record high for third-quarter earnings. Revenues of $166.8 million fell from $186.8 million y/y but exceeded the consensus expectation of $158.4 million, and the company’s unit sales of 1,656 declined from 1,784 in the year-ago quarter. MasterCraft says consumer demand is returning to more historical levels. The company’s guidance of fiscal-year 2023 EPS of $5.05 and revenue of $656 million exceeded the consensus expectation of $4.56 and $632 million, respectively.

- Reynolds Consumer Products, which provides household products including Reynolds aluminum foil and Hefty branded items, generated adjusted EPS of $0.08, meeting the consensus expectation but declining substantially from the EPS of $0.25 in the first quarter of 2022. Its quarterly revenue of $852 million exceeded the consensus estimate of $846.4 million and was up from $818 million in the year-ago quarter. The company’s results reflect various broad themes within the economy. For example, its revenues were supported by higher prices, which helped offset the impact of a 2% decline in unit sales. The company also reported increased costs for materials, advertising and labor. Its net income was also hurt by higher interest rates.

Markets are rotating from watching the Fed and inflation to focusing on the impact of previous rate hikes amidst continued quantitative tightening. Today’s news of regional bank stress and rising layoffs illustrates the painful results of the Fed’s inflation quarrel. As monetary policy operates with long and variable lags and pandemic savings dwindle, increased economic turbulence will be felt throughout the year as we descend into a likely recession in the second half. A debacle on the debt-ceiling issue may serve as a black swan event, thereby sparking a recession during this quarter rather than later in the year.

Visit Traders’ Academy to Learn about Initial Unemployment Claims and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.