This morning’s weaker-than-expected retail sales data along with Home Depot lowering its revenue guidance and angst about the debt ceiling is sparking a broad selloff in equity markets.

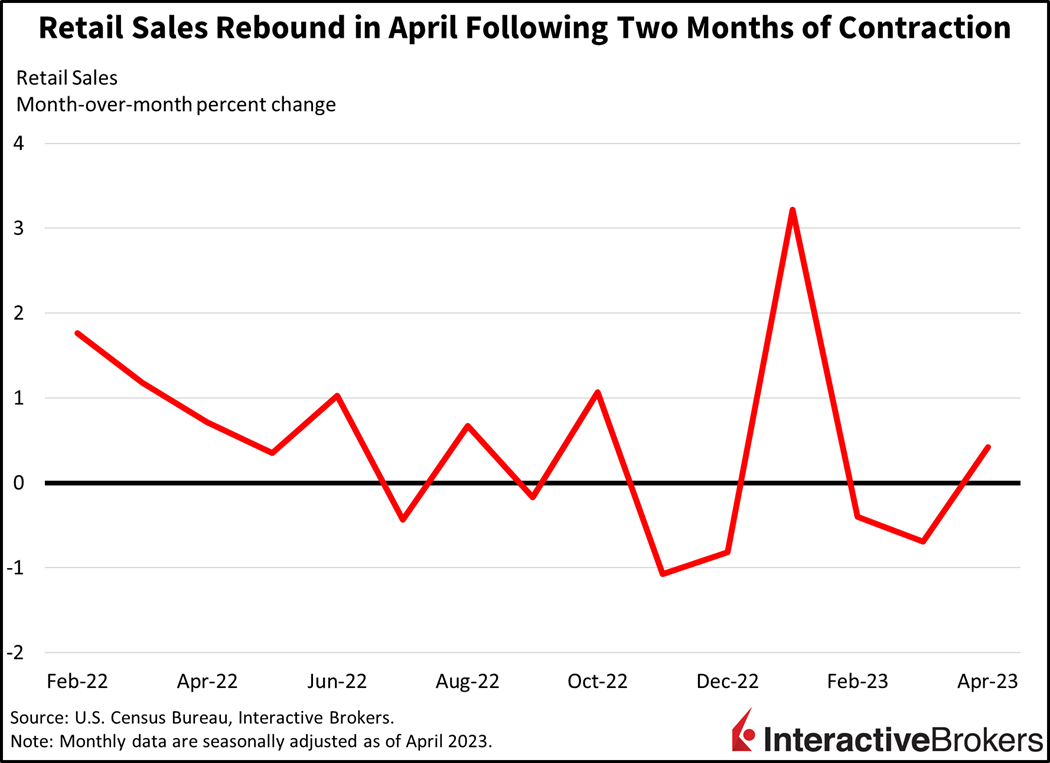

Following two months of weakening consumer spending, the Commerce Department today reported that retail sales rebounded in April, climbing 0.4% month-over-month (m/m), better than the previous month’s 0.7% decline but trailing expectations calling for a 0.8% gain. From an inflationary perspective, April was the first month in three in which retail sales growth matched the corresponding month’s rate of inflation. Retail sales excluding autos came in at 0.4% m/m. With both autos and gas excluded, the rate increased to 0.6%.

Driving the April increases were miscellaneous store retailers, e-commerce destinations, general merchandise suppliers and health and personal care stores with gains of 2.4%, 1.2%, 0.9% and 0.9%, respectively. Contributing more modestly to gains were restaurants and drinking parlors, building materials and garden equipment suppliers, and automobile dealerships and parts shops with gains of 0.6%, 0.5% and 0.4%. Weighing on the headline were establishments supplying sporting goods, gasoline, furniture and home furnishings, electronics and appliances, clothing and food and beverages with declines of 3.3%, 0.8%, 0.7%, 0.5%, 0.3% and 0.2%.

Investors are also anxiously waiting for a resolution in the debt ceiling debate with Republicans pushing for spending reductions and Democrats maintaining that such cuts would have dire economic consequences. Later today, Democratic President Joe Biden and top congressional Republican Kevin McCarthy will attempt to strike a deal to raise the U.S. government’s $31.4 trillion debt ceiling and avert an economically catastrophic default of U.S. debt payments. Time is tight for the two leaders with the U.S. Treasury Department warning that it could run short of money to pay all its bills as soon as June 1, a problem that could not only trigger a default but also spark a recession.

Markets Digest Consumer Spending Data and Debt Ceiling Fears

Markets are reacting cautiously to the confluence of information this morning with all major U.S. stock indexes down. However, the Nasdaq Composite Index, which has led the market year-to-date, is barely down this morning as investors view tech stocks as being less vulnerable to recessions or higher interest rate environments. Cyclical sectors are weighing down the S&P 500 Index, which is down 0.3% while the Russel 2000 and Dow Jones Industrials Average are down 1.3% and 0.6%, respectively. The strength in retail sales excluding gasoline and autos alongside fiscal issues are weighing on bond prices, with yields higher across the curve driven by the shorter-end. The 2-year and 10-year yields are up 12 and 6 basis points (bps), each to 4.11% and 3.57%. Higher yields are pushing up the dollar as well, with the Dollar Index up 24 bps to 102.67. Yesterday’s news of the U.S. Department of Energy’s purchase of 3 million barrels of crude oil for the U.S.’s Strategic Petroleum Reserve (SPR) alongside this morning’s news of the International Energy Agency (IEA) raising its forecast for global oil demand by 200,00 barrels per day (bpd) to an all-time high of 102 million bpd are failing to underpin energy prices, with WTI crude oil down 0.4% to $71.33 per barrel.

Homeowners Cut back on Spending but Secular Growth Continues

Consumer spending is facing a mix of headwinds. Many consumers are tapped out on purchasing goods as partially reflected in this morning’s report, after splurging on home renovations, furnishings and technology during the depths of the pandemic. They have since switched their spending focus to services. At the same time, consumers are struggling with higher costs of living as inflation has spread across the economy. New homeowners, furthermore, are struggling with higher mortgage rates which has weighed significantly on construction activity. Many of those factors contributed to Home Depot lowering its guidance for 2023. Conversely, the secular trend of growing e-commerce and digital payments has allowed Paysafe to maintain its guidance.

Home Depot reported $3.82 earnings per share (EPS) for the first quarter, down from $4.09 a share in the year-ago quarter but above the analyst consensus expectation of $3.80. Its revenues of $37.26 billion, however, missed the consensus expectation of $38.28 billion and declined 4.2% from $38.9 billion in the first quarter of 2022. The company’s same store sales in the U.S. declined 4.6% year-over-year (y/y), with half of the decline attributable to lower lumber prices. Cold weather in the West also hurt sales. Homeowners have also shifted from large projects to smaller projects. Home Depot Chief Financial Officer Richard McPhail had previously cautioned that sales this year would be relatively flat y/y because homeowners had splurged on projects during Covid-19 and consumers have shifted their spending to entertainment and other services. The company now expects overall sales and same store sales to decline as much as 5%, largely due to higher mortgage rates.

Paysafe, which provides a digital payment platform for merchants and consumers, reported adjusted EPS of $0.54, beating the consensus expectation of a $0.01 loss per share but down from $0.62 in the first quarter of last year. Its net income declined 11% largely due to higher interest expenses. After accounting for interest and other expenses as expressed by earnings before interest, taxes, depreciation and amortization (EBITDA), its earnings increased y/y from $74.5 million to $83.5 million. Additionally, the company’s revenues increased 5% y/y from $367.7 million to $395.2 million due to strong performance with its digital wallet and e-commerce services. On a constant currency basis, revenues climbed 7%. The company maintained its guidance for its 2023 revenues to increase 5% to 7% y/y.

A High Stakes Meeting for Investors and the Economy

With the June 1 deadline getting dangerously close and Republicans wanting to deal with spending and budget matters now rather than later, both bond and equity markets will be extremely disappointed with a lack of diplomacy.

Looking to this afternoon’s 3:00 pm eastern time debt ceiling meeting between Republicans and Democrats, stakes are high. With Speaker McCarthy not yet satisfied with the Democrat’s position, investors are praying that this meeting offers more progress than the last, which offered zilch. With the June 1 deadline getting dangerously close and Republicans wanting to deal with spending and budget matters now rather than later, both bond and equity markets will be extremely disappointed with a lack of diplomacy.

Visit Traders’ Academy to Learn about Retail Sales and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.