Market Recap

- Equity markets were challenged with another volatile week, alongside ongoing uncertainty in the U.K. and another sticky U.S. inflation report.

- The S&P 500 fell 1.6%, with gains in banks and consumer staples outweighed by declines in consumer discretionary and technology.

- The TSX gave back 1.4%, as 3%-plus slumps in energy and materials dragged on the index.

U.K. Bonds

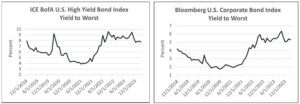

Over the past week, we’ve seen more chaos in British bond yields as the Bank of England put an end to its emergency bond-buying program. Combined with the U.K. government’s poorly received fiscal policies, which have resulted in the firing of Chancellor of the Exchequer Kwasi Kwarteng, there’s definitely elevated risk in the region. At this point, the true extent of the crisis is still unclear. But it was enough for the Bank of England to step in, which tells us that they perceive the problem as significant. There are already other issues elsewhere in Europe, with Germany and Italy dealing with their own economic and political challenges and the Russia-Ukraine conflict persisting. Together, these headwinds add to our rationale for being underweight Europe.

Bottom Line: The U.K. bond crisis is yet another reason why we’re bearish on Europe.

Chipmaker Earnings

Semiconductor chipmakers have begun to report earnings, and there are a few aspects we’re examining closely. When Nvidia reported Q2 earnings in August, it was the start of a negative outlook for the industry. They’ve had somewhat disappointing results over the last couple of quarters, so expectations were fairly low. But markets’ takeaway seemed to be that there was still some bad news there, and that chipmakers in general could potentially move a leg lower. They’ve been behind on the supply side, and work-from-home during COVID brought a lot of their demand forward, meaning that there may not be as much growth in the short term. That being said, we wouldn’t expect these companies to be out of favour for an extended period of time, because prices are relatively attractive, and semiconductors are still a crucial input to so much of the economy. Outlook will be very important to watch, and we’re hoping to hear that supply chains—and the overall situation—are improving for these companies. Another quarter of disappointing earnings may lower expectations to the point where these names would become more attractive. If a potential recession prompts chipmakers to implement cost-saving measures and become more efficient, that’s when we’d like to own them, especially coming out of a downturn.

Bottom Line: Chipmakers may move another leg lower in the near term, but we see potential opportunities in the longer term.

U.S. Inflation

The U.S. annual inflation number for September came in at 8.2%, just shy of the 8.3% from August. This was not a surprise for us—we knew that inflation would still be hot despite the energy component cooling off. However, it was surprising that the market went down as much as it did in response. All along, we’ve believed that we’d be fortunate to reach 5-6% inflation by the end of the year. That level is still possible, or it may be a little higher given energy prices have risen again. At present, there is no reason to think that the U.S. Federal Reserve will slow down its rate hike schedule, or that inflation will suddenly drop off. Remember: The Fed doesn’t care about lower inflation—it cares about low inflation.

Bottom Line: As long as markets continue to hope that the Fed will suddenly change its tune, we’ll continue to see knee-jerk reactions.

Positioning

There are no major changes to positioning on the equity front. Recently, we asked ourselves two questions. First—are we still bearish on equities? Yes, we are. And second—are we still bearish to the same degree? Again, yes, we are. At some point, as markets continue to decline, we’ll consider adding to equities. But we still believe that earnings declines haven’t been fully priced in, and we’re waiting for that shoe to drop. We’re a little more optimistic about bonds and cash. If we’re going to begin to take on more risk, the first trade will likely be from cash to bonds. Only down the road, when we believe markets have bottomed out, will we move from bonds to equities.

—

Originally Posted October 17, 2022 – U.K. Bonds, Chipmaker Earnings, U.S.

Disclosures

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Commissions, management fees and expenses (if applicable) all may be associated with investments in mutual funds. Trailing commissions may be associated with investments in certain series of securities of mutual funds. Please read the fund facts, ETF facts or prospectus of the relevant mutual fund before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Distributions are not guaranteed and are subject to change and/or elimination.

For a summary of the risks of an investment in the BMO Mutual Funds, please see the specific risks set out in the prospectus. ETF Series of the BMO Mutual Funds trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.®/™Registered trademarks/trademark of Bank of Montreal, used under licence.

Disclosure: BMO Exchange Traded Funds

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

®/™Registered trade-marks/trade-mark of Bank of Montreal, used under licence.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from BMO Exchange Traded Funds and is being posted with its permission. The views expressed in this material are solely those of the author and/or BMO Exchange Traded Funds and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.