AT A GLANCE

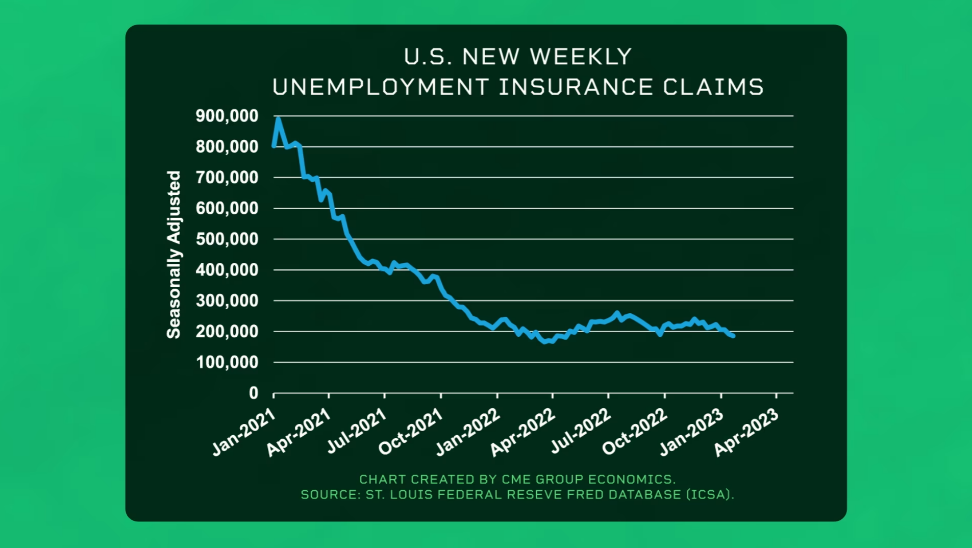

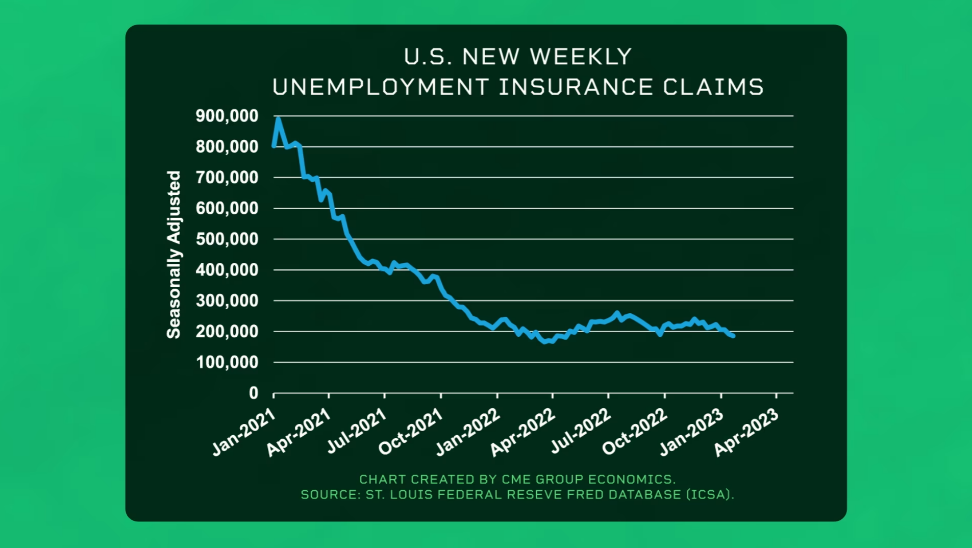

- New unemployment insurance claims have stabilized at a pace close to 200,000 per week

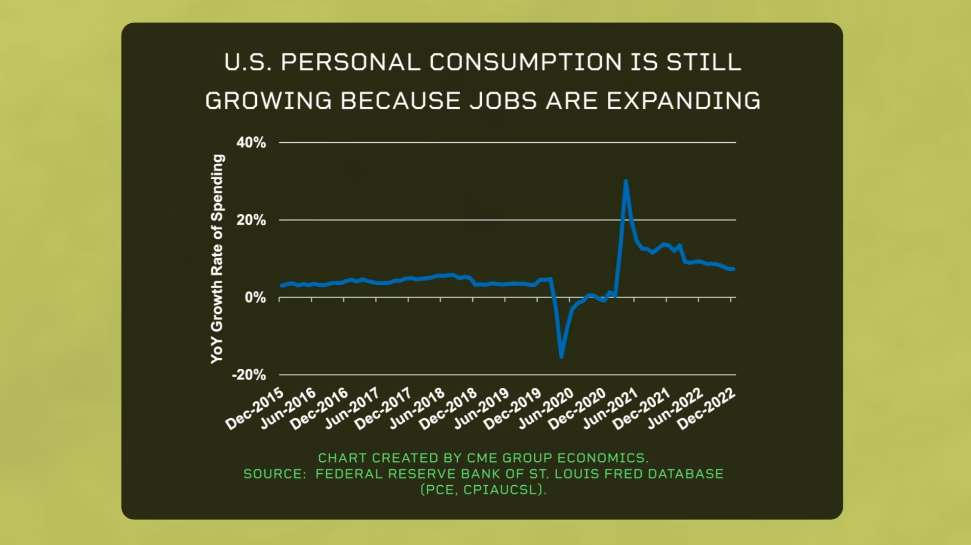

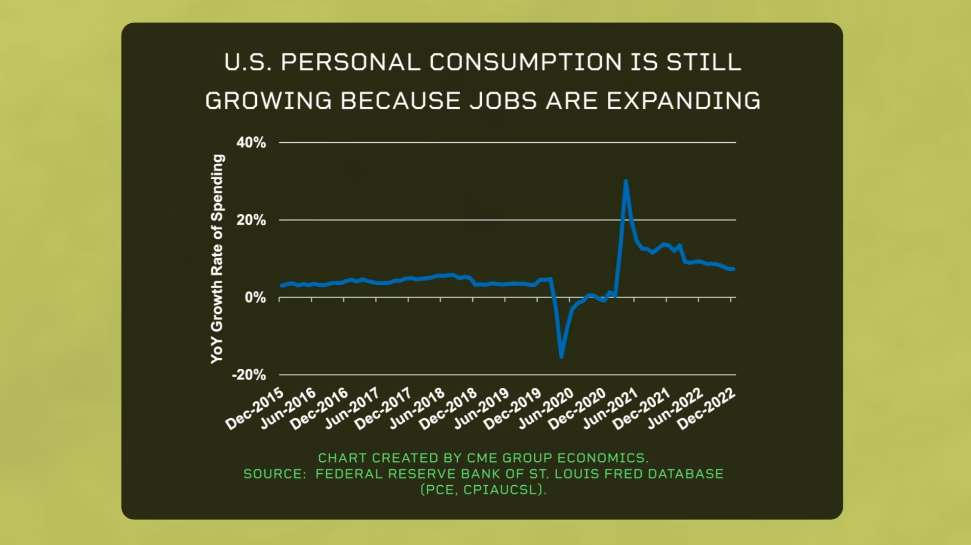

- During the pandemic, consumption spending had outsized growth due to massive fiscal stimulus

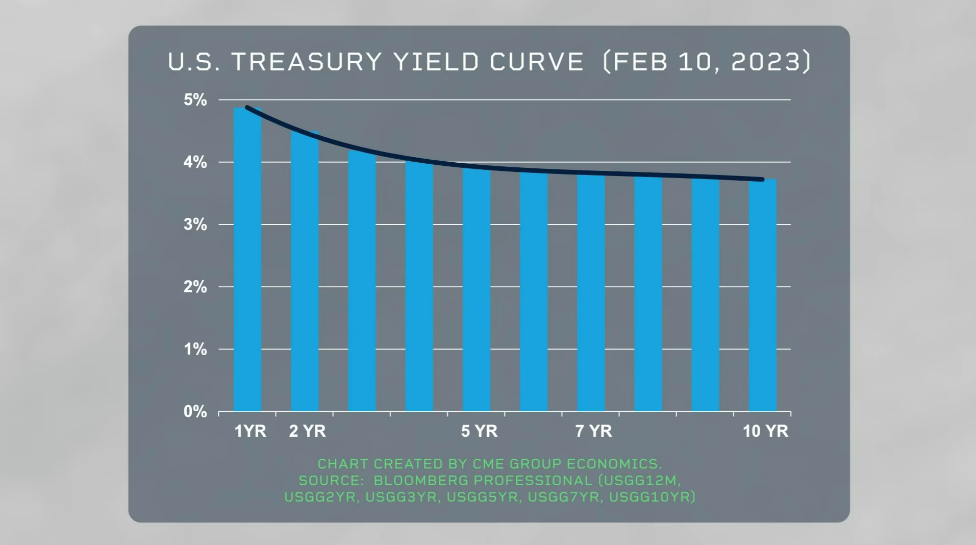

The Fed raised rates and the yield curve inverted – an indicator of a potential future recession. Nevertheless, the widely forecasted U.S. recession did not happen in 2022, and it might not happen in 2023 either.

Recessions occur when personal consumption spending, representing about two-thirds of GDP, weakens materially. The resiliency of personal consumption is directly related to jobs, not rates or inflation. Inflation can mean one does not get quite as much for one’s money, but spending continues. Credit card rates are considerably higher and set differently than the Fed’s policy rates, so Fed rate increases do not hit consumption directly. But, if one loses one’s job, one likely spends less. If one witnesses colleagues lose their jobs, one may cut back on spending. If extended family members lose their jobs, spending may be reduced.

What is happening as we enter 2023 is that sectors that benefitted in the pandemic often hired aggressively to take advantage of the situation (e.g technology, social media, Wall Street). Indeed, these sectors hired more people than the number of jobs that were lost; and now as the economy rebounds, these same sectors are losing their advantages and having to lay off some workers. By contrast, in the leisure and hospitality sectors, hiring has not yet caught up with pre-pandemic levels. The ebb and flow of jobs lost in some sectors and jobs gained in others is not an indicator of a recession.

Watch the weekly new unemployment insurance claims. Weekly new claims under 225,000 are a sign of good health. If the numbers rise above 250,000, that is a danger signal. An abrupt shift to 300,000 or more new claims in a week? The recession is in progress.

—

Originally Posted February 17, 2023 – Unpacking Recession Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CME Group and is being posted with its permission. The views expressed in this material are solely those of the author and/or CME Group and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)