By: Aneeka Gupta and Jeremy Schwartz, CFA

The value factor continues to outperform in emerging markets (EM). In contrast, value’s victory lap in developed markets (DM) in 2022 ended with the growth factor taking back control in 2023. This is largely due to the market expecting an earlier Federal Reserve (Fed) pivot, owing to falling inflation, the banking crisis and further signs of an economic slowdown. As a result, investors rotated out of low-duration value sectors into high-duration growth sectors as future interest rate expectations were lowered, making growth appear attractive again.

Scarcity Premium of the Growth Factor Recedes during Higher EM Economic Growth

However, value continues to outperform growth in EM, extending the trend of the last three years. According to the International Monetary Fund’s latest report, EMs are expected to grow at 3.9% in 2023, led by China and India achieving a growth rate of 5.2% and 5.9%, respectively.1 EM’s growth is expected to outpace that of DM in 2023 and 2024, according to the IMF’s latest projections.

While it might seem counterintuitive, value stocks tend to benefit more than growth during periods of accelerating growth. This is because as economic growth weakens, companies that are able to generate higher earnings growth look relatively attractive and benefit from a scarcity premium. So as overall economic growth declines, the growth factor generally outperforms. However, as overall growth rates pick up in EM, growth stocks command less of a scarcity premium and value stocks appear relatively well priced.

Value in EM is dominated by financials, asset-heavy cyclical commodity or manufacturing businesses and state-owned enterprises (SOEs).

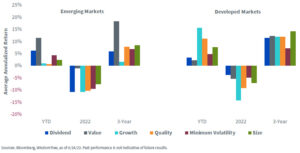

Factor Performance in Emerging & Developed Markets over Three Years

EM Banks—Slow and Steady Wins the Race

The banking crisis triggered by the failure of Silicon Valley Bank and Signature Bank and the forced takeover of Credit Suisse by rival UBS in March 2023 tarnished sentiment toward the financial sector across DM.

However, EM banks, owing to their conservative approach and tighter regulation, escaped unscathed. The divergence in interest rate cycles has an important role to play here. While DM central banks saw a uniform increase in interest rates, EM central banks followed divergent policies. For instance, the Chinese central bank cut interest rates and Brazil’s central bank is expected to cut rates. In addition, interest rates in EM averaged at a higher level than DM, which helped EM banks avoid a squeeze on net interest margins. EM banks also avoided buying large quantities of government bonds as credit demand remained resilient. In the aftermath of the banking crisis, DM banks will likely be required to hold more capital, reduce dividends and bear the brunt of a higher cost of funding. In comparison, EM banks’ capital levels are significantly above international levels and local regulatory requirements, which supports a more conservative approach to bank regulation.

China’s Consumption Rebound Is Underway

China’s post-Covid recovery is well on track, supported by consumption, exports and services. Recovery in sales is leading property stabilization. The support measures implemented by the authorities have helped the stem the crisis in the real estate sector. Growth in the industrial sector was held back by the contraction in computer and semiconductor production, owing to the turnaround of the global electronic cycle as well as very strict controls imposed by Washington on electronic component sales to Chinese companies. In Q1 2023, Chinese economic growth stood at 2.2% quarter on quarter. We expect real GDP growth to accelerate further in Q2 2023.2

A combination of improving growth rates in EM, higher dividend yields, lower valuations, a resilient Chinese re-opening and a weaker U.S. dollar are important drivers for the next stage of the recovery.

EMs have received $16 billion in exchange-traded funds (ETF) inflows in 2023, marking the second-highest geographic region after international markets.

Maintaining a Value Tilt in a Diverse EM Universe

The WisdomTree Emerging Markets High Dividend Total Return Index (WTEMHY) aims to provide investors access to high-dividend-yielding EM stocks. The strategy uses aggregate cash dividends paid by each company to weight the constituents on an annual basis, which introduces valuation discipline and helps avoid value traps.

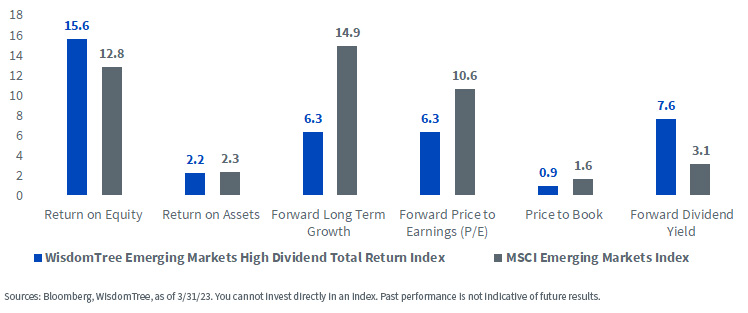

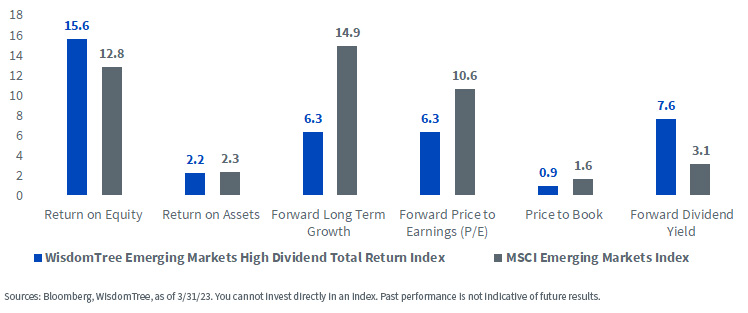

The Index trades at a 6.3x price-to-earnings ratio, marking a 40% discount to the benchmark MSCI EM total return index, highlighting the positive tilt toward value. In addition to the valuation discount, the Index continues to exhibit comparable quality characteristics with an average return on equity (ROE) of 15.6 (benchmark 12.8) and return on assets (ROA) of 2.2 (benchmark 2.3). The Index’s dividend yield is high at 7.6% versus 3.1% for the benchmark.

Comparison of Fundamentals

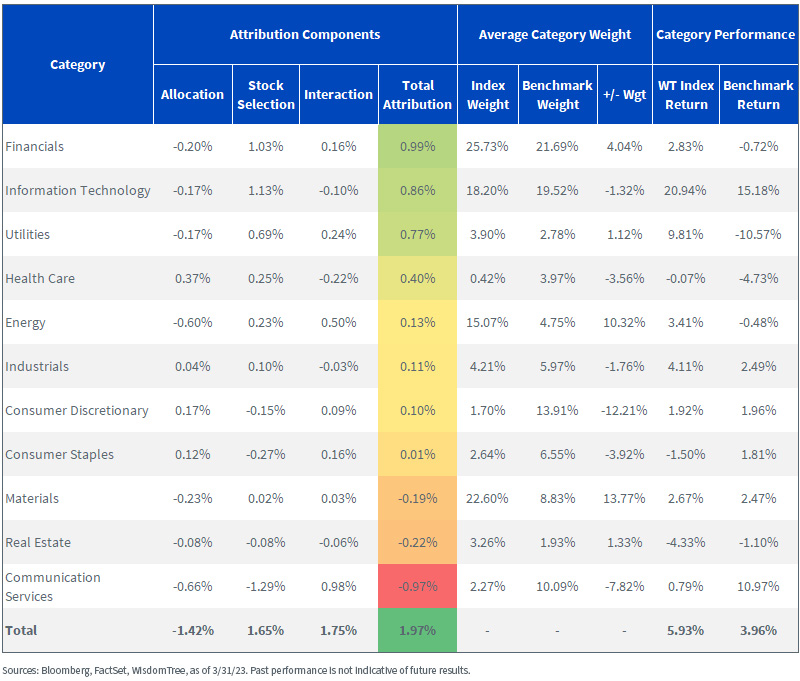

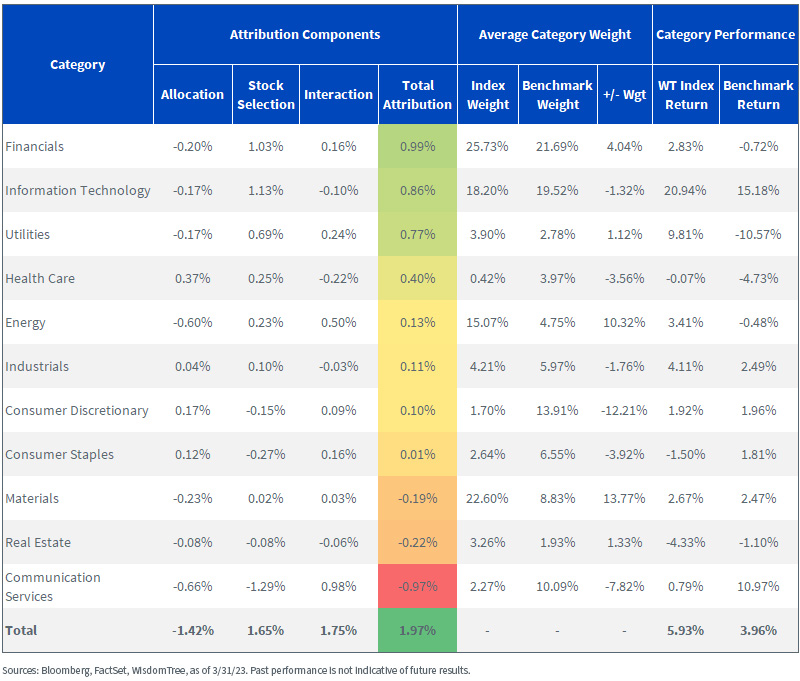

Since the start of 2023, the Index has outperformed the benchmark by 1.97%, benefitting from its higher exposure to sectors such as financials, information technology and utilities. From a geographic perspective, the higher allocation to countries such as Taiwan and India have helped the Index outperform the benchmark.

Sector Attribution

1 IMF World Economic Outlook, April 2023

2 National Bureau of Statistics, as of 4/18/23

3 As of 4/21/23

—

Originally Posted May 5, 2023 – Values Strong Run in Emerging Markets

Important Risks Related to this Article:

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.