EXECUTIVE SUMMARY

- The short selling of sterling and UK bonds at the end of September was misleadingly attributed to a judgement on the mini Budget of the new UK government.

- In reality it was just a last push on existing and extremely profitable short sales by momentum macro hedge funds (broadly known as CTAs), who have been short most fixed income and most currencies against the $ for months now.

- They have of course also been short equities and as October starts they are certainly taking profits and pausing to see if they can ‘ go again’ in Q4, or perhaps even move onto the long side.

Short Term Uncertainties

The short selling of sterling and UK bonds at the end of September was misleadingly attributed to a judgement on the mini Budget of the new UK government. (See here). In reality it was just a last push on existing and extremely profitable short sales by momentum macro hedge funds (broadly known as CTAs), who have been short most fixed income and most currencies against the $ for months now. They have of course also been short equities and as October starts they are certainly taking profits and pausing to see if they can ‘ go again’ in Q4, or perhaps even move onto the long side. Remember, for all the apparent conviction in the rhetoric, the CTAs are largely agnostic about markets, they are just seeking to generate a combination of volatility and panic sufficient to promote a winning directional trade.

The technicalities that drove the upward crash in 2021 have been working in reverse this year. But they can easily flip again.

It is also worth remembering that the technicals (what we refer to as market mechanics) that led to short squeezes this time last year – helping to drive upward momentum in meme stocks, ARKK, crypto etc, such as illiquidity and short gamma positions by options market makers that forces them to buy rising markets, have been one of the key drivers for the markets this year, albeit in reverse. It is just that, whereas in rising markets an upward crash driven by momentum and fuelled by illiquidity can have widespread participation and everyone is a winner, a more ‘traditional’ downward crash, such as we have seen this year, only really benefits the traders able to go short. No-one knows this better than the traders themselves, which is why they are booking profits and waiting to exploit the next directional move – up or down. Naturally, they have the narrative script to back it up – in either direction! Interesting then to see also that the biggest flows into ETFs at the moment are in things that go short- the SH ETF short S&P has seen its best year of inflows ever apparently. This could be some simple hedging, but equally it might be the classic retail ‘buy at the top sign’.

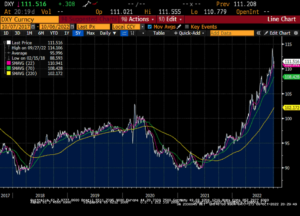

Chart 1: All eyes on the DXY

Source: Bloomberg

Medium Term Risk

The coming month brings into focus two big events that have been somewhat overlooked in all the macro noise; the CCP party congress on October 16th, at which Xi is expected to be appointed in effect ‘leader for life’ and the US Mid term elections. We have long suspected that both the extension of the covid restrictions to keep order and the over-dramatic escalation in cities known to house Xis domestic opponents were competing sides of this ‘run to the finish line’. As such, and assuming that he succeeds (we discussed this here, in all eyes should be on the 20th party congress), we would expect things to ‘move on’.

In particular we would suggest that the CCP will announce plans to move away from a focus on exports and more toward domestic consumption. A key part of this is that with an increasing ability to pay for its energy imports in Rmb, China literally has no need to earn so many $. And certainly not by subsidising US imports with cheap labour and capital. This may lead markets to revisit inflation concerns, after all, if China is going to resume growth – and thus demand – but not resume excess supply to the west, then prices will likely stay elevated. Not necessarily inflation, but certainly no bailout on margins.

Meanwhile, post the mid terms, it will be interesting to see if the US government keeps raiding the Strategic Petroleum Reserve to hold down politically sensitive gas prices. A final, but perhaps the most important point for medium term risk is whether the current ‘lack’ of escalation in Ukraine from the Russian side is due to an agreement not to disrupt Xi’s Party Congress, similar to the perceived delay over the winter Olympics. One thought is that the recent ‘retreats’ actually reflect a withdrawal to the ‘border’ of the Northern Donbass and that the plan, post the referenda and the amendment of the constitution, is to establish all the new borders as a ‘line of defence’ and then argue for a cessation of hostilities. We shall know soon enough.

Many of the medium term risks are emerging from the unwind of bad policies. For example, as the central bank herd turns and runs from the folly of zero interest rates, it is having widespread knock on effects across economies and markets. Most obviously in carry trades, flattened yield curves and margin calls are causing deleveraging at a time that central banks have withdrawn an estimated $3tn in liquidity year to date. The panic in the UK Liability Driven Investment (LDI) market is just one example of this – although relatively easily calmed by the Bank of England doing its job to provide liquidity to a temporarily illiquid market, as we discussed here (LDI, Leveraged and Dangerously Illiquid). It is also having an impact in markets actually rather than accidentally designed to be illiquid, such as the many leveraged ‘alternatives’ that sprang up to meet the low volatility requirements of the risk management industry over the last decade of yield chasing. When rates are 75bp, tying up cash for 7 years is an opportunity cost of around 8%, as is the cost of borrowing cash and playing with the balance sheet. At 3.75%, the cost/opportunity cost is nearer 30%, a different proposition entirely, Indeed, cash is now a genuine asset class again.

We suspect that the volatility turmoil that is currently causing such problems for the medium term risk managers may end up presenting a compelling opportunity for longer-term, unleveraged investors. In particular, the strength of the $ has left a wide variety of non $ assets looking extremely good value to holders of $ cash. This would include residential and commercial property, as well as listed and unlisted corporate debt and equity, where leveraged distressed sellers unable to roll their leverage or meet the new financing rates are likely to offer very attractive ‘in prices’.

Long Term Trends

We remain convinced that the biggest long term trend remains the multi-polar world, not just in terms of geo-political blocs but also in terms of investment blocs. In particular, the consequences of the current actions over Russia and Ukraine are going to reset the Financial and trading system. Already, we see the lines drawn between ‘the West’ which is essentially a $ bloc and ‘the rest’ which is increasingly going for bilateral trade and also evolving some common trade settlement currency. China of course is a prime mover in this, but we believe that they are not looking to replace the US as the Hegemon, they just don’t want to have to ‘kowtow’ to any Hegemon. The confiscation/freezing of Russia’s FX reserves effectively imposed US Foreign Policy as well as US interest Rate policy on the rest of the world, and understandably most are looking to remove that threat. Many are also looking to reduce/remove their dependency on US capital, in the form of either debt or equity – as China has already done. Meanwhile, holders of $s may also be looking to deploy their capital into other regions – specifically Asia. We might not need a Plaza Accord to trigger capital flows out of US financialisation and into non $ ‘real assets’ as we did last time the world talked of ‘King Dollar’, the value proposition and a shift of momentum may do it all by itself.

—

Originally Posted October 6, 2022 – October Market Thinking

Disclosure: Smartkarma

Smartkarma posts and insights are provided for informational purposes only and shall not be construed as or relied upon in any circumstances as professional, targeted financial or investment advice or be considered to form part of any offer for sale, subscription, solicitation or invitation to buy or subscribe for any securities or financial products. Views expressed in third-party articles are those of the authors and do not necessarily represent the views or opinion of Smartkarma.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Smartkarma and is being posted with its permission. The views expressed in this material are solely those of the author and/or Smartkarma and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.