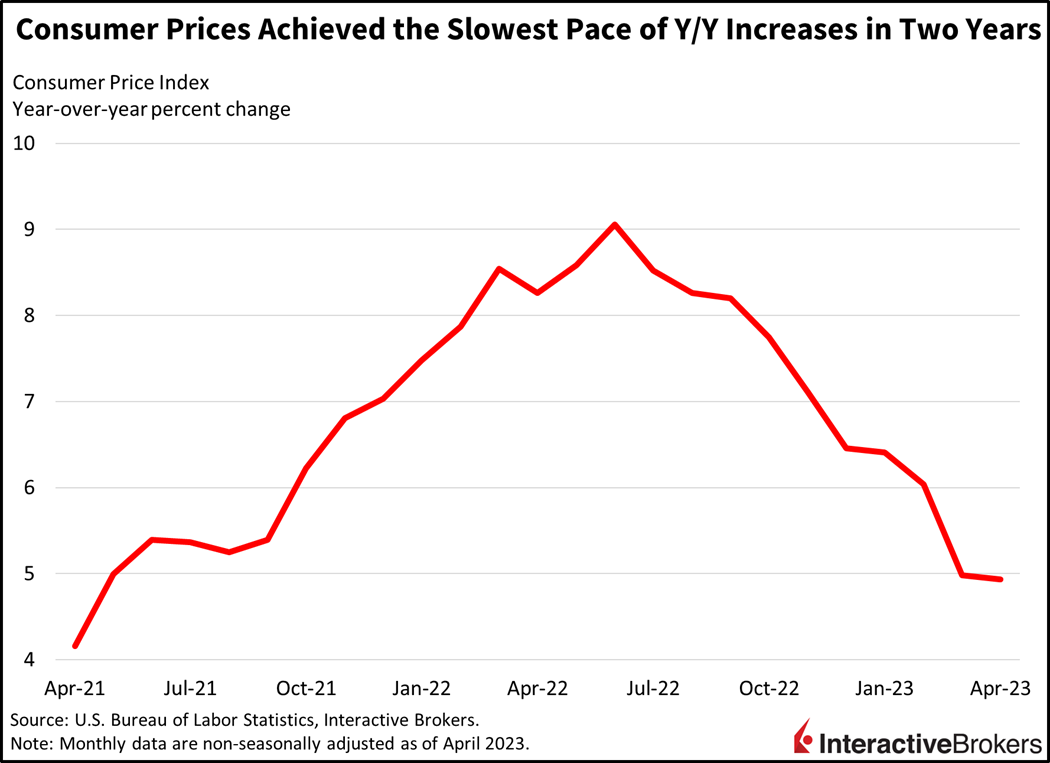

Markets are advancing this morning in response to the Consumer Price Index (CPI) matching investors’ expectations for slowing inflation, but the optimism is occurring as the White House and Republican leaders in congress appear deadlocked in the debate over raising the debt ceiling, fueling fears that the country may default on its debt as it runs out of funds in early June.

This morning’s CPI Report for April was elevated and hotter than the previous month’s. Both the overall and core month-over-month (m/m) price increases came in at 0.4%, exactly as expected by the consensus. The overall figure was much hotter than March’s 0.1% increase while core prices rose at the same 0.4% pace during the period. While short-term measures are still running hot, the headline year-over-year (y/y) rate of change notched its tenth-consecutive month of decline and its lowest increase since April 2021. Headline CPI came in at 4.9% y/y, slightly better than the 5% from March and from expectations of an unchanged pace of increase. Core CPI rose 5.5% y/y, exactly as expected and slightly slower than March’s 5.6% level.

April price pressures were supported heavily by used automobiles, gasoline, medical care commodities, shelter and food away from home with each category climbing 4.4%, 3.0%, 0.5%, 0.4% and 0.4%, respectively. Apparel also contributed to price pressures at the margin. Energy services, such as electricity and heating, transportation services, new automobiles, food at home and medical care services provided modest relief during the month, with prices dropping 1.7%, 0.2%, 0.2%, 0.2% and 0.1%.

Markets are taking the glass half-full approach this morning, focusing on the y/y progress on inflation while dismissing the m/m acceleration. Yields are down across the curve while most equity indexes are solidly in the green. The 2- and 10-year Treasury yields are down 7 basis points (bps) each to 3.95% and 3.45%. The S&P 500 Index catapulted at the open before finding important resistance at around 4150, cooling from a 1% gain to up only 0.2%. The interest rate sensitive Nasdaq Composite Index is leading this morning’s charge. Despite tapping the brakes since the open, it’s up 1%. WTI crude oil is down 1.6% to $72.52 per barrel as unexpected news today of rising U.S. inventories fueled demand concerns, sparking oil’s first down day in four. The dollar is down slightly this morning as inflation trends and NY Fed President John William’s comments at the Economic Club of New York yesterday bolster Fed tightening expectations. Markets continue to price in a cut in September, despite continued hawkish rhetoric from the central bank.

Failing to lift the debt ceiling would result in the U.S. defaulting on its debt, causing a decline in the country’s debt rating and making financing more expensive. It would also result in higher interest rates for both consumers and businesses while causing millions of job losses.

While the CPI is helping alleviate inflation fears, fiscal policy risks are escalating. President Biden and Congressional leaders from both political parties appeared to make no progress yesterday on reaching an agreement for raising the debt ceiling beyond its current $31.4 trillion limit. Fearing that U.S. debt is becoming unsustainable, House Republicans recently passed the Limit, Save, Grow Act of 2023 which would raise the debt ceiling in exchange for restoring discretionary spending to 2022 levels and implementing a 1% annual cap on government spending increases. It would allow deficit spending to increase up until March 31, 2024, but with a $1.5 trillion limit. The bill would also reduce green energy subsidies and eliminate an extra $80 billion for improved tax enforcement. The bill has little chance of passing the Democrat controlled Senate and Biden claims it would reduce funding for law enforcement, border security and veteran benefits, while House Speaker Kevin McCarthy says Republicans will pass a bill to increase veteran benefits. Failing to lift the debt ceiling would result in the U.S. defaulting on its debt, causing a decline in the country’s debt rating and making financing more expensive. It would also result in higher interest rates for both consumers and businesses while causing millions of job losses. A default, furthermore, would also lead to a lack of confidence in the U.S. On a positive note, Congressional leaders say they are hopeful that they can reach an agreement with the White House for increasing the debt limit.

Earnings results continue to show that consumers are splurging on traveling, entertainment and other non-housing services while cutting back on purchasing goods as illustrated by the following examples:

- Airbnb, which facilitates rentals of homes to travelers, generated earnings per share (EPS) of $0.18 compared to the $0.09 loss per share for the year-ago quarter. The results trailed the consensus EPS expectation of $0.20 but it was the first time that the company generated a profit during the first months of a year. Revenue of $1.82 billion exceeded the $1.5 billion in revenue from the first quarter of last year and beat the consensus expectation of $1.79 billion. The company is anticipating a strong summer travel season and expects second-quarter revenues to be between $2.35 billion and $2.45 billion while analysts were anticipating guidance of $2.42 billion. The company cautioned that its second-quarter y/y growth will be challenged by the second quarter of last year having unusually high travel volumes due to pent up demand among consumers following the end of lockdowns intended to mitigate Covid-19. Shares are sinking roughly 10% on the news.

- Six Flags Entertainment, which is the world’s largest regional theme park company, experienced a net loss of $70 million, or $0.84 a share, considerably worse than the $65.7 million loss, or $0.76 a share, in the year-ago quarter but better than the estimated $0.85 loss per share. Despite severe weather in California and Texas reducing attendance in the company’s parks during the first quarter, Six Flags’ revenues grew from $138 million to $142 million y/y as per-capita guest spending increased 7%. Revenues set a record for the company and beat the consensus expectation of $132.6 million. Six Flags’ bigger loss than the year-ago quarter was driven by higher advertising spending. Six Flags’ CEO said special events, such as parades and fireworks, along with improvements to the company’s theme parks have caused sales of seasonal passes to accelerate. Shares are falling approxmately 4% on the news.

- IRobot, which makes robotic vacuum cleaners and other automated equipment, posted a loss of $1.67 a share, much worse than both the analyst expected loss of $1.32 and the year-ago loss of $0.66. Revenue also declined from $292.0 million in the same period last year to $160.3 million. IRobot maintains that the revenue decline resulted, in part, from the company receiving a large order in the year-ago quarter from an e-tailer, which caused muted order volumes in subsequent quarters. Shares are down about 11% on the news.

With the Volatility Index (VIX) down 3.9% to 17 today and the S&P 500 Index maintaining its impressive year-to-date gain of nearly 8%, investors are pricing in calm waters over the next thirty days. Yet, a full economic calendar, including the following, could support market shifts and economic turbulence:

- Producer Price Index scheduled for tomorrow

- A slew of earnings reports scheduled throughout this week

- Consumer Sentiment scheduled for Friday

The shortest end of the yield curve appears worried about debt ceiling talks, but equity markets appear complacent. A continued stalemate in Washington due to a lack of compromise between Democrats and Republicans appears to be the largest threat to markets today. As both parties appear more separate than any time in the past regarding ideology and fiscal policies, the odds of a continued standoff are the highest since 2011.

Visit Traders’ Academy to Learn about the Consumer Price Index and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.