For the first time in quite a while we have a monthly Payrolls report on the second Friday of the month rather than the first one. While the calendar may be quirky, traders’ focus on employment numbers is not. Because “maximum employment” is part of the Federal Reserve’s dual mandate – alongside “price stability” – we have no choice but to pay close attention to the data that will be released tomorrow morning at 8:30 EST.

The key reports are the change in Nonfarm Payrolls, the Unemployment Rate, and Average Hourly Earnings for February. The consensus estimates and prior readings are:

| Consensus | Prior | |

| Change in Nonfarm Payrolls | 225,000 | 517,000 |

| Unemployment Rate | 3.4% | 3.4% |

| Average Hourly Earnings MoM | 0.3% | 0.3% |

It is important to recall what a stunner the January numbers were. They put an abrupt halt to a stunning three-day rally spurred largely by Chair Powell’s comments about disinflation. The 517k increase in Nonfarm Payrolls blew well past the 189k median estimate, the Unemployment Rate was 0.2% below expectations, leading to a generational low, and while Hourly Earnings matched expectations, the December reading was revised up 0.1% to 0.4%.

It will be crucial to see whether the January report was aberrational or part of a trend of higher-than-expected payrolls data. Over the past few days Fed Funds futures have ratcheted up the likelihood for a 50bp hike at the March 22nd FOMC meeting from about 25% to 70%. Tomorrow’s report can spur a major recalibration in either direction; near-certainty of 50bp on stronger prints, reversion to 25bp expectations if labor conditions are softening.

As I write this, equity indices have given back their early advance that was spurred by this morning’s report of 221k weekly jobless claims. The report was above the 195k expectation and broke a string of sub-200k reports. Traders seem to have remembered that one week does not make a trend and that a volatile weekly number will be quickly superseded in either direction by tomorrow’s more robust monthly report.

Options markets show some increasing concern, but hardly any outright worry. The quickest way to see that is that VIX remains below 19.5, but there are other more detailed ways to see that concerns remain generally modest. We will focus on the weekly options expiring tomorrow (oh, by the way, these options become zero-dated tomorrow – just as every option does on expiration day).

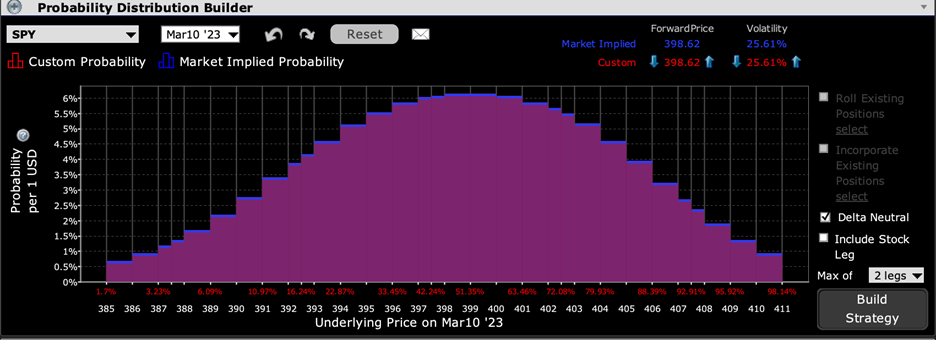

The IBKR Probability Lab shows a peak in the 398-400 range – hardly surprising when SPY is trading just below 399. The symmetry of the curve shows that there is a general lack of specific concern in either direction. I find that curious, considering that a definitive break below key support levels could create an important shift in the market’s reliance upon positive technical trends.

IBKR Probability Lab for SPY Options Expiring March 10, 2023

Source: Interactive Brokers

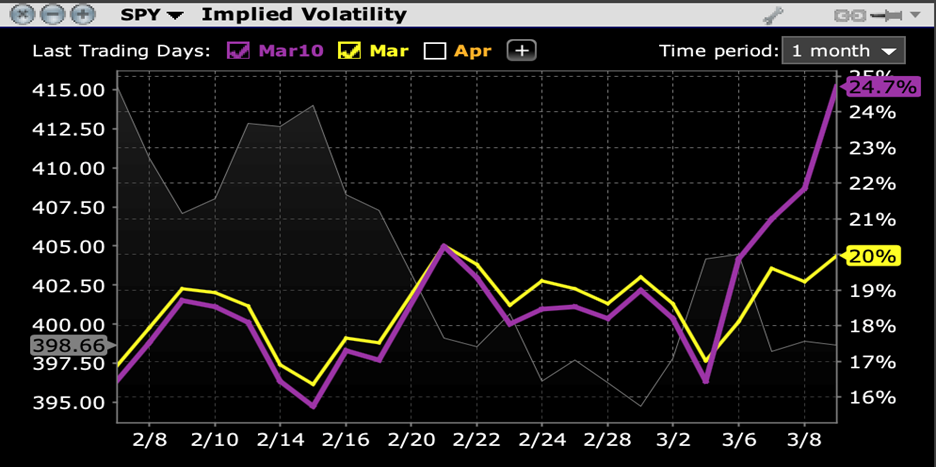

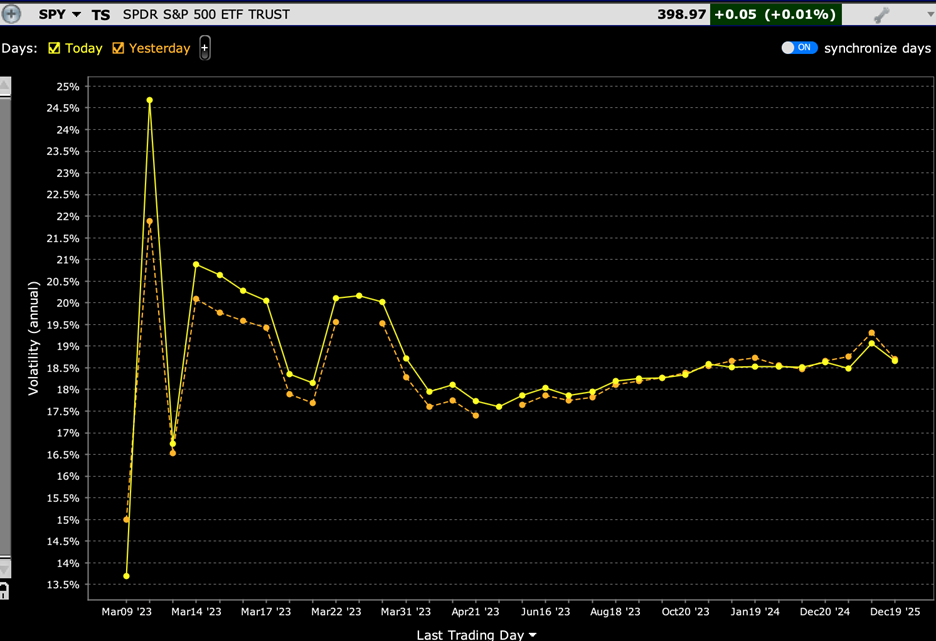

We have seen implied volatility for SPY options increase substantially in the past few days. It is typical for implied volatilities to rise ahead of “known unknowns”, events like economic reports or earnings that have well-disclosed release times, but uncertain outcomes. The chart below shows the changes in at-money implied volatilities for SPY options expiring tomorrow and next week (which is a “triple-witch” quarterly expiration). An at-money implied volatility of 24 implies a roughly 1.5% move tomorrow.

SPY Implied Volatilities, March 10th (purple), March 17th (yellow) Expirations

Source: Interactive Brokers

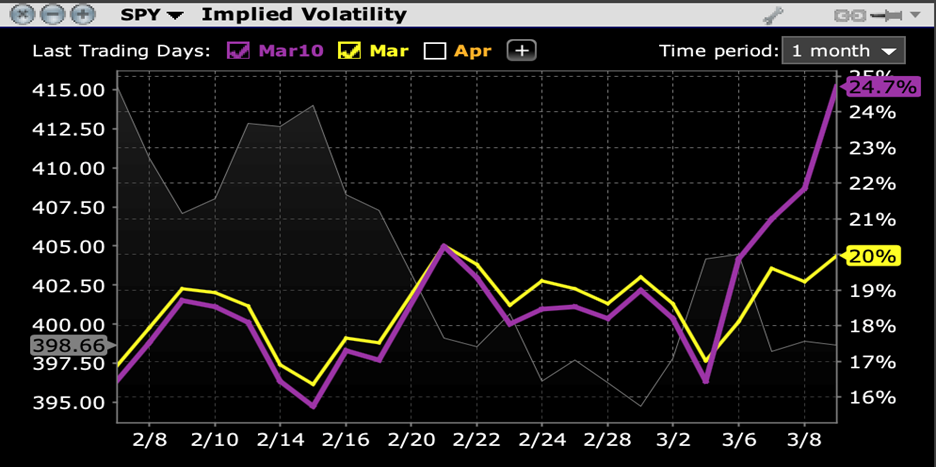

The chart below shows the term structure of at-money implied volatilities across all available SPY expirations. We see that all near-term options are elevated above yesterday’s levels:

SPY Implied Volatility Term Structure, Today (yellow), Yesterday (March 8th, orange)

Source Interactive Brokers

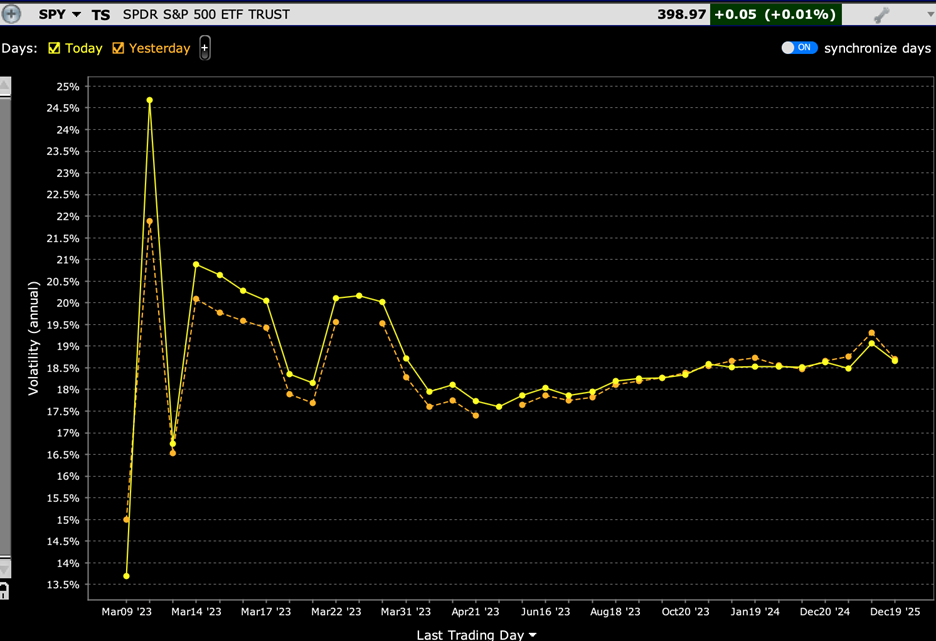

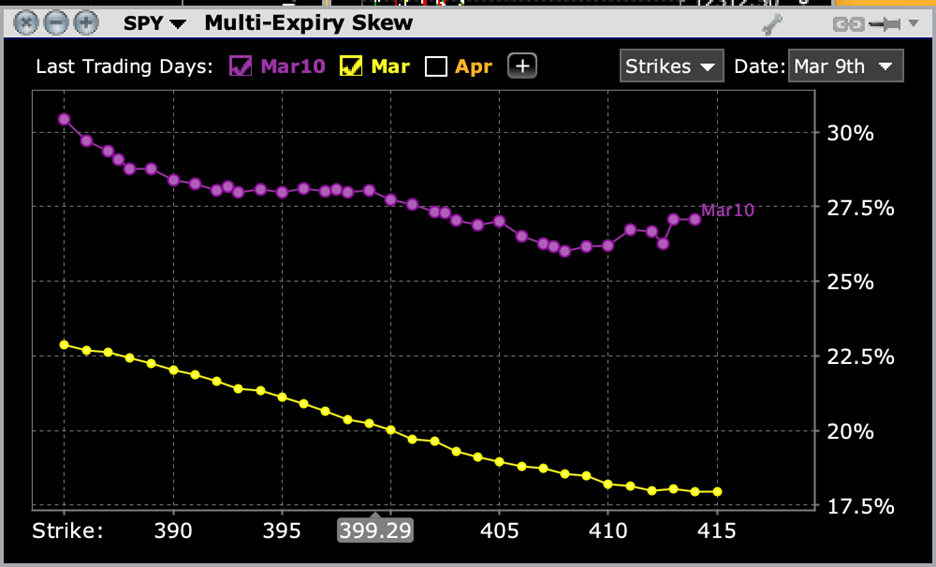

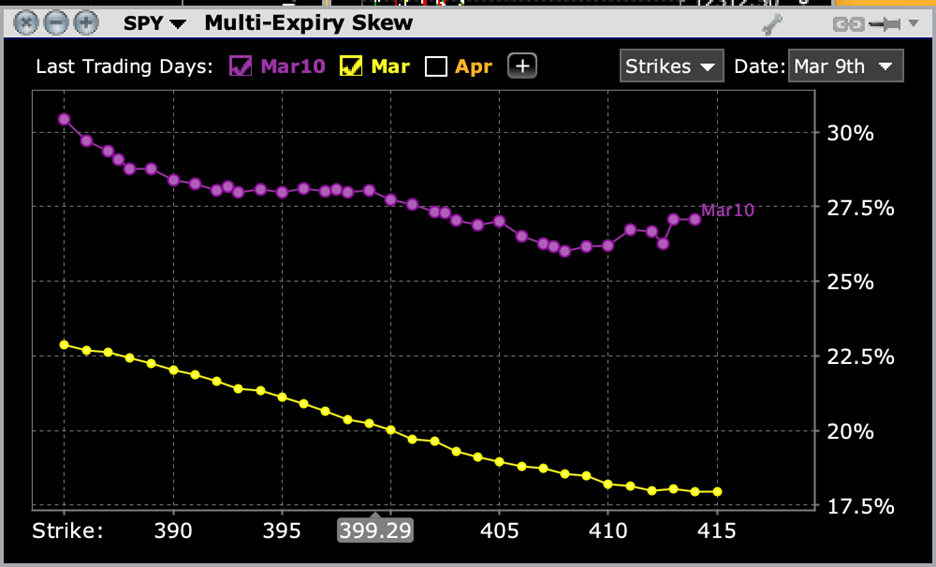

Finally, we see that skew for options expiring tomorrow is relatively flat for below-market options down to the 390 strike. That appears to indicate traders’ view that we will remain well-supported even if the report is market-unfriendly:

SPY Skew, March 10th (purple), March 17th (yellow) Expirations

Source: Interactive Brokers

The bottom line: options traders have ratcheted up their volatility expectations for tomorrow’s report, but not unusually so. A 1.5% move in SPY would not be particularly crazy – last month’s move was -1.04% — but the seeming complacency of traders about a trendline break is indeed noteworthy.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ