This afternoon we hope to learn quite a bit about the state of interest rates with the FOMC rate announcement and Chairman Powell’s press conference. The rate decision itself seems to have a broad consensus, with Fed Funds futures indicating a 90% likelihood of a 25-basis point hike. We will need to glean the more important clues about the future direction of rates from the FOMC statement and the Chair’s commentary. The options market seems to expect good things to follow.

The key question on everyone’s mind is whether today’s hike will be the last, and whether there is a reasonable likelihood for cuts in the coming months. It seems reasonable to think that the former is true. We’ve seen rates rise dramatically in a short period of time, and it is undeniable that the recent banking woes are a direct consequence of that activity. The FOMC must be cognizant of this, and it is hard to imagine that they will be eager to add to those concerns.

As for cuts, however, that might be a different matter. On March 27th we wrote:

“Do you reasonably expect the FOMC to say, “Sure, we’ve whipped inflation, so let’s start cutting rates.”? Of course not.”

In a speech delivered on April 11th, Philadelphia Fed President Harker is quoted as saying:

“But at this point, I don’t see why we would just continue to go up, up, up and then go, whoops! And then go down, down, down very quickly. Let’s sit there.”

Harker is a voting member of the FOMC, and given the recent consensus, it seems reasonable to assume that his comments are not completely at odds with the rest of the committee. Much of the rhetoric from Fed talking heads has been about continuing to fight inflation and pushing back on the notion that rate cuts are imminent. The logical assumption would be that the Chair will reinforce the notion that even if we are at the end of the current hiking cycle, rates will remain at current levels for some time…

Unless, of course, circumstances dictate a change in policy. Think about what those circumstances might be. Are they likely to be a positive for equity valuations? Probably not!

On the other hand, Powell could trot out his familiar “Goldilocks in a Suit” persona, and all will be perceived as rosy. Disinflation, anyone?

One thing we already know for sure is that today’s hike will get us very close to the peak rates seen in 2006-2007. In that cycle, we saw the Fed Funds rate rise from 1% to 5.25% over the course of just over two years and the Fed kept that peak rate for a full year. Unfortunately, we now know how that ended – with a global financial crisis. For some perspective, if expectations hold, the current cycle will show rates rising from 0% to a midpoint of 5.12% in just over a year.

Effective Fed Funds Rates, 25 Years Monthly Data

Source: Bloomberg

Notice that over the past 25 years there is no precedent for a rate cut quickly following a hiking cycle. The 2000 and 2019 hikes persisted for at least 6 months. Yet Fed Funds futures anticipate a cut as early as July. Again, ask yourself what might bring that about?

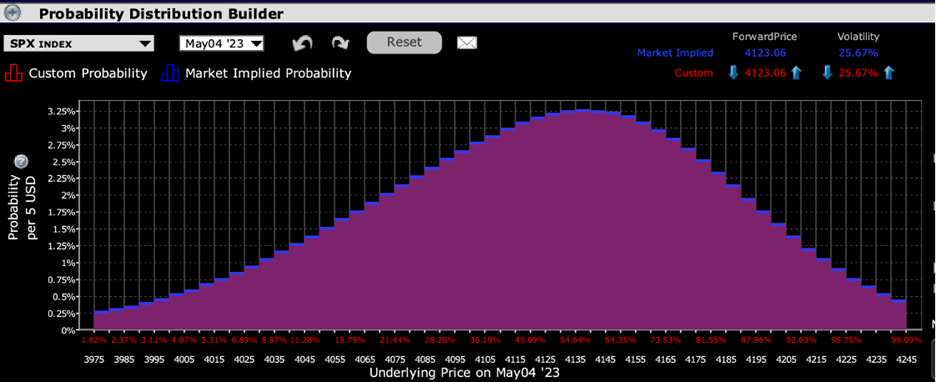

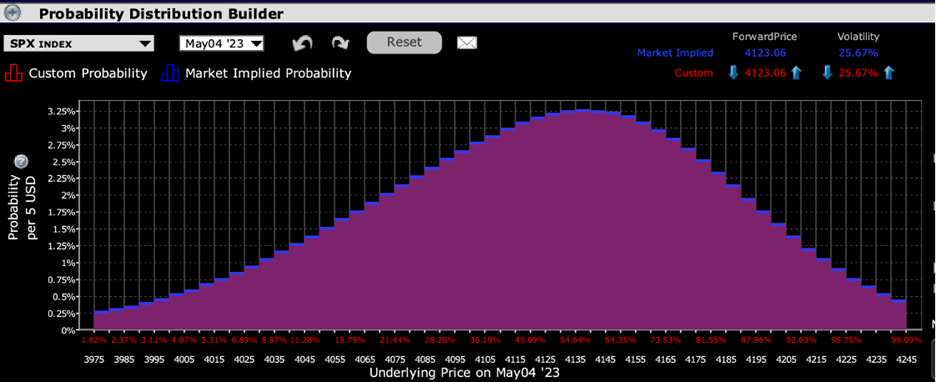

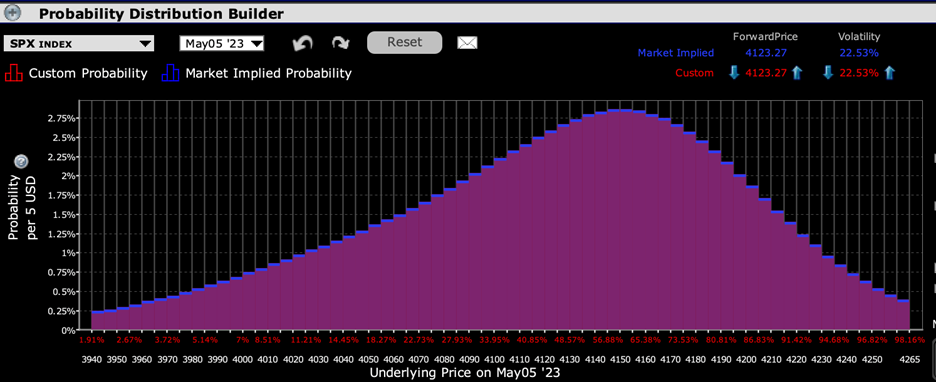

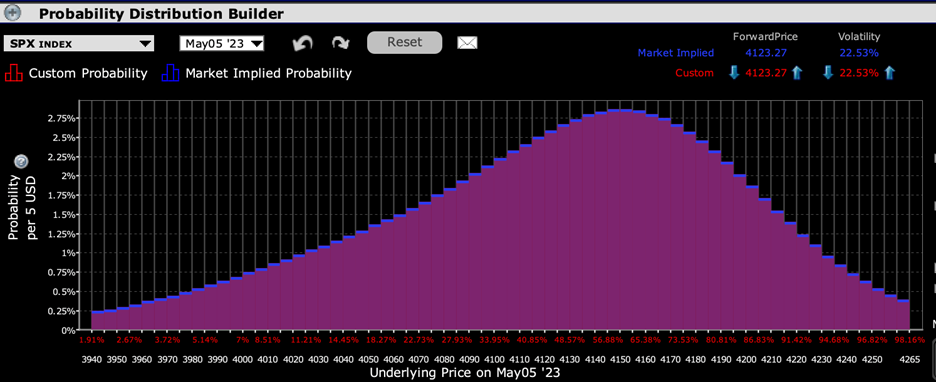

As for the options market, we see that short-dated options on the S&P 500 Index (SPX) are anticipating a bounce after the results. Looking at options expiring tomorrow, the IBKR Probability Lab shows a peak probability in the 4140-4145 range, while options expiring Friday show a peak in the 4150-4155 range:

IBKR Probability Lab for SPX Options Expiring May 4th

Source: Interactive Brokers

IBKR Probability Lab for SPX Options Expiring May 5th

Source: Interactive Brokers

Meanwhile, VIX is off its recent lows, but still hardly showing any strong demand for volatility protection:

VIX, 2 Weeks, 10-Minute Bars

Source: Interactive Brokers

Bottom line, we’ll know soon enough whose predictions, if any, will be correct. Buckle up.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.