As concerns about bank stability and persistent inflation continue, it’s likely that Federal Reserve Chairman Jerome Powell will announce a 25 basis point (bp) rate hike this afternoon. A quarter-point hike is the sweet spot that demonstrates sensitivity to financial stability risks while simultaneously maintaining discipline on the inflationary front. Fortunately for the Fed, its decision later today comes as efforts by both the U.S. government and large banks have helped calm fears of a banking contagion. Without these integral interventions, the Fed may have been compelled to delay its inflation battle in the name of financial stability.

Under normal circumstances, the Fed strikes a balance between stabilizing inflation and maximizing employment, but the recent high-profile banking failures have complicated matters. Overall inflation has been slowing but remains nowhere close to the Fed’s 2% inflation target. In fact, the Fed’s preferred inflation gauge, the core PCE, is at 4.7%, with the services sector demonstrating persistent price gains. While demand declines have weighed on goods and commodity prices to an extent, the tightest labor market in ages is sporting fewer than 200,000 initial unemployment claims per week. Restoring price stability requires softening labor market conditions, even as financial stability risks mount. The Fed is between a stone and a brick wall.

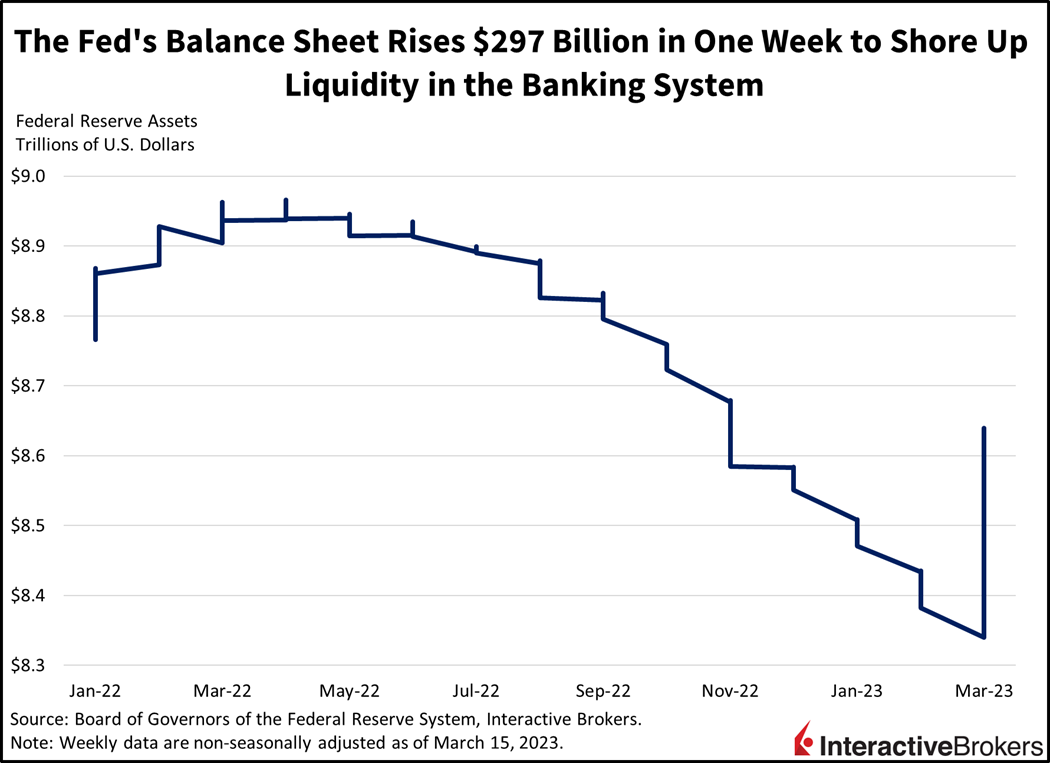

Even though the Fed realizes that strong inflation is unacceptable, it has boosted liquidity levels to safeguard the banking system, which counteracts progress on subduing price pressures. As the Fed has raised interest rates for much of last year, prices of long-duration bonds held on banks’ balance sheets have cratered. Last year, banks lost $620 billion in long-duration bond values, and additional losses have occurred year-to-date with fears of financial stability sparking a bank run consisting of billions of dollars in withdrawals. To meet withdrawal requests, banks have been forced to sell bonds from their portfolios, thereby realizing huge balance sheet losses.

Today’s Fed meeting, however, comes after the U.S. Treasury, the Federal Reserve and the Federal Deposit Insurance Trust Corp. announced the extraordinary measure of protecting approximately $175 billion in deposits at failed Silicon Valley Bank (SVB) and $88.6 billion in deposits at failed Signature Bank rather than just the $250,000 per account ceiling. Yesterday, Treasury Secretary Janet Yellen explained that government actions have helped stabilize bank withdrawals and that the government will consider protecting bank deposits at smaller banks if needed. Additionally, shares of troubled First Republic rallied yesterday on news that JP Morgan Chase CEO Jamie Dimon is leading a banking group that is considering providing a fresh capital infusion into the regional bank. First Republic already received $30 billion in deposits from 11 big banks after it suffered from more than $70 billion in withdrawals in the aftermath of the recent collapse of SVB and Signature. At one point this month, First Republic’s shares had declined 90%.

One issue going forward is just how much in assets banks will have to write down and if future bank runs will occur. Researchers at the University of Southern California, Northwestern University, Columbia University and Stanford’s Graduate School of Business have determined that marked-to-market bank assets, which are assets held for meeting redemptions, have declined in value by an average of 10% across all banks. Held-to-maturity assets, which for accounting standards are valued at face value, have seen market trading prices decline by $2 trillion relative to book value. If a significant bank run occurs that depletes banks’ marked-to-market assets, then banks would be forced to sell their held-to-maturity assets as a substantial loss.

In Europe, meanwhile, regulators have forced UBS to acquire troubled Credit Suisse for $3.25 billion. Credit Suisse had issued $17 billion in AT1 bonds that were intended to protect banks during periods of instability without relying on taxpayer bailouts. In some instances, the bonds can be converted to equities. UBS executives have convinced the Swiss government to completely write down the value of the bonds so that the securities don’t become a burden. While Credit Suisse equity holders will receive a payout, a handful of AT1 investors are considering filing a lawsuit against Swiss regulators to oppose the bond write downs.

While Treasury Secretary Yellen has commented on the banking sector being better positioned than during the 2008 financial crisis, this time is certainly different from a portfolio standpoint. Due to the duration mismatches and interest rate risk in many regional bank portfolios, for now, this time resembles the 1980s a lot more as loan delinquencies haven’t become a widespread problem just yet. As former Chairman of the Fed Paul Volcker and previous FDIC Chairman William “Bill” Isaac dealt with persistent inflation and thousands of bank failures, the era offers significant perspective in the tradeoffs necessary to control inflation. Volcker and Isaac are credited with slaying the inflation dragon while accepting painful tradeoffs regarding financial stability.

Today’s meeting comes at a time when the path for the Powell Fed has never been narrower as the central bank decides just how much easing is necessary for a safe and sound banking system while measuring the amount of tightening needed to win on inflation. Chair Powell will be walking on thin ice as he reflects on the victories and trade-offs of Volcker and Isaac.

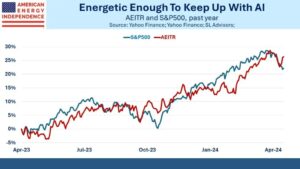

Investors will be watching the Fed’s balance sheet plans very closely to see if the recent jump in the central bank’s assets was a one-time thing or a more persistent phenomenon. The latter case would be desired by most investors as added liquidity supports valuation expansion at the expense of higher inflation. The $297 billion added to Fed’s balance sheet just last week effectively negated roughly three months of Quantitative Tightening (QT). As it seems that once again, plans to reduce the balance sheet generate economic turbulence and quickly reverse, the most recent example in 2019. Even more important will be the Fed’s Summary of Economic Projections at today’s meeting, which will reflect official projections on the year-end funds rate, economic growth, inflation, and more. Today’s meeting comes at a time when the path for the Powell Fed has never been narrower as the central bank decides just how much easing is necessary for a safe and sound banking system while measuring the amount of tightening needed to win on inflation. Chair Powell will be walking on thin ice as he reflects on the victories and trade-offs of Volcker and Isaac.

Visit Traders’ Academy to Learn More about Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)