Investors flocked to safe-haven assets this morning in response to Deutsche Bank, which sparked renewed jitters about banking instability, while fears about both the U.S. economy and corporate earnings strengthened.

Shares of Deutsche Bank dropped more than 14% in response to the price of credit default swaps jumping from 142 basis points (bps) to more than 173 bps overnight. Credit default swaps serve to protect the bank’s bond holders from a possible default. The increased costs of default protection sent Deutsche shares down for the third consecutive day, resulting in the securities losing nearly a fifth of their value. The turmoil occurred despite European Central Bank (ECB) leader Christine Lagarde’s comments that European banks have strong capital and liquidity, but if issues arise, the ECB is prepared to provide liquidity.

Concerns about Deutsche Bank intensified existing banking fears, causing equities for U.S. regional banks such as PacWest Bancorp, Western Alliance Bancorp and KeyCorp to drop at least 3% during morning trading before recovering. Shares of First Republic Bank, which is in the process of being shored up by a group of banks under the leadership of JP Morgan Chase CEO Jamie Dimon, fell more than 6%. The banking turmoil occurs as UBS is acquiring failed Credit Suisse, and U.S. regulators are assessing the failures of Silicon Valley Bank and Signature Bank.

Bond yields are continuing to plunge led by expectations that the Fed is done hiking. Odds are favoring rate cuts as early as June, as the disinflationary effects of credit contagion stall economic activity.

Bond yields are continuing to plunge led by expectations that the Fed is done hiking. Odds are favoring rate cuts as early as June, as the disinflationary effects of credit contagion stall economic activity. The 2-year Treasury yield is down 10 bps and is roughly 140 bps lower than its cycle high reached earlier this month. The Dollar Index is up 0.6%, however, as trouble at European banks pull the euro down 0.7% versus the dollar. Banking contagion fears are also weighing on oil demand forecasts and the inflationary outlook, bringing WTI crude oil down 2% to $68.56 per barrel and the 10-year Treasury yield down 5 bps to 3.35%. The S&P 500 Index is down 0.2% after being down 1% earlier in the session.

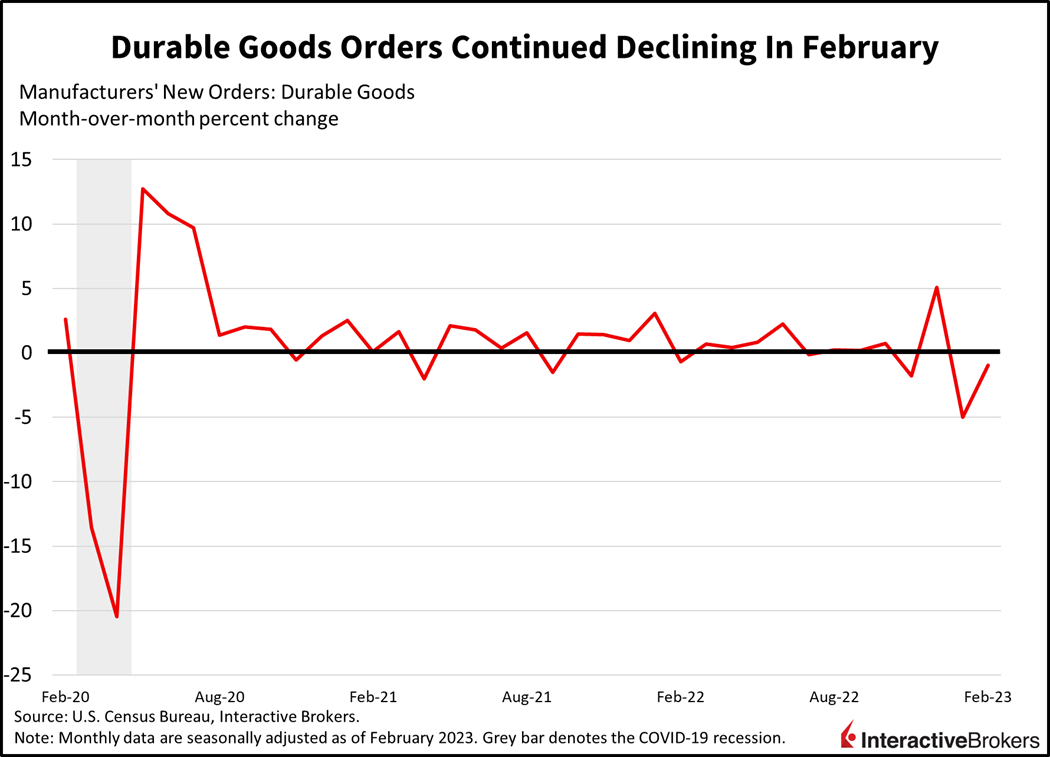

Investors today are also assessing new data showing the manufacturing sector is continuing to weaken as higher rates take their toll. Durable goods orders fell 1% in February versus the 0.6% growth expected by analysts, a slower rate of decline relative to January’s -5%, however. Transportation equipment weighed on the headline figure with defense and nondefense aircrafts notching significant declines in orders of 11.6% and 6.6%. Computer and automobile orders also weighed on results, falling 2.7% and 0.9% during the period. Core capital goods orders offset some weakness, gaining 0.2% on the month and slowing from the 0.3% rate of growth experienced in January.

Today’s Flash PMI data from S&P Global reflect further March weakness, with the manufacturing sector remaining in contraction territory for the fifth consecutive month. March’s reading of 49.3 was a five-month high, however, as the rate of decline in the manufacturing sector is slowing. The service sector, however, remained red hot, reaching an 11-month high of 53.8. Demand for services and for employees remained strong, driving continued price pressure in the sector. Flash PMIs for both manufacturing and services beat consensus expectations handsomely, with analysts expecting 47 for the former and 50.5 for the latter.

Investors are also grappling with anticipated declines in U.S. corporate earnings as higher interest rates dampen economic activity. At the end of 2022, analysts expected first quarter year-over-year earnings to decline 0.3%. However, the earnings picture has worsened significantly and as of late last week, analysts expected first quarter earnings to decline 6.1%, according to FactSet. The 6.1% decline would be the largest decline since the second quarter of 2020 when the Covid-19 pandemic was at its depth. Materials, Health Care, Communication Services, and Information Technology sectors are expected to experience the largest earnings declines while Consumer Discretionary, Industrials and Energy sectors are expected to have the largest gains. Earnings are also expected to decline in the second quarter, but turn positive in the third quarter–a rosy outlook that will likely fail to materialize if a recession arrives in the second half of the year.

Visit Traders’ Academy to Learn More about the PMI-Manufacturing, Corporate Earnings and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.