October marks the beginning of the fourth quarter and it is likely to be filled with market volatility against the backdrop of surprises to the upside and surprises to the downside. Investors are eager and nervous to realize how dovish or hawkish global central banks become as tighter financial conditions and higher interest rates weaken economic performance and threaten financial stability. Inflation and GDP readings will provide details on how price pressures are evolving and how economic growth is holding up. U.S. Jobs data may fry the thermometer because the labor market is on fire against the backdrop of labor shortages and rising wages. Earnings season will tell us how companies are managing through a difficult macroeconomic environment of slowing demand, rising expenses, and a firm dollar with significant implications for equity prices and bond yields. Geopolitics remain a wildcard with investors hoping for peace, resolution, and mediation. For better or for worse, we’ll likely gain further clarity on these topics in October as decisions are made, economic indicators are released, and earnings are announced while markets shift simultaneously.

In a bold move, the Bank of England (BOE) shifted from a hawkish stance to a more dovish one by temporarily restarting bond-buying to prevent financial stability problems. Market participants or more specifically in this case, bond vigilantes, protested an inflationary move by the UK government of cutting taxes and increasing borrowing by selling off Gilts and the Pound Sterling. The fiscal proposal adds to the deficits and is inflationary because it boosts demand. A large, stagflationary conflict lies here because the Bank of England was previously committed to fighting inflation and it is now buckling under financial stability problems. Financial stability problems arose due to the speed at which rates rose as bond vigilantes aggressively sold off bonds to protect against inflation risk. UK pensions hold a large amount of long-term debt on their balance sheets and quickly rising long-term rates contribute to big mark to market losses on their books that could lead to insolvency, failure and create contagion across markets. The Bank of England delayed its inflation fight to protect markets in what had the potential to be a catastrophic event.

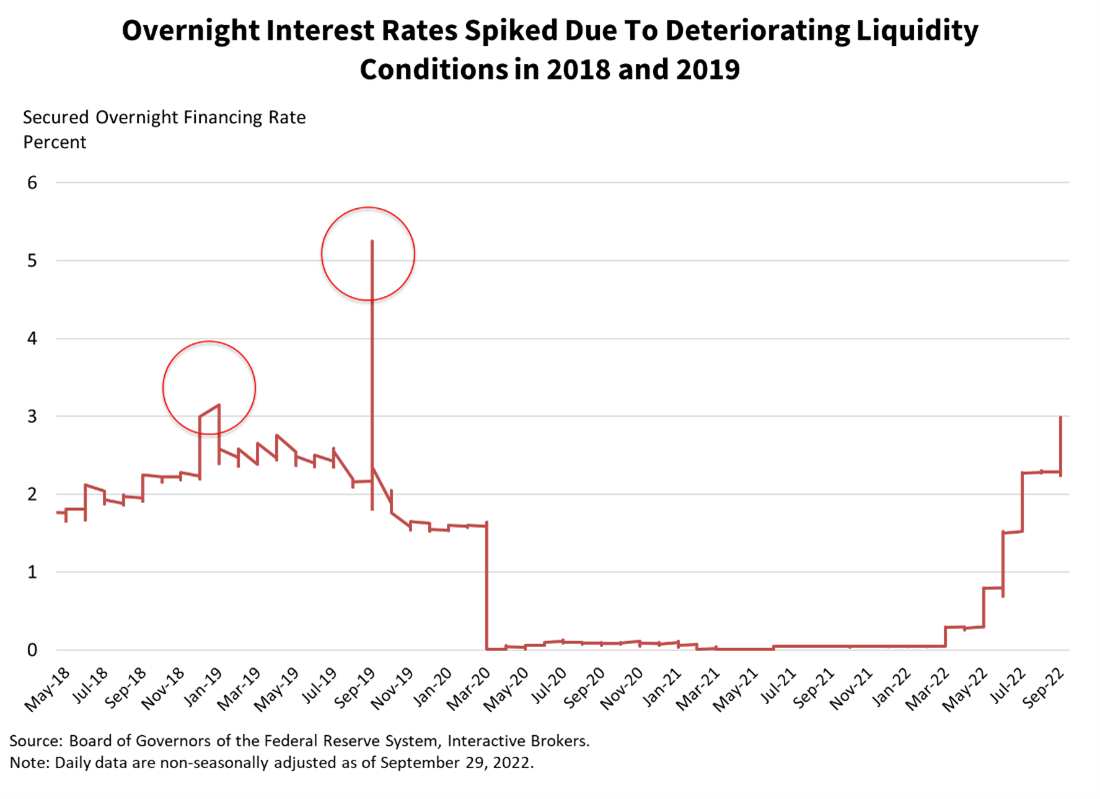

In similar fashion, the Fed, dealt with financial stability problems in 2019 and to a lesser extent in 2018 as overnight interest rates spiked due to deteriorating liquidity conditions as the Fed was reducing their balance sheet. This caused the Fed to reverse course as they turned from quantitative tightening back to quantitative easing to protect markets and keep yields subdued, similar to what the BOE did this week. Markets welcome the arrival of monetary injections from central banks very warmly, the departure of those injections and the reintroduction of liquidity withdrawals, however, are not warmly welcomed and are accompanied by volatility as market participants sweat while discovering true prices in less distorted markets. Markets love the arrival of new money, while the removal of old money is a less exciting development and at times, depressing. Inflation is a tough opponent while weakening economic conditions and market volatility are the expensive costs of victory. The resolve of central banks will be tested further in the coming months and the world will be watching to see if they stay true to the inflation fight or buckle amidst market volatility and weaker economic performance.

Markets will be awaiting fresh economic indicators released in October. The Jobs Report will arrive on October 7th and will provide insights on how hot the U.S. labor market is. Good news could be bad news in this case because the Fed wants to slow down the labor market to cool demand. A strong number will likely bode poorly for markets as expectations of further interest rate hikes will increase alongside bond yields. This leads to an increase in the risk-free rate and incrementally incentivizes investors to place cash in bonds rather than in equities. The Consumer and Producer Price Indices on October 13th and 12th respectively will provide us with a fresh look on inflationary pressures. The market will pay more attention to the former, released on the 13th because services inflation is currently the primary inflation driver while the latter is more sensitive to goods and commodities. Similar to the Jobs Report, too hot of a number for CPI will propel expectations of Fed tightening. Real estate construction activity on the 19th and PMIs for manufacturing and services on October 24th will provide clues as to how tighter financial conditions and higher interest rates are affecting some of these cyclical, capital intensive, interest rate sensitive industries. So far, real estate activity has been particularly hard hit as buyers are nowhere in sight while manufacturing and services have deteriorated to a lesser degree.

Earnings seasons for the 3rd quarter kicks into high gear in the coming month. Investors will be watching to see how resilient earnings are. Consumer demand will be top of mind as companies offer clues on the durability and strength of their customers. The pricing environment will also be significant. Investors will keep a close eye on what companies are planning to do with prices and what their expectations are of customer reactions and their subsequent behavior. How will revenue and earnings guidance hold up as the economy slows down? How are companies managing the evolving supply chain dynamics and how hard of a hit is the stronger dollar causing to the bottom line? Earnings season will provide answers to some of these challenging questions.

Geopolitics add massive uncertainty to the evolving economic landscape. The land war in Ukraine is causing massive human hardship and negatively affecting supply chains and the commodity complex, namely food and oil. Covid lockdowns in China are also negatively affecting supply chains while the Taiwan situation remains uncertain. Will more sanctions and penalties be delivered to the Kremlin? Will China relax lockdowns after the Chinese Communist Party Congress as rumored? Will the world get involved to defend Taiwan if tensions flare and further stress geopolitical conditions? A lot remains to be seen.

I suspect inflation to stay hot as the U.S. labor market is on fire and will contribute to continued elevated inflation readings in the services segment. Increasing wages and elevated credit card spending will keep demand high while companies increase their prices to offset wage gains in an effort to protect margins. I suspect the Fed to stay tough on inflation against the backdrop of Jerome Powell’s admiration of the late Paul Volcker. This will cause economic conditions to continue slowing, bond yields to rise further, albeit they’re probably close to the top, and equities to reach new lows, although they’re probably close to the bottom. I believe the labor market will finally show signs of cooling in 2023 as earnings contract due to rising costs and slowing revenue. Geopolitics are very negative right now but any signs of peace in Ukraine, easing tensions in Taiwan and/or easing lockdowns in China will be positive for inflation and bullish for markets.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.