There is an interesting divide between interest rate policies in the US versus those in the rest of the world. While the US Federal Reserve continues to hike rates, the other major international banks are doing what seems like the opposite:

- Bank of England goes back into quantitative easing

- ECB continues to buy bonds of weaker members

- People’s Bank of China keeping rates unchanged

- Bank of Japan continues to cap its 10-year bond yield near 0%

On October 3, in an unprecedented move, the U.N. called on the US Federal Reserve to halt interest rate increases, arguing that higher rates would “cut off growth” and make “life much harder for heavily indebted firms, households, and governments”. Throughout 2022, the US Federal Reserve has steadily increased interest rates, strengthening the dollar and making it more expensive to borrow dollars, in an attempt to tame decades high inflation.

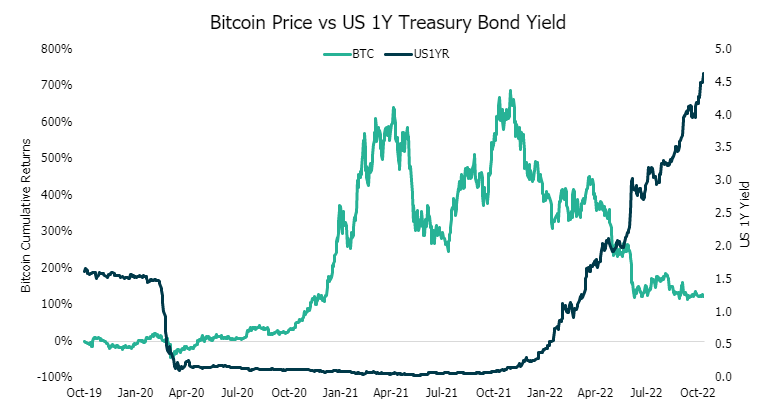

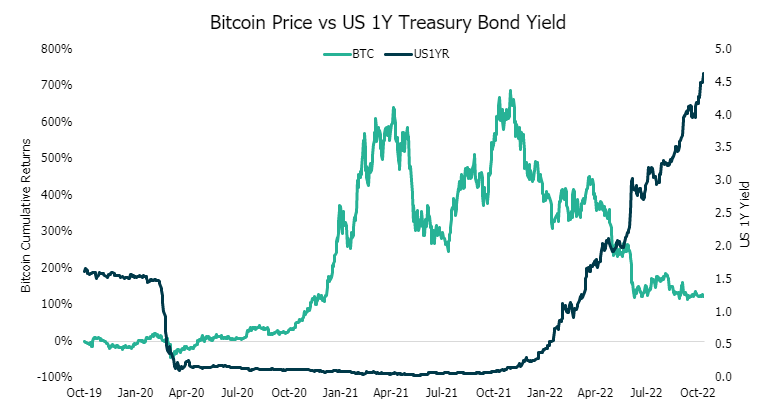

The very policies being employed to reduce inflation and slow economic growth could result in a liquidity crisis, which could force the Fed to reverse course. Changing interest rates impacts the yield of US Treasury (UST) bonds, increasing volatility and constraining secondary market liquidity. During March 2020 when the stock market crashed due to the onset of the Covid-19 pandemic, mutual funds, foreign official agencies, and hedge funds were among those with urgent liquidity needs, forcing the Fed to buy $1T of Treasuries.1 The monetary policy employed by the Federal Reserve to fight inflation has created a liquidity crisis similar to 2020, leaving many wondering if or when the Fed will pivot to avoid damaging the economy.

Source: Bloomberg as of 10/15/2022

A liquidity crisis of the magnitude seen in 2020 may not be so bad for crypto investors hoping for another bull market. If the Fed is forced to pivot by lowering interest rates, we may see an uptick in spending, particularly in risk assets. The ~2 year period of low interest rates using 1 Year USTs as proxy was a catalyst for the price of Bitcoin and other crypto assets reaching new all-time highs. The challenge is knowing when the Fed will pivot.

Source: TradingView. Past performance is not indicative of future results.

On-Chain Privacy by Choice

On-chain privacy applications may in fact be one of the most underrated categories of crypto. The proliferation of the internet created new opportunities for tech companies to collect data on user behavior to provide the best possible product – and they have been extremely successful doing so. For example, the TikTok algorithm uses artificial intelligence (AI) to analyze engagement and understand what types of content a user enjoys. It then begins to test the users with new types of content to expand its understanding of what the user enjoys to keep them engaged. As a result, TikTok creates detailed psychological profiles of their users in addition to collecting personal information. Apple launched a feature in 2021 to prevent apps from tracking user activity across other apps, with Facebook blaming the feature for a $10 billion revenue loss.

Crypto is no exception to data collection, despite blockchains like Bitcoin and Ethereum being pseudonymous databases. Pseudonymous means that on-chain activity is anonymous until a wallet address is tied to someone’s identity. As the ecosystem of crypto applications and services grows, the amount of user data generated will become increasingly valuable, especially from sources who can tie addresses to identities with reasonable certainty.

User data is crucial to a business for building the best possible product. However, as we’ve seen with traditional tech, the line between improving user experience and an invasion of privacy may often require a delicate balancing act. Solutions to these issues exist both in the form of privacy-enabled blockchains like Zcash (ZEC), but also applications like RailGun which offer privacy for users on Ethereum.

Privacy-enabled blockchains like Zcash offer users a way to hold secure value without exposing their balance through shielded and unshielded transactions. Unshielded transactions are pseudonymous and transparent, while shielded transactions remain confidential while allowing people to selectively share address and transaction information for auditing or regulatory compliance. RailGun offers users privacy for transacting on Ethereum Decentralized Exchanges (DEXs) like Uniswap. Using RailGun, a user can execute trades obfuscated on-chain and export a decoded transcript for tax reporting purposes.

The common theme between the two solutions is privacy by choice. In daily life, a person looking for financial privacy can make purchases in cash. Privacy by choice solutions aim to offer a similar luxury for the crypto ecosystem.

First Month Post-Ethereum Merge Statistics

Despite modest on-chain activity compared to 2021, Ethereum is bordering on becoming a deflationary asset. The Merge reduced the amount of ETH entering circulation by ~98% over the past month, creating approximately 7,200 2 ($9.4m) ETH. Under Proof of Work, the total supply would have increased significantly more with over 390,000 3 ETH ($507m) entering circulation.

Due to difficult macroeconomic conditions, price has not been the best indicator of network health. More than 500k ETH have been staked since September 15 4, increasing the total staked ETH to over 14.2 million, or 11.6% of the total supply. Despite waning interest in NFTs and DeFi from the market peak in November 2021, activity is still strong with the active smart contract addresses on Ethereum more than doubling since October 9 5. Additionally, the amount of ETH locked in smart contracts is also beginning to increase, crossing above 30 million Ether on October 1. 6

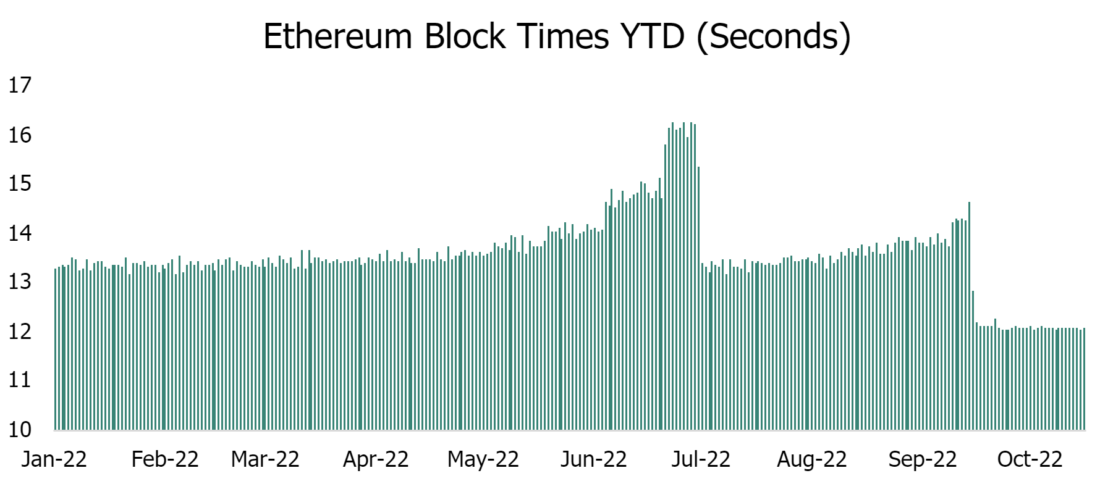

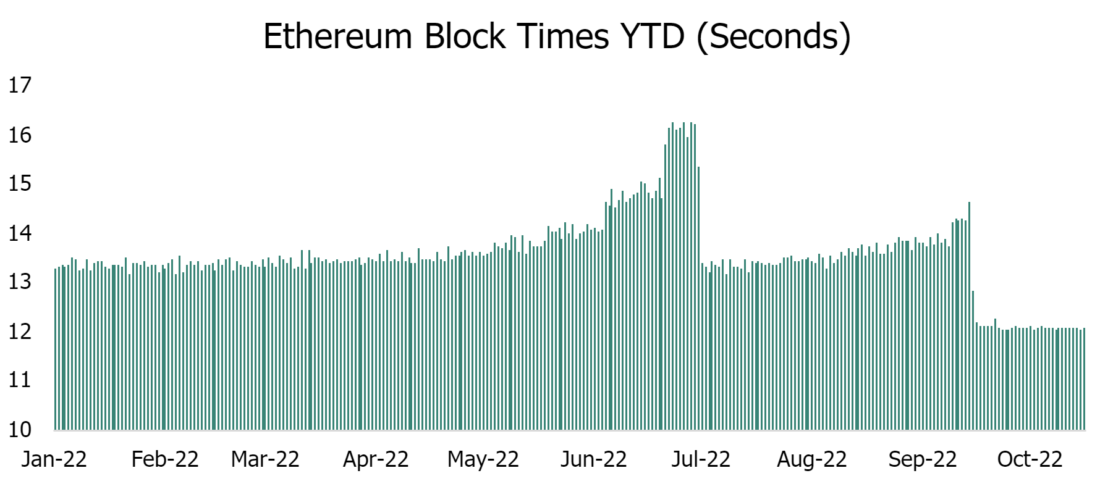

Unexpectedly, the Merge improved the consistency of Ethereum’s block production. Block times have smoothed to a consistent ~12.05 seconds per block, which previously varied by ~30 seconds even under stable network conditions.

Source: Coin Metrics as of 1/1/2022 to 10/16/2022

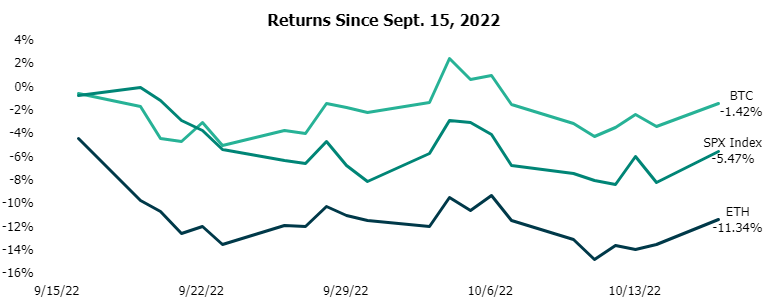

Rising interest rates and high inflation have continued to weigh on the price of ETH, Bitcoin, and other risk assets using the S&P 500 Index 7 as proxy. Coming off of the Merge hype, ETH fared the worst, down ~11% 8 in the past month. Bitcoin, however, was the top performer, losing ~2.5% 9 vs 7.5% 10 for the S&P 500 Index, indicating a possible “flight to quality” within the crypto space. The potential price impact of the Merge will likely take time to manifest, especially given the difficult macroeconomic environment. For comparison, Bitcoin halvings reduce the inflation rate by 50% and historically have resulted in an increase in Bitcoin’s price by an order of magnitude in the 12-18 months that follow.

Source: TradingView

It’s important to note that the transition to Proof of Stake is also not fully complete. Ethereum still needs to undergo a number of upgrades to enable unstaking. Stakers have been earning unrealized rewards since December 2020; however, liquid staking solutions like Lido Staked ETH (stETH), RocketPool (rETH), and Coinbase ETH (cbETH), have enabled investors to liquidate their staked positions. This means there may not be as many investors looking to unstake and sell as soon as it is enabled. Once enabled, unstaking may spark a wave of users looking to stake their long ETH exposure.

Distress & Opportunities in Bitcoin Mining

In today’s market, higher hash rate and decreasing Bitcoin prices have led to lower revenues and profitability for miners. Leveraged miners have begun to face financial challenges due to shrinking profitability, which could persist well into 2023. We believe this may provide opportunities to purchase equipment as miners liquidate assets in order to meet debt obligations.

Historical Context and Phases of the Mining Cycle

Bitcoin mining has historically been cyclical with four phases. 11 Each phase has distinct price trends, impacts mining hardware supply & demand, and generates varying sentiment across the mining industry. Profitability of Bitcoin mining has historically followed a four phase cycle based on the price and hash rate 12. The four phases are:

- Rising Bull Market: The price of Bitcoin rises faster than hash rate grows

- Mining Gold Rush: Hash rate growth increases, while Bitcoin price continues to rise

- Inventory Flush: The price of Bitcoin drops, while hash rate continues to grow

- Shakeout: Hash rate and Bitcoin price both fall

To date, investment success in the mining ecosystem has varied depending upon which stage of the cycle capital is deployed in. Historically, deploying capital in a “Shakeout” phase and exiting in a “Mining Gold Rush” phase is most profitable. Conversely, deploying capital in a “Mining Gold Rush” phase is historically the least profitable, as this becomes an overcrowded and expensive investment. The below chart illustrates the historical revenue in each of the four phases through May 2022.

Mining Machine Revenue ($/mWh

Source: CoinMetrics, Glassnode, Anicca Research, Foundry Research. Past performance is not indicative of future results.

—

Originally Posted October 21, 2022 – Market Commentary

1https://www.bis.org/publ/work966.htm

2Ultrasound.money as of 10/16/2022

3Ultrasound.money as of 10/16/2022

4Source: Nansen

5Source: Coin Metrics

6Source: Coin Metrics

7The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States

8TradingView as of 9/16/2022 – 10/16/2022

9TradingView as of 9/16/2022 – 10/16/2022

10TradingView as of 9/16/2022 – 10/16/2022

11https://www.aniccaresearch.tech/blog/the-alchemy-of-hashpower-part-ii

12Hash rate is the combined measure of all miners’ computational power used to mine BTC, measured in hashes per second. The higher the hash rate, the higher the combined computing power of all miners at a given time.

13As defined by Rule 506 of Regulation D under the Securities Act of 1933. To qualify as an accredited investor, an individual must earn more than $200,000 a year (or $300,000 per year with a spouse or spousal equivalent), have a net worth over $1 million either alone or together with a spouse or spousal equivalent, excluding their primary residence, or hold in good standing their Series 7, Series 65, or Series 82 professional certifications. Entities must have $5 million in liquid assets or all beneficial owners must be Accredited Investors.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Grayscale and is being posted with its permission. The views expressed in this material are solely those of the author and/or Grayscale and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.