The Hershey Company (NYSE: HSY) sold US$750 million worth of new notes Monday to stellar demand, despite rising U.S. interest rates and higher costs of chocolate production.

The Hershey, Pennsylvania-headquartered confectionary giant tapped the U.S. investment-grade primary market to sell fresh, single-‘A’ rated, five-year and 10-year notes – primarily to repay all its outstanding 2.625% and 3.375% senior debt securities due 2023.

Bond buyers generally consumed the deal with fervent demand, with final pricing on each of the two tranches at the tighter side of guidance:

Hershey’s sold US$350 million worth of 4.25% notes due May 4, 2028, at 67 basis points (bps) more than the yield on five-year U.S. Treasuries, as well as US$400 million of 4.50% debt due February 15, 2033, at 97 bps above the 10-year U.S. Treasury. The tranches will yield 4.282% and 4.525% to maturity, respectively.

Since the deal’s announcement early Monday, pricing on the tranches compressed by roughly 30 bps from initial price talk, illustrating healthy demand among bond buyers.

At completion, the issuance will extend the firm’s maturity profile out to November 2024, when US$300 million worth of its unsecured notes are scheduled to reach their term.

Spooky Rates Backdrop

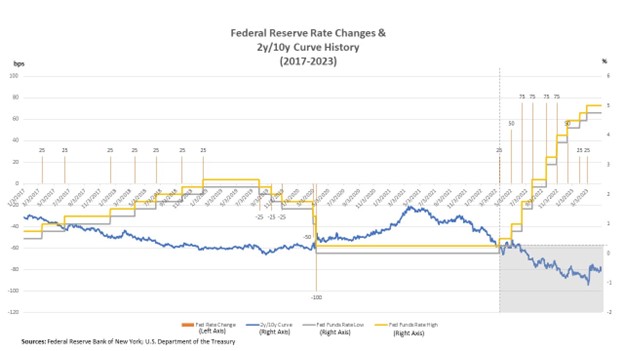

The offering falls against a mostly cautious corporate debt landscape, as fixed-income investors contend with ever-higher interest rates – largely stoked by the Federal Reserve’s aggressive tightening of monetary policy in their aim to combat inflation.

The Fed has hiked rates nine times since its March 17, 2022, policy meeting – lifting the range on the federal funds rate by 475 bps to between 4.75% and 5.0% from effectively zero during the COVID-19 pandemic.

The central bank’s actions have reignited fears about an economic recession, with inversions in key parts of the yield curve signaling the potential for a relatively deep and prolonged bout of downturn.

In fact, the two-year/10-year yield curve has remained inverted since at least July 6, 2022, and briefly topped 100 bps in early March 2023.

In intraday trading Monday, the yield on the 10-year U.S. Treasury note was bid at about 3.604% — an inversion of roughly 134.8 bps with the 3-month bill, which was trading at around 4.952%. The yield on the two-year note was bid at about 4.136%, 53.2 bps more than the 10-year.

Meanwhile, Refinitiv U.S. Lipper Fund Flows reported almost US$1.32bn exiting investment grade corporate funds in the week ending April 26, while high yield funds witnessed net inflows of close to US$600 million.

Cocoa Highs

Against this backdrop, Hershey’s faces certain other challenges – namely the impacts from higher producer costs for its cacao-based products.

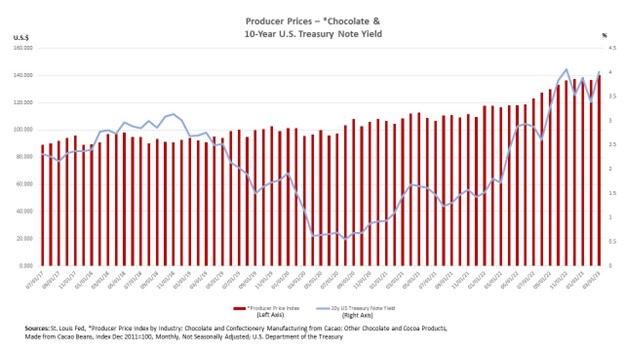

Rupen Doshi, senior analyst at Moody’s, noted that Hershey’s is exposed to potential commodity cost fluctuations, especially cocoa, which has experienced price increases over the past year. Doshi continued that such factors are “among those that require Hershey to maintain stronger and more stable credit metrics” than other consumer firms that have been assigned the ratings agency’s investment-grade ‘A1’ credit rating.

Indeed, data from the St. Louis Fed shows a year-over-year increase in March 2023 of more than 20% in its producer price index of chocolate and confectionery manufacturing from cacao. The latest tally in the index is a climb to US$140.16 – a rise that is in tandem with the cost of the continuous cocoa futures contract and falls at the heels of aggressive rate hikes by the Federal Reserve.

Hershey’s chair and CEO Michele Buck recently said at the company’s first-quarter 2023 earnings call that company management continues to see some of its inputs rise – recently, cocoa and sugar – which is most likely one of the reasons the firm decided to slap a high, single-digit price increase on 50% of its confection portfolio (effective at the end of May).

Chocolate Lovers Keep the Beat

Hershey’s trounced most analysts’ estimates with its latest earnings results.

Among its figures in the first-quarter 2023, Hershey’s consolidated net sales rose just north of 12% to nearly US$3bn, while organic net sales increased 12.2%. The firm attributed list price increases and strong consumer demand as drivers of balanced growth across segments, amid a rise of nearly 9% in product prices and close to 3.5% in higher volume/product mix.

In the meantime, the company earned GAAP net income of over US$585 million, or US$2.85 per share, up 11% year-over-year, while adjusted net income came in at around US$610 million, or US$2.96 per share, a 17% increase over the prior year.

Both revenues and earnings handily beat most analysts’ expectations for US$291bn and US$2.66 EPS, respectively.

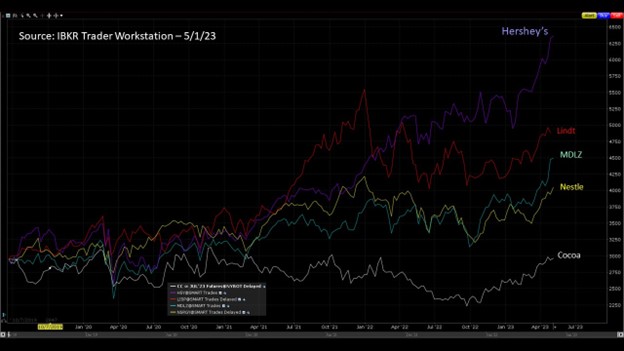

Year-to-date in 2023, Hershey’s shares have soared more than 21.5% to US$275.84 – a massive 37% jump over its 52-week low of US$201.42 set in mid-May 2022. For comparison, Mondelez International (NASDAQ: MDLZ) is up 16.8% year-to-date, Nestle’s American Depositary Receipts (ADRs, OTCMKTS: NSRGY) have risen 9.6%, and Swiss chocolatier Lindt & Spruengli’s (OTCMKTS: LDSVF) stock is up about 18% over the same period.

Over the past three months, Hershey’s five-year credit default swap (CDS) spreads have remained about flat at 53.5bps, while perceptions about Nestle’s (‘AA’) creditworthiness have stayed roughly unfettered, with its five-year CDS spreads at around 35 bps, and Mondelez (‘BBB’) around 5.5 bps tighter and close to 41.75 bps.

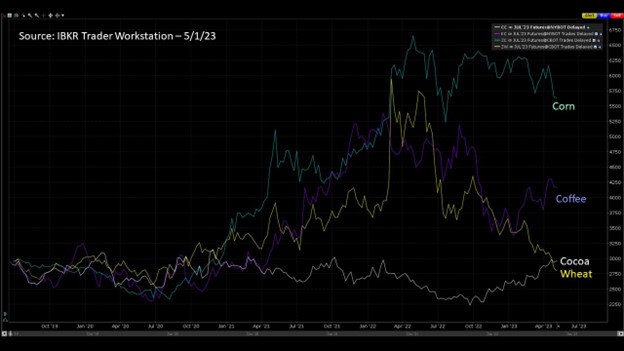

Investors will likely be watching the path of inflation closely, along with the costs of agricultural commodities such as cocoa, sugar, corn, wheat, and coffee for their impact on consumer and producer prices.

—

LEARN MORE

IBKR PODCASTS

Ep. 59 – Time for a Coffee Break?

Ep. 63 – The War on Wheat – How Much Bread is on the Table?

Ep. 71 – Eyepopping Corn Prices – Fueling Food Inflation

IBKR TRADERS’ ACADEMY

- Introduction to Futures

- Futures Fundamental Analysis

- CME Micro WTI Crude Oil Futures

- Understanding South American Soybean Futures

- Introduction to Grains and Oilseeds

- Hedging with Grain and Oilseed Futures and Options

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.