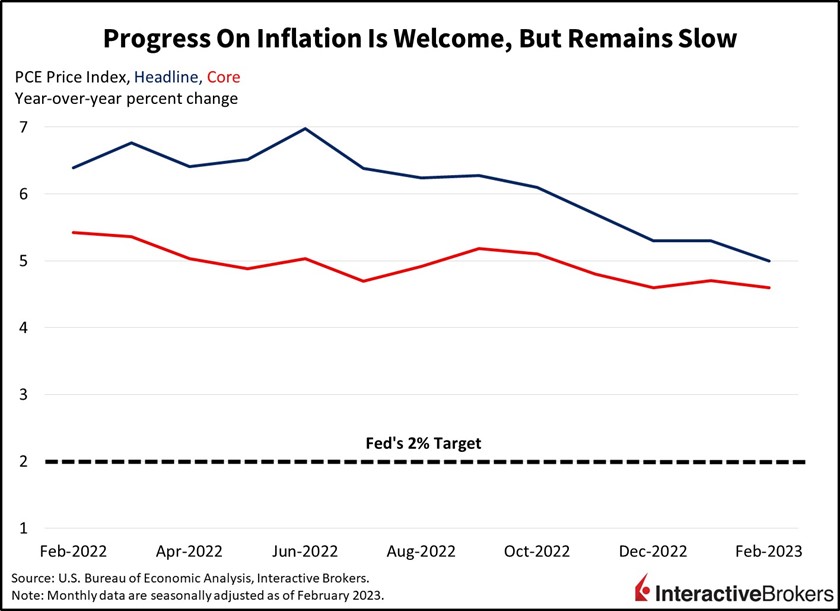

This morning’s Personal Consumption Expenditures (PCE) Price Index came in lower than expected, giving the Federal Reserve a bit of wiggle room in its difficult position of curtailing inflation while maintaining banking stability. Nevertheless, the PCE report shows the Fed still needs to do more work to fight inflation.

For February, the headline and core month-over-month (m/m) PCE inflation numbers of 0.3% were better than the analysts’ consensus expectations of 0.4%, indicating that disinflation is continuing after a setback for core disinflation in January. Both February numbers are an improvement from January’s headline and core numbers of 0.6% and 0.5%. On a year-over-year (y/y basis), the headline and core PCE for February climbed 5% and 4.6%, also better than the prior month’s 5.3% and 4.7%.

While the headline and core numbers are declining, this morning’s PCE data shows that one of the Fed’s greatest challenges—persistent inflation in the services sector—is weakening. In February, the services component of the PCE climbed 0.3% m/m compared to 0.6% in January. Consistent with declining services prices was a notable decline in consumer spending during the month, with personal spending growing only 0.2% on the month, a lot slower than the prior periods 2% increase. The cooling of both spending and services prices are likely occurring as the economy digests 475 basis points of tightening from the Fed while the labor market cools, albeit at a snail’s pace.

Markets are cheering the news of weaker inflation, largely ignoring the slower spending numbers as we finish off the quarter. The S&P 500 and NASDAQ Indices are up 0.6% and 0.8%, respectively, while bond yields are relatively unchanged. The Dollar Index is up 0.3% to 102.47 and WTI crude oil is recovering a lot of lost ground, climbing 0.6% to $75 as traders shrug off economic slowdown concerns.

The modest decline in the PCE comes as investors wade through somewhat conflicting economic developments, including the Fed’s efforts to fight inflation while maintaining sufficient liquidity to prevent further banking instability in the aftermath of Signature Bank and Silicon Valley Bank failures and the ongoing bailout of First Republic Bank.

The Fed Balance Sheet Contracts for the First Time in Four Weeks

After allowing its balance sheet to decline to a low of $8.34 trillion as of the start of March, the Fed abruptly began increasing its assets to support the banking sector through its new Bank Term Funding Program. The Fed’s balance sheet reached $8.73 trillion as of March 22. The Fed subsequently reduced the balance sheet to $8.71 trillion as of Wednesday. The expanded balance sheet, along with leaders from the Fed, the U.S. Treasury and the FDIC maintaining that the bank sector is strong, appears to have helped calm overall fears about a potential banking contagion.

Meanwhile, recent earnings reports depict the continuing trend of strong demand for entertainment and traveling amid a glut of consumer goods. The strong demand for travel and entertainment is likely to make it hard for the Fed to curtail inflation in the non-housing services sector. Earnings reports from Dave & Busters and Carnival Corp. illustrate consumers’ strong demand for travel and entertainment while Micron’s earnings report illustrates the inventory overhang in consumer goods.

- Dave & Buster’s, which operates full-service restaurants with video arcades and other entertainment venues, announced strong fourth quarter results, but said its quarter-to-date (qtd) same-store sales for the period started January 30 have been flat relative to a year ago. However, CFO Michael Quartieri added that the year-ago period is a tough comparable because reopening of the economy fueled unusually strong demand for entertainment. He added that the current qtd results relative to the same period in 2019 have been strong. The company’s fiscal fourth quarter revenues of $563.8 million exceeded the consensus expectation of $537 million. In the prior-year quarter, the company reported revenues of $343.1 million. The company also approved a $100 million stock buyback, which it says is an indication of its confidence in its future results.

- Cruise ship operator Carnival Corp. also posted encouraging results, achieving an all-time record for booking volume in its fiscal first quarter. The company believes consumers with higher incomes haven’t been deterred by inflation. However, the company said it expects to continue operating at a loss because of high fuel costs and a strong U.S. dollar.

- Micron, which makes memory chips, posted an adjusted loss per share of $1.91 for its fiscal quarter ended March 2, its largest loss ever and much worse than the analyst expectation of 67 cents. For the same period last year, the company generated $2.14 in earnings per share. For the most recent reporting period, Micron took a $1.43 billion inventory write-down. It expects to take another inventory write-down of approximately $500 million in its current quarter and anticipates a current quarter adjusted loss of $1.58 per share. Micron Chief Executive Sanjay Mehrotra explained that challenges for the memory chip sector will continue in the coming months even though the supply-demand balance is slowly improving as certain customer segments drawdown inventory.

Today’s subdued inflation readings arrive at the expense of slowing consumer spending, which makes up roughly 70% of the economy and drives a large portion of corporate revenues. With earnings estimates continuing to soften, the latest equity rally appears to be running out of gas with valuations at around 19 times earnings, which hardly accounts for financial stability risks, potential labor market softness, or any turbulence whatsoever.

Today’s subdued inflation readings arrive at the expense of slowing consumer spending, which makes up roughly 70% of the economy and drives a large portion of corporate revenues. With earnings estimates continuing to soften, the latest equity rally appears to be running out of gas with valuations at around 19 times earnings, which hardly accounts for financial stability risks, potential labor market softness, or any turbulence whatsoever. As rates remain above trend and with odds of 54% favoring the Fed raising another 25 bps in May, markets appear vulnerable at this juncture.

Visit Traders’ Academy to Learn More about the Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.