By: Christopher Gannatti, CFA and Eric Rothman, CFA

New economy real estate can simply be described as the real estate where other ‘megatrend’ technologies and innovations occur. These are the physical buildings that house the internet and bio-life science technology; the communication towers that transmit data; and the properties involved in logistics (specifically e-commerce).

It also focuses on the markets and cities where there are high concentrations of innovation and technology; for example, the golden triangle between London, Cambridge and Oxford, the sites of the universities that are encouraging a lot of biotech, life science and medical innovation. Another example is South San Francisco where there is the combination of computer science, artificial intelligence (AI) technology and life science technology. You might also think of Boston, the Shibuya district of Tokyo or Geneva in Switzerland. These markets all have high concentrations of technology industries in their overall economic makeup.

These cities, or areas, house the property types that have the most growth behind them. They are highly specialized, mission-critical properties, and they are in small supply. Therefore, if you own these buildings, in these locations, you have the potential to charge better-than-average rental growth. As such, ‘new economy’ real estate is the ‘best of the best,’ the ‘tip of the spear’ of the real estate market.

It’s worth mentioning that this is not old economy real estate. It doesn’t include much residential or any obsolete office space and it avoids entirely retail assets (that are quickly being replaced in the transition to internet purchases). We have identified the key areas for new economy real estate as:

- Data centers

- Cell phone towers

- Logistics properties

- Biotechnology properties

- Technology properties

The growing need for data centers

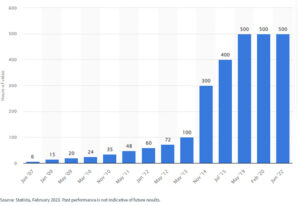

We are consuming huge amounts of data and this is increasing every day. Take YouTube, for example. Every minute, over 500 hours of video is uploaded to the video platform.1

Figure 1: Hours of video uploaded to YouTube every minute (as of February 2023)

Over the course of a year, this equates to thousands of years’ worth of content. And the same thing is happening on platforms like TikTok—if you were to sit down and try and watch all of the video content on the internet, from beginning to end, it would take you back to the dinosaurs. That’s how much there is. Global consumption of data has been accelerating at a 30% compound, average annual growth rate for the last decade, and is expected to continue to accelerate at a 30% average annual growth rate.2

This is a huge amount of data and it needs to be processed and stored somewhere—data centers—and so data center demand is also accelerating, fueled by trends like 5G, the internet of things and artificial intelligence. With the emergence of new AI technologies, like ChatGPT, this is only going to grow further.

Greater Connectivity = More Cell Phone Towers

We’re all using our cell phones more and we’re transmitting more data. The big story from a macro perspective focuses on the transition to 5G. This ‘upgrade’ is going to require a lot more antennas and more points of service. We’re currently in the process of building out 5G and, over the next three years, U.S. carriers (and global carriers) are expected to spend a record amount of money building out their networks. That level of investment will directly benefit the owners of telecommunication towers; every time a company puts another antenna on top of an existing antenna, it generates a payment to the owner of that underlying tower. So, we can see there is strong, fundamental demand, driven by this macro trend of us all using our phones more.

Modernizing the Global Supply Chain

E-commerce has grown exponentially, further fueled by the COVID-19 pandemic, which has accelerated the monumental shift from bricks and mortar retail to online shopping. This increase in e-commerce demand is driving demand for logistics, and for space to store, process and distribute consumer products. The facilities or warehouses associated with e-commerce need to be big. To give some perspective, an e-commerce supply chain typically requires three times the amount of warehouse and logistics space as a traditional bricks and mortar supply chain.3 Not only that, but you need the building to be close to consumers—when people place an order on their phone, they expect that product to arrive within a matter of hours, not weeks. But, as we know, there’s not often huge amounts of free space close to cities that house large populations of ‘purchase-loving’ consumers. So, we start to see a very limited supply which, as determined by the basic economic law of supply and demand, leads to increase demand and allows those who own those assets to charge higher prices.

Furthermore, the actual machines within these buildings that facilitate quick processing of packages are unique and relatively scarce. So if you are the owner of these assets you can, to an extent, charge whatever you want. E-commerce companies don’t have much choice but to use these valuable facilities. In fact, in many markets, there is no asking rental rate for that type of asset. They literally put the potential tenants in a room and ask them to bid on the space. This is a unique dynamic and one that we don’t see much of in the traditional real estate space.

Why Now for New Economy Real Estate?

The above examples make clear the high level of demand for this type of real estate. But what about supply and, importantly, valuation? Well, by virtue of the recent changes in interest rates and the immediate impact on the public markets and their repricing of all real estate, we have a potentially unique opportunity where the valuations have come down, and come down materially.

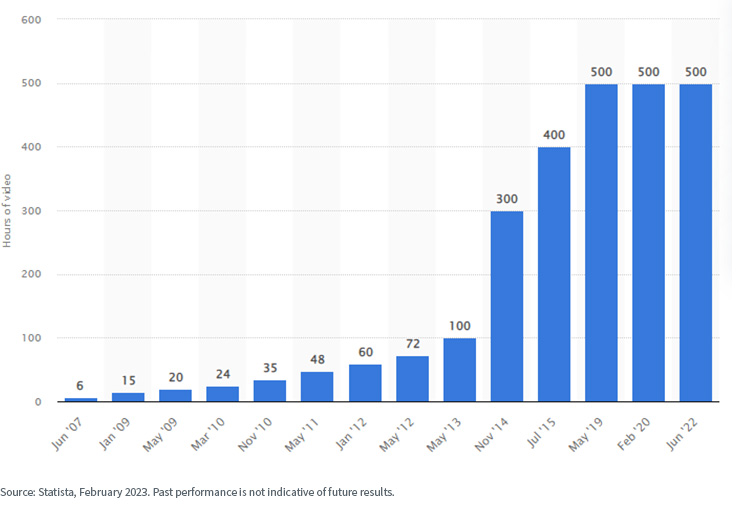

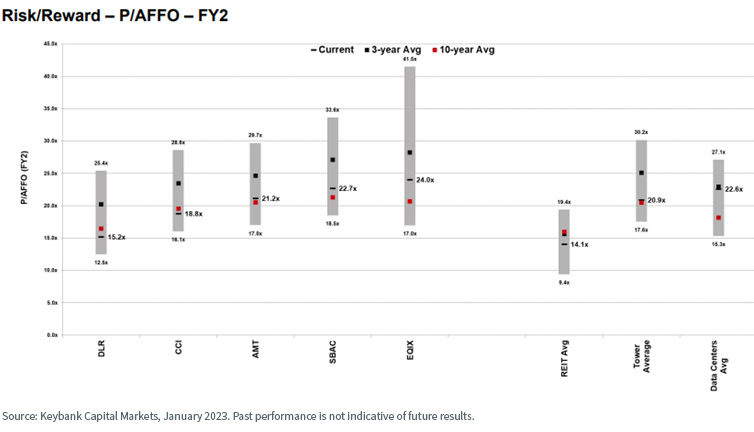

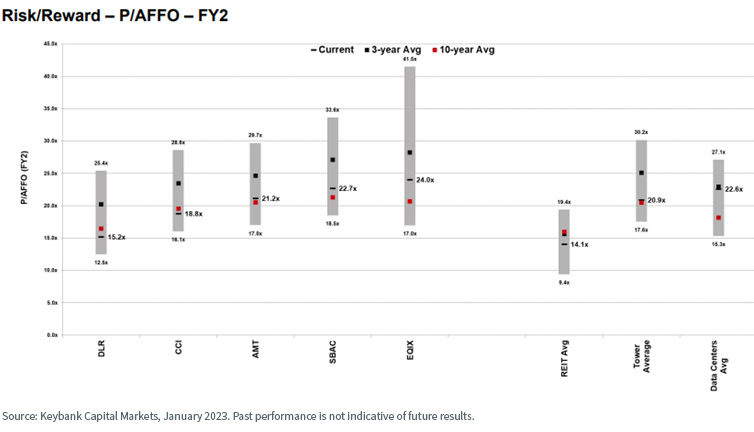

Figure 2

Figure 2 highlights how these multiples have changed over the last decade. What was the high, what was the low, what was the average over the prior three years? Looking at where the multiples sit today, you can see that, in every case, they are at the bottom end of their historical range and well below the average of the last three years. So, from a repricing standpoint, now is potentially a good time to get into these sectors in the public markets, because it’s already been repriced.

1 Source: Statista, February 2023 https://www.statista.com/statistics/259477/hours-of-video-uploaded-to-youtube-every-minute/

2 Source: Global Data Consumption Chart, Statista January 2023. https://www.statista.com/statistics/871513/worldwide-data-created/

3 Source: CBRE, E-Commerce’s Impact on Industrial Real Estate Demand https://www.cbre.com/insights/briefs/ecommerces-impact-on-industrial-real-estate-demand

—

Originally Posted March 10, 2023 – What Is New Economy Real Estate and Why Is it Important?

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.