TLDR:

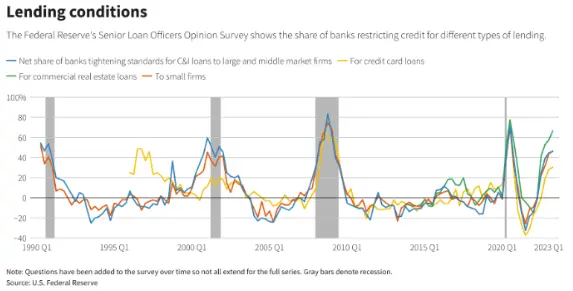

If they did want to cut rates, the alibi to reverse Fed’s policy may just have been published yesterday. Two highly anticipated publications highlighted mounting concerns that the three major regional bank collapses will lead to pullbacks in lending and drive down asset prices. How do you fight a credit crunch? You cut rates.

The twice-yearly financial stability report didn’t mince words. Recent regional bank crises and resulting worries about the “economic outlook, credit quality, and funding liquidity” could lead “banks and other financial institutions to further contract the supply of credit to the economy”, it said.

The quarterly Fed Senior Loan officer survey was equally surly. “In comparison to the largest banks, midsized and other banks more frequently cited concerns regarding their liquidity positions, deposit outflows and funding costs as reasons for tightening.”

If you’re a small (or even medium) bank, your not-entirely-crazy anxiety is that almost anyone with a sizable Twitter following has the potential to ruin your business. The best thing you can do for customer loyalty is to offer better yields on savings accounts. People like high rates after years of getting a big fat zero on their deposits.

But that makes shareholders sad because it weighs on profit margins. So loan rates have to go up, too. Businesses don’t like to pay higher prices so they borrow less. And the overall credit and investment cycle slows down.

You’d think in a competitive market – the US has literally thousands of banks, more than any other nation – the pressure to earn business is too strong to keep rates high. You’d be surprised.

Money center banks (Citi, JPMChase) are a visible presence in large metro areas but much of the US is banked by a few small lenders. Marissa, the local banker, often knows the borrower personally. If Hank is late on his loan payments, he knows the next school pick up could be awkward.

Small businesses employ half of all American workers so these banks are a lifeline to a very important source of job creation, local construction etc. Central bankers understand that shutting off credit to the economy is like cutting off blood supply: it can’t happen.

What stocks are doing well today?

This section is powered by Open AI connected to TOGGLE AI

Thanks for all your feedback! This section is still paused but an enhanced version is on the way (we promise)!

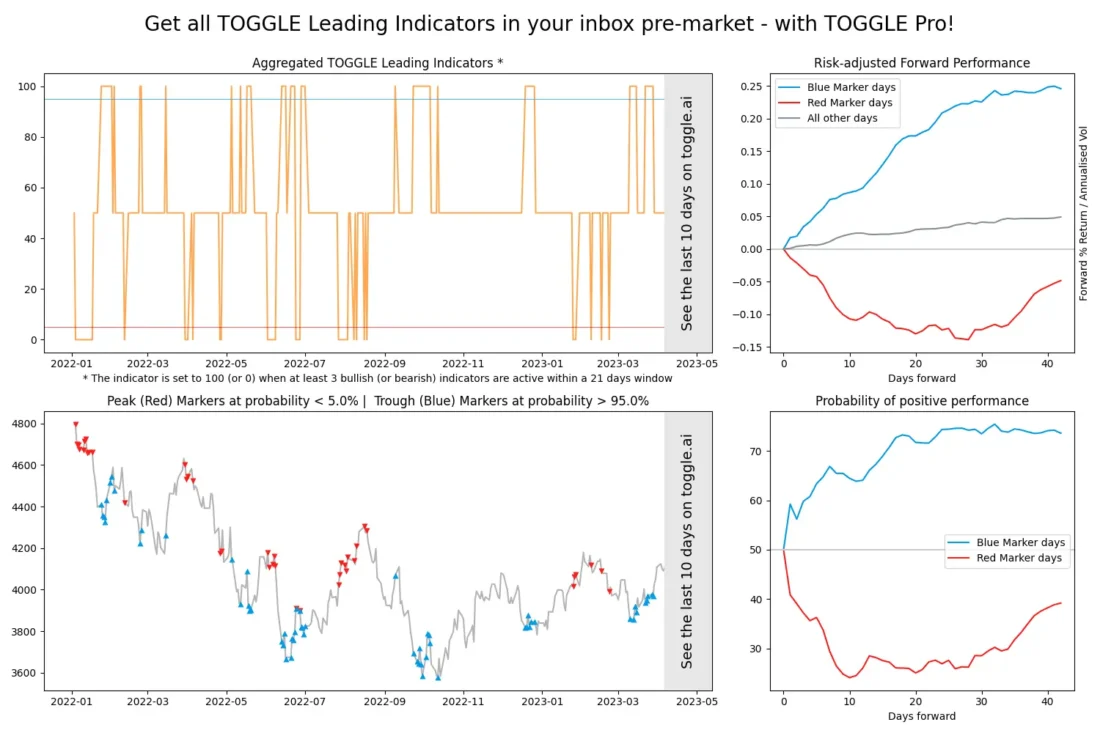

Aggregated Leading Indicators!

Subscribe to Pro here to receive our pre-market Leading Indicator newsletter and access all Leading Indicators online!

Something is moving! After squeeze-Friday the TLI is heading towards its threshold!

Learn more about the Leading Indicators in the Learn Center!

Upcoming Earnings: Airbnb reports today

Click here to test how ABNB stock could perform after beating earnings expectations.

Discover how other companies could react post earnings with the help of TOGGLE’s WhatIF Earnings tool.

Asset Spotlight: Momentum in Walmart stock

TOGGLE analyzed 5 similar occasions in the past where momentum in Walmart stock has been mostly positive and historically this led to a median increase in the stock price over the following 6M. Read full insight!!

General Interest: The liars amongst us

Don’t call her Elizabeth. Elizabeth is gone, and so are the black turtlenecks and the deep voice. These days, there’s only Liz, mother of two.

As Elizabeth Holmes prepares to go to prison, she’s embarking in a PR campaign to rehabilitate her public image – and she has adopted a new persona: devoted mother.

The goals of this campaign are not stated but neither hard to infer: shorten her sentence. Critics already pointed out that she conceived her first child as a measure to stall her criminal proceedings. So this is just another step in the process, according to her many detractors.

The puff piece was received with – shall we say – mixed reviews globally. One twitter user asked if Thanos would be the next to ask the NYT for a rehabilitation profile. Others pointed out that the NYT is the reputational laundromat for failed business types. Cue last year’s piece about SBF.

Something interesting emerges towards the end of the piece. Hated as she may be, Elizabeth Holmes has not lost the ability to charm when you meet her in person. Quoting the end of the NYT piece:

“Ms. Holmes is unlike anyone I’ve ever met — modest but mesmerizing. If you are in her presence, it is impossible not to believe her, not to be taken with her and be taken in by her.”

This reminds of Jobs’ reality distortion field, of Elon Musk pathological liar accusations (like this LOL) and of Markus Braun denials of wrongdoing in court.

It shows how certain personality traits – like narcissism – thrive in the business world and are indifferent to being exposed.

Read the full NYT piece here.

—

Originally Posted May 9, 2023 – The perfect Fed excuse (for cuts)

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: TOGGLE Relationship with IBKR

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.